Gold Price Weekly Forecast: Can XAU/USD reclaim $1,900 following NFP-inspired drop?

- Gold price ended the highly volatile week in negative territory below $1,900.

- The near-term technical outlook points to a bearish tilt.

- Comments from Fed policymakers and US yields will be watched closely next week.

Following a quiet start to the week, Gold price touched its highest level since April near $1,960 but staged a deep correction toward the end of the week to close below $1,900 for the first time in three weeks. In the absence of high-impact data releases from the US, comments from Federal Reserve officials and the performance of US Treasury bond yields could influence XAU/USD’s action next week.

What happened last week

Although the data from China revealed that the business activity in the manufacturing and non-manufacturing sectors expanded at a more robust pace than expected in January, XAU/USD struggled to gain traction on Monday and Tuesday. Ahead of the key central bank events and the US data releases, investors avoided making large bets at the beginning of the week.

On Wednesday, the monthly report published by Automatic Data Processing revealed that employment in the US private sector rose by 106,000 in January, falling short of the market expectation of 178,000 by a wide margin. Later in the session, the ISM survey showed the Manufacturing PMI fell to 47.4 in January from 48.4 in December with the Prices Paid component of the report rebounding to 44.5 from 39.4. These data releases made it difficult for XAU/USD to make a decisive move in either direction but the pair fluctuated wildly on the US Federal Reserve’s (Fed) policy announcements.

As expected, the Fed raised its policy rate by 25 basis points (bps) to the range of 4.5-4.75%. In its policy statement, the US central bank noted 'ongoing increases' in rates will be appropriate and added that inflation remains elevated despite having eased somewhat. With the initial reaction, the US Dollar (USD) gathered strength against its rivals and XAU/USD declined toward $1,920. During FOMC Chairman Jerome Powell’s press conference, however, the pair made a dramatic U-turn and surged beyond $1,950.

Powell acknowledged that the disinflation process had started in goods and admitted that they would have to reflect it in the policy if inflation declined faster than expected. The chairman tried his best to convince markets of the hawkish outlook by repeating that history warns against prematurely loosening and that he was not expecting a rate cut in 2023, his remarks on the inflation outlook weighed heavily on US Treasury bond yields. With the benchmark 10-year US T-bond yield losing nearly 3% on the day and dropping below 3.4%, Gold price rallied to fresh multi-month highs. Meanwhile, the risk rally picked up steam and caused the USD to continue to weaken, providing an additional boost to XAU/USD.

In another dramatic turn of events, the USD shook off the selling pressure on Thursday and staged an impressive comeback. In turn, Gold price erased all the post-Fed gains and fell to the $1,900 area.

The European Central Bank (ECB) and the Bank of England (BoE) both raised key rates by 50 bps as anticipated. In its updated projections, the BOE lowered the 2023 inflation forecast to just under 4% from 5% in November’s projections. Additionally, Bank of England Governor Andrew Bailey said that they were expecting inflation to fall “quite sharply” and added that they will re-evaluate the policy if the economy were to evolve in line with central forecasts.

In the meantime, the ECB said in its policy statement that it was intending to raise key rates by 50 bps in March but ECB President Christine Lagarde refrained from committing to additional rate actions after March. Moreover, Lagarde noted that inflation risks were more balanced.

Surprisingly dovish outcomes from the ECB and BoE events allowed the USD to capture capital outflows out of the Euro and the Pound Sterling, triggering a strong downward correction in XAU/USD.

Following a consolidation phase during the European trading hours on Friday, Gold price turned south and suffered heavy losses ahead of the weekend. After the data published by the US Bureau of Labor Statistics revealed that Nonfarm Payrolls rose by an impressive 517,000 in January, the USD outperformed its rivals. At the same time, the 10-year US T-bond yield recovered back toward 3.5% and triggered a leg lower in XAU/USD. As Gold price broke below $1,900, the technical selling pressure gathered momentum and didn't allow the precious metal to rebound.

Next week

In December, the Fed Summary of Economic Projections (SEP) suggested that policymakers were planning to raise the policy rate by 25 bps three times in 2023. Dovish comments from Fed officials following the December policy meeting, however, convinced markets that there was a strong chance that the US central bank could stop tightening the policy after March.

According to the CME Group FedWatch Tool, there is a 45% probability that the Fed could opt for one more 25 bps in May. In the absence of high-impact data releases next week, comments from Fed officials will help market participants figure out whether the Fed will pause in May.

If FOMC policymakers continue to push back against the ‘Fed pivot’ narrative and leave the door open for another rate hike in May, the US Dollar could hold its ground and weigh on XAU/USD. It will also be interesting to see what policymakers will say about the impressive January labour market figures. They could use the strong NFP growth to push the hawkish narrative and support US yields or welcome the softer wage inflation and help XAU/USD keep its footing. The underlying details of the jobs reports revealed that the Average Hourly Earnings were up 4.4% on a yearly basis in January, down from 4.9% in December and below the market consensus 4.9%.

