Gold Price Forecast: XAU/USD retains gains near fresh record highs

XAU/USD Current price: $2,548.15

- The European Central Bank trimmed interest rates, repeated it will remain data-dependant.

- The United States Producer Price Index rose by more than anticipated MoM in August.

- XAU/USD eased just modestly from a fresh all-time high, maintains its bullish strength.

Spot Gold surged to a fresh all-time high of $2,555.11 on Thursday, following the European Central Bank (ECB) monetary policy announcement and some relevant macroeconomic figures from the United States (US). Still, the news had a limited impact across the FX board, as they lacked a surprise factor. Nevertheless, XAU/USD soared, finding additional support on the poor performance of US indexes after Wall Street’s opening.

On the one hand, the ECB decided to reduce the deposit facility rate by 25 basis points (bps) to 3.5%, as widely anticipated. However, the interest rate on the main refinancing operations was cut by 60 bps to 3.65%, while the interest rate on the marginal lending facility was also trimmed by 60 bps to 3.9% from 4.5% previously. The decision could be seen as dovish, but it fell short of having a negative impact on the Euro.

On the other hand, the US reported that the August Producer Price Index (PPI)h rose by 1.7% from a year earlier, below the 1.8% expected and the previous 2.1%. On a monthly basis, the PPI was up by 0.2%, slightly above the 0.1% anticipated. Additionally, Initial Jobless Claims for the week ended September 6 met expectations by printing at 230K. The figures were supportive of a Federal Reserve (Fed) interest rate cut next week but not enough to revive hopes for an aggressive 50 bps reduction. The US Dollar turned lower afterwards.

In the meantime, Asian and European equities edged higher, compliments to a firm recovery in the tech sector. US indexes, however, were unable to follow the positive lead, with the Dow Jones Industrial Average and the S&P500 posting modest intraday losses.

XAU/USD short-term technical outlook

