Gold Price Weekly: Bullish potential stays intact as XAU/USD ignores rising US yields

- XAU/USD registered impressive gains for the second straight week.

- Gold continues to shine as the go-to safe-haven asset.

- The near-term technical outlook points to overbought conditions.

After posting its largest one-week gain since March, Gold has continued to rise for a second consecutive week and reached its highest level in three months above $1,980, fuelled by safe-haven demand. Next week’s economic docket will offer several high-tier data releases that could potentially impact XAU/USD’s action, but investors are likely to stay focused on headlines surrounding the Israel-Hamas conflict.

What happened last week?

Gold started the week in a calm manner, staging a downward correction on Monday after rising more than 3% on Friday. On Tuesday, the data from the US showed that consumer activity remained healthy, with Retail Sales rising by 0.7% on a monthly basis in September. This data failed to trigger a noticeable market reaction, allowing XAU/USD to end the day virtually unchanged.

Safe-haven flows started to dominate the financial markets early Wednesday as geopolitical tensions escalated on reports of a strike on al-Ahli Arab Hospital in Gaza. As a result, Gold advanced to a multi-month high above $1,960. Bulls’ willingness to continue to defend the 200-day Simple Moving Average (SMA) also attracted technical buyers mid-week and provided an additional boost to the pair. Meanwhile, the data from China showed early Wednesday that the Gross Domestic Product (GDP) grew at an annual rate of 4.9% in the third quarter, surpassing analysts' forecast for an expansion of 4.4%. Additionally, Retail Sales and Industrial Production increased by 5.5% and 4.5% on a yearly basis in September.

Speaking before the Economic Club of New York on Thursday, Federal Reserve Chairman Jerome Powell acknowledged that rising yields were producing tighter financial conditions. This would take some pressure off the US central bank to raise the policy rate, Powell said. The US Dollar (USD) came under selling pressure on these comments, helping XAU/USD preserve its bullish momentum and advancing beyond $1,980.

Despite Powell’s cautious tone, US Treasury bond yields continued to push higher, with the yield on the 10-year reference reaching its highest level since 2007 at 5%. However, the surprisingly bullish performance of XAU/USD in the face of rising yields suggested that the inverse correlation between the 10-year yield and Gold price weakened.

Assessing the conditions in the bond market, Powell said that the recent rise in yields was not a result of markets pricing in higher expected inflation or the Fed doing more on rates. On a similar note, “some part of bond yield rise is tied to term premiums,” Dallas Fed President Lorie Logan stated on Friday. In fact, the CME Group FedWatch Tool shows that markets are pricing in a 75% probability that the Fed policy rate will remain unchanged at 5.25%-5.5% by the end of the year.

The upsurge in yields could be a product of heightened uncertainty surrounding the upcoming US budget negotiations ahead of the November 17 government shutdown deadline.

In a televised speech on Thursday, US President Joe Biden said that he will ask Congress to approve extra funding to aid Israel. Citing a person familiar with the matter, Reuters reported that the funding would total $14 billion. In the meantime, Republicans are yet to approve the next House speaker. Even if the Senate supports additional funding, a legislation cannot be passed until there is a new speaker. Republicans are unlikely to approve someone who will side with Democrats in these negotiations. In summary, bonds struggle to find demand even though they carry a relatively high interest rate, with investors growing increasingly concerned about the US budget deficit and a potential downgrade to the country’s debt rating.