On the other hand, the USD could have a hard time finding demand if officials remind markets that they don’t have to follow the SEP and that they could revise their rate expectations. An optimistic tone in inflation outlook could also help the pair edge higher.

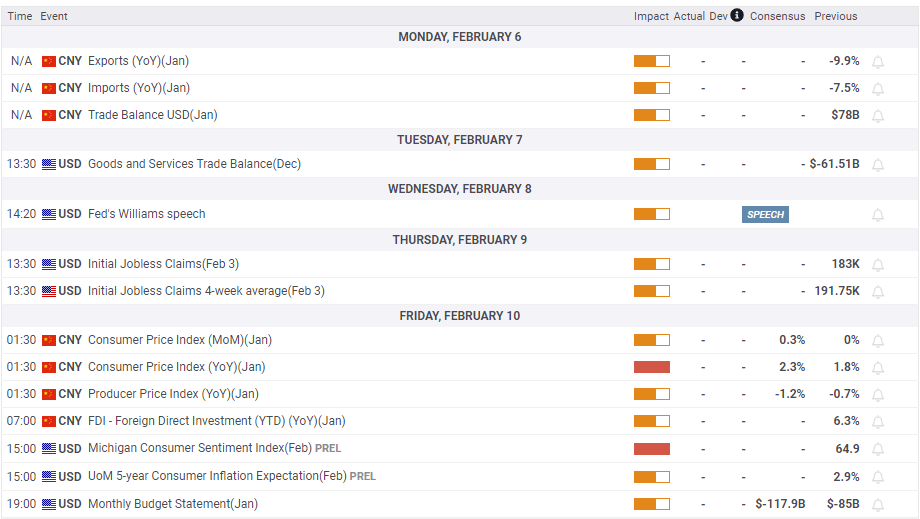

On Thursday, the US economic docket will feature the weekly Initial Jobless Claims data and the University of Michigan (UoM) will release the preliminary Consumer Confidence Index for February on Friday. The 5-year Consumer Inflation Expectation component of the UoM’s sentiment survey, which stood at 2.9% in January, could trigger a market reaction ahead of the weekend. A decline in this figure is likely to weigh on the USD and vice versa.

Market participants will also keep a close eye on US Treasury bond yields. 3.5% aligns as a key level for the 10-year US Treasury bond yield. As long as this level stays intact, XAU/USD’s downside is likely to remain limited. A decisive rebound above that level on hawkish Fed commentary could cause Gold price to push lower.

