Gold Price Forecast: XAU/USD retreats from monthly high as Fedspeak grabs attention

- Gold price corrects from a monthly high of $2,670 early Thursday amid a US holiday.

- The US Dollar consolidates gains despite Treasury bond yields pullback and risk aversion.

- Gold price risks deeper correction amid impending Bear Cross and as RSI turns south.

Gold price pulls back from a monthly high of $2,670 set on Wednesday as buyers turn cautious after discouraging China’s inflation data and the hawkish Federal Reserve (Fed) Minutes. All eyes now remain on a bunch of Fed speakers due to speak later amid US holiday-thinned market conditions.

Gold price awaits Fedspeak amid looming downside risks

China’s Consumer Price Index (CPI) inflation slowed to 0.1% annually in December from 0.2% in November, aligning with the market estimates while the Producer Price Index (PPI) fell 2.3% year-on-year (YoY) in December, slower than the 2.5% fall in November and coming in as expected.

Slowing Chinese inflation suggested a weakening domestic demand in the world’s biggest consumer, accentuating the economic concerns despite several stimulus efforts by the authorities. Growing China’s economic worries add to the pullback in the Gold price as the dragon nation is the world’s top Gold consumer.

Further, Gold price bears the brunt of the recent US Dollar (USD) upswing and elevated US Treasury bond yields amid a slew of strong US data, including the JOLTS Job Openings survey, Jobless Claims and ISM Manufacturing and Services PMI, which continues to back the case for fewer interest rate cuts by the Fed this year.

Additionally, the hawkish Minutes of the Fed’s December meeting offset the weak US ADP Employment Change data on Wednesday, allowing Gold sellers to stage a comeback after two straight days of gains. The Minutes showed that Fed policymakers expressed concern about inflation and the impact of US President-elect Donald Trump’s immigration and trade policies, suggesting that they would be moving more slowly on rate cuts.

Looking ahead, Gold traders will closely scrutinize speeches from Richmond Fed President Tom Barkin, Kansas Fed President Jeffery Schmid and Fed Governor Michelle Bowman for fresh insights on the US central bank’s future rate cuts.

However, speculations surrounding incoming US President Trump’s tariff plans will continue to rock Gold markets, with moves likely to be exaggerated by a partial US holiday on account of a national day of mourning for former President Jimmy Carter.

On Wednesday, citing four sources familiar with the matter, CNN News reported that US President-elect Donald Trump is considering declaring a national economic emergency to allow for a new tariff program by using the International Economic Emergency Powers Act, known as “IEEPA. The headline triggered a sharp US Dollar advance, notwithstanding the weaker-than-expected US ADP private payrolls data, which came in at 122K in December, against a 140K print expected.

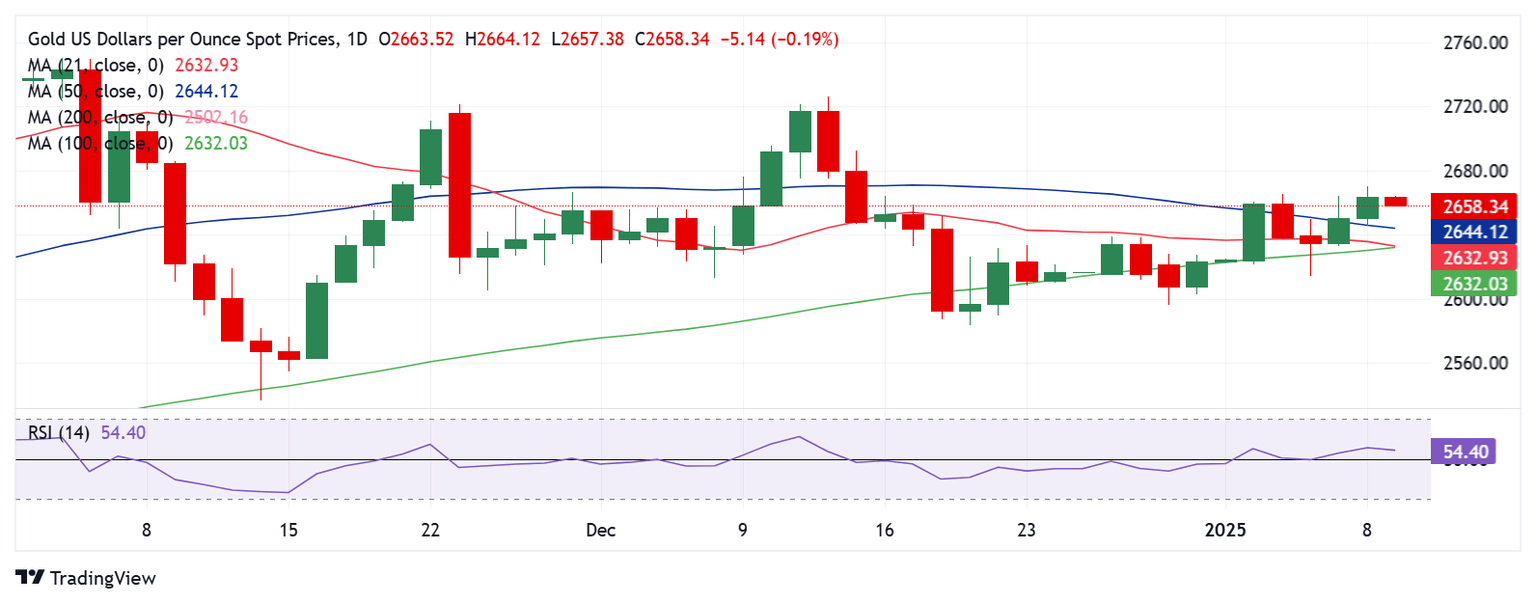

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) has turned lower toward the midline, though holding well above it. This suggests that Gold buyers could be facing some exhaustion.

Adding credence to the dwindling recovery momentum, the 21-day Simple Moving Average (SMA) is set to cross the 100-day SMA from above, which, if materialized on a daily closing basis, would validate a Bear Cross.

If the Gold price correction extends, the initial demand area will be seen at the 50-day SMA of $2,644. A sustained move below that level will challenge the confluence of the 21-day SMA and the 100-day SMA at $2,632.

Deeper declines will call for a test of the January 6 low of $2,615, followed by the $2,600 round level.

On the other hand, should Gold buyers jump back on the bids, the $2,665 static resistance must be scaled sustainably.

Further up, the December 13 high at $2,693 and the $2,700 level will be next on buyers’ radars.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.