Next week

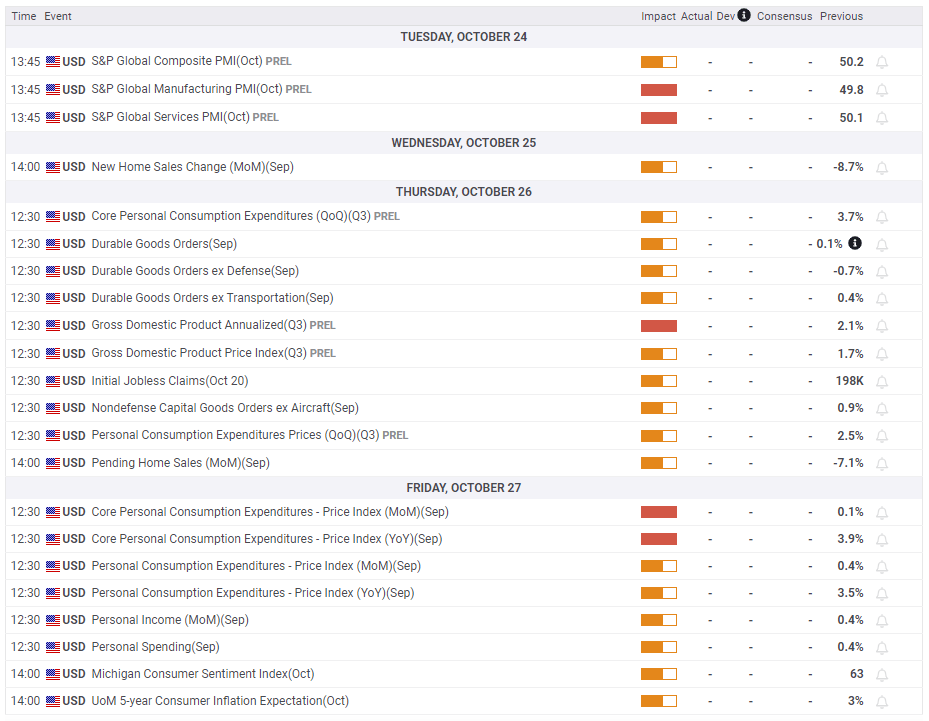

The US economic calendar will feature several high-impact data releases next week, starting with the S&P Global Manufacturing and Services PMI surveys on Tuesday. On Thursday, the US Bureau of Economic Analysis (BEA) will release the first estimate of the third quarter Gross Domestic Product (GDP) growth and publish the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, on Friday.

The market reaction is likely to be straightforward to these data and remain short-lived. A strong Q3 GDP growth could reaffirm the Fed’s view that the US economy remains resilient despite high interest rates and help the USD gather strength. On the other hand, a soft monthly Core PCE inflation, at or below 0.3%, could support the view that the Fed doesn’t need to tighten the policy further this year and weigh on the USD.

Geopolitics are likely to remain as the primary driver of Gold’s action next week. The Israeli defense minister reportedly ordered troops to prepare to see Gaza "from the inside." A ground invasion is likely to trigger another bout of flight to safety and support Gold. A de-escalation of tensions in the Middle East seems very unlikely in the near term, especially with Hezbollah getting more involved in the conflict.