Gold price technical analysis

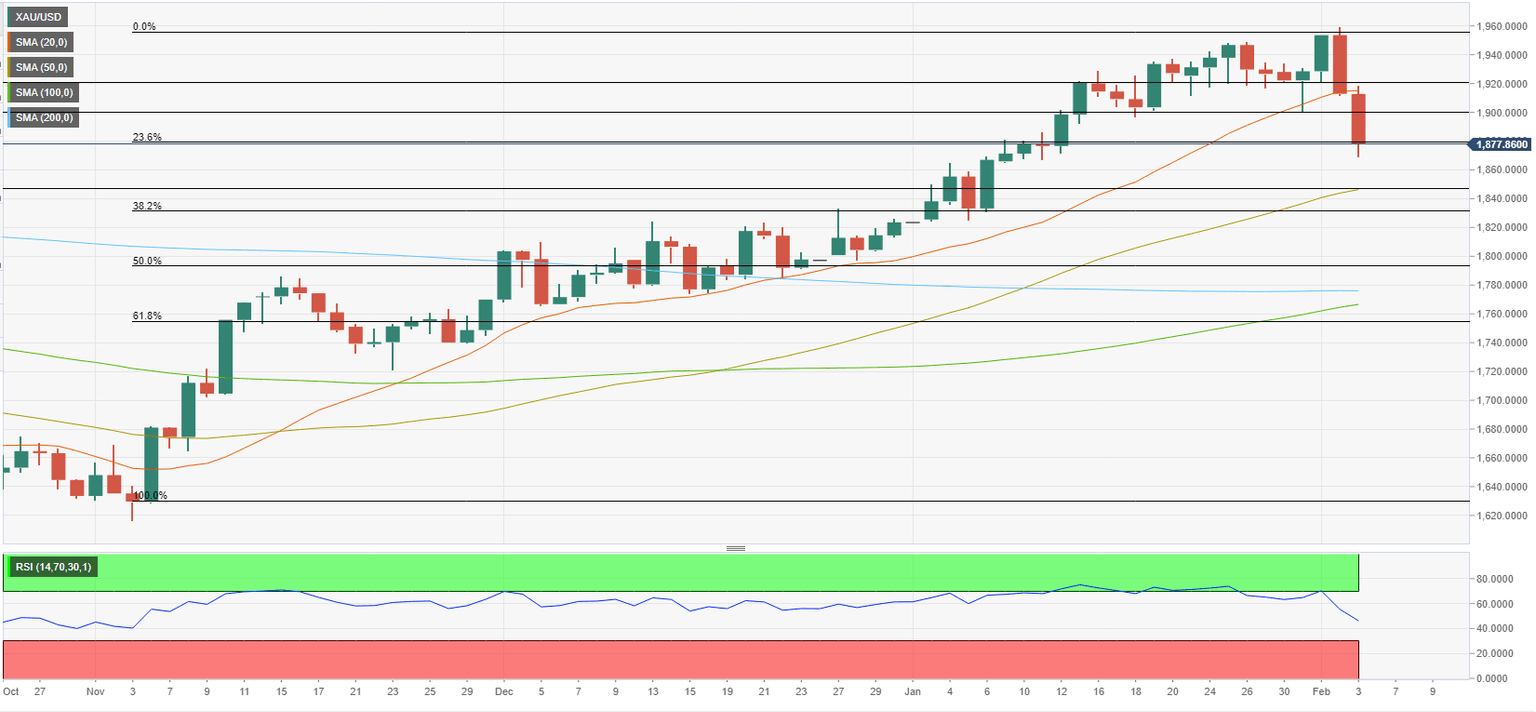

Following the sharp decline witnessed in the second half of the week, XAU/USD's near-term technical outlook points to a bearish shift. The pair closed below the 20-day Simple Moving Average for the first time since early November, the beginning point of the latest uptrend. Additionally, the Relative Strength Index (RSI) indicator dropped below 50.

On the downside, the 50-day SMA aligns as first support at $1,845 ahead of $1,830 (Fibonacci 38.2% retracement of the latest uptrend). A daily close below the latter could open the door for an extended slide toward $1,800 (Fibonacci 50% retracement, psychological level). The daily RSI, however, is likely to come close to the oversold area in that scenario, which could discourage sellers.

XAU/USD faces first resistance at $1,880 (Fibonacci 23.6% retracement). In order to turn bullish again, the pair needs to rise above $1,900 (psychological level, static level) and stabilize above that level before testing $1,920 (static level, 20-day SMA).

Gold price forecast poll

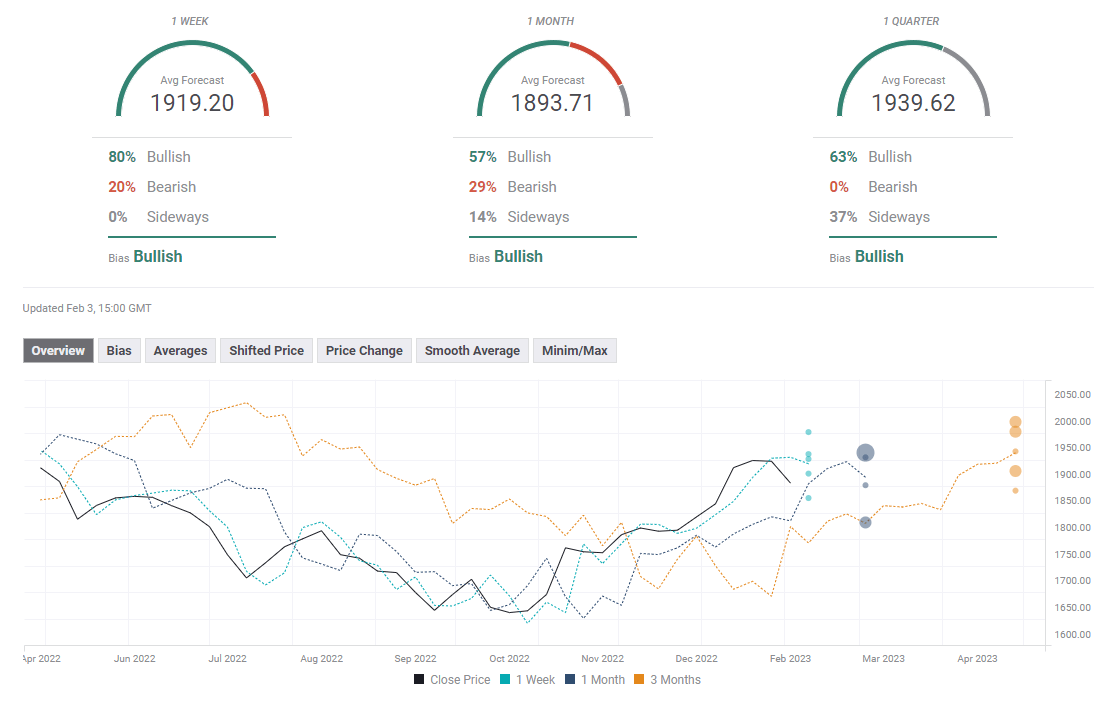

Despite the recent losses, FXStreet Forecast Poll shows that a large portion of polled experts hold a bullish view for XAU/USD in the short term with the one-week average target aligning near $1,920. The one-month outlook offers a mixed picture.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.