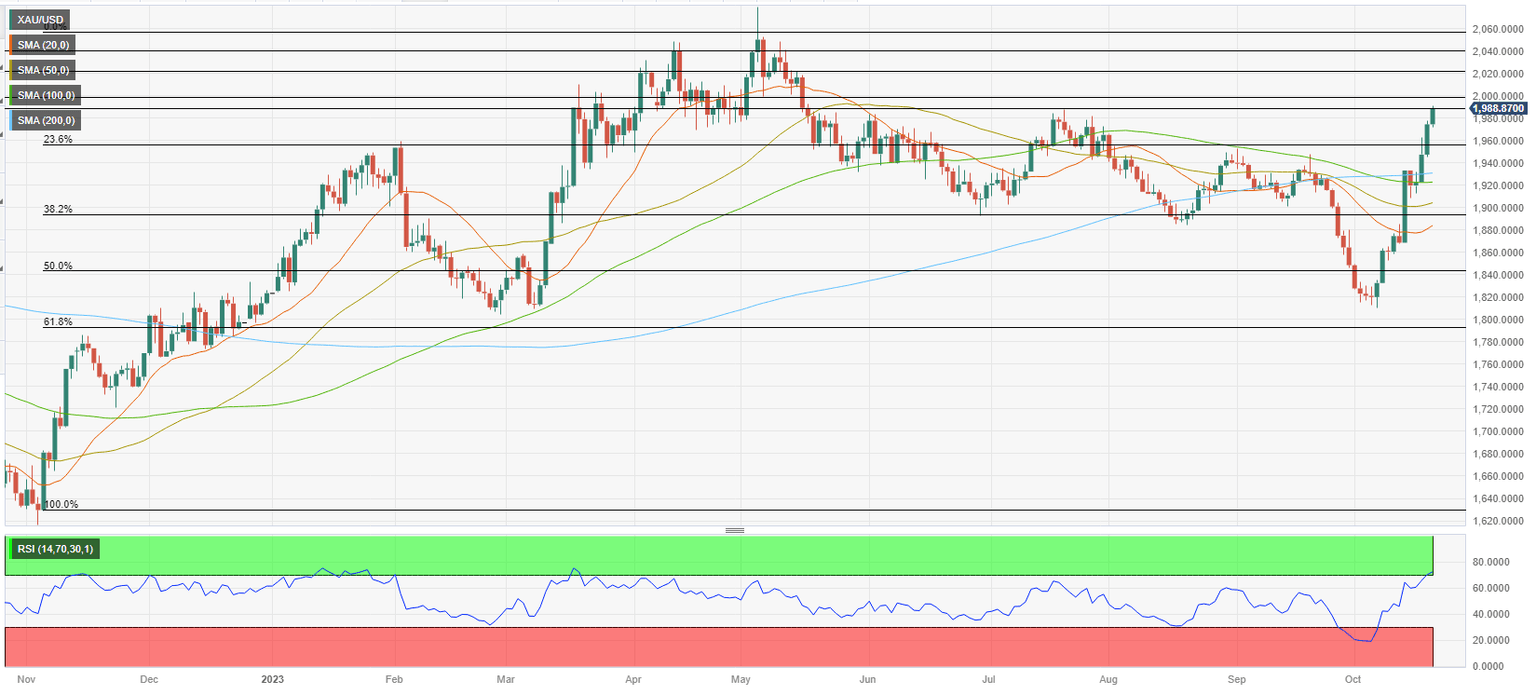

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart rose above 70, highlighting technically overbought conditions for Gold for the first time since March. In case XAU/USD stages a technical correction, $1,960 (Fibonacci 23.6% retracement of the latest uptrend) aligns as first support before $1,930-$1,920 (200-day Simple Moving Average (SMA), 100-day SMA). A daily close below that support area could discourage buyers and open the door for an extended slide to $1,900 (Fibonacci 38.2% retracement, psychological level).

On the upside, Gold could face stiff resistance at $2,000 (psychological level, static level). In case XAU/USD rises above this level, technical buyers could take action and fuel another leg higher toward $2,020 (static level) and $2,040 (static level).

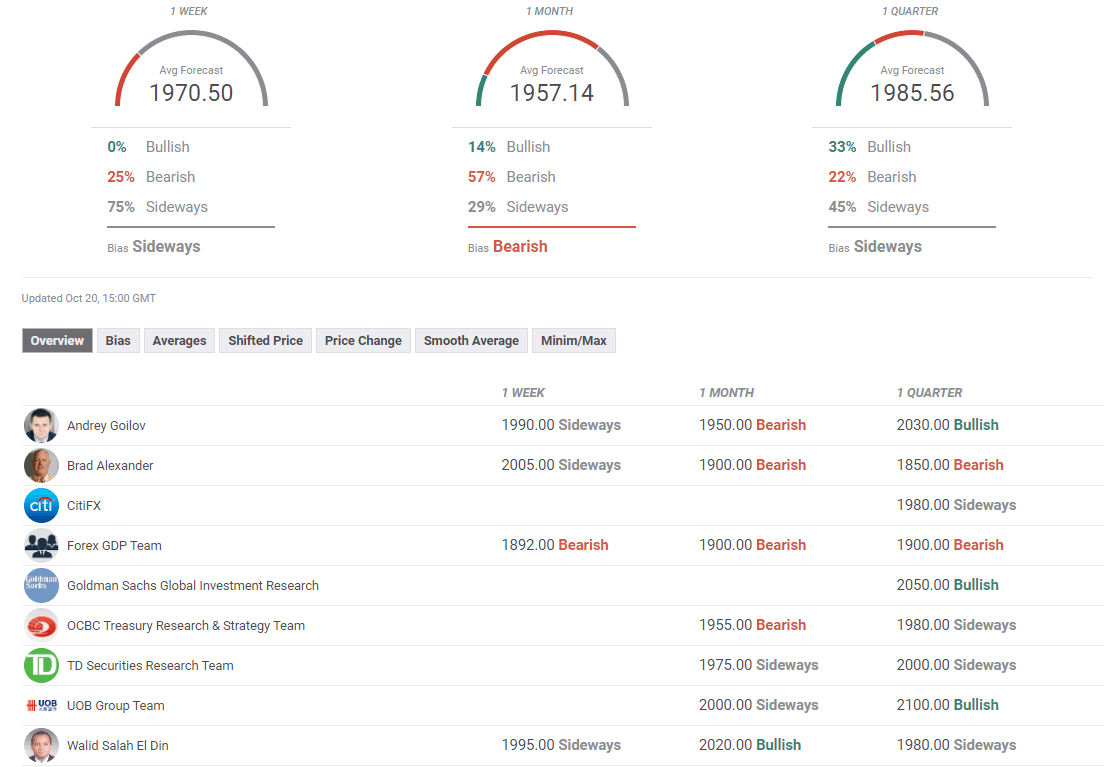

Gold forecast poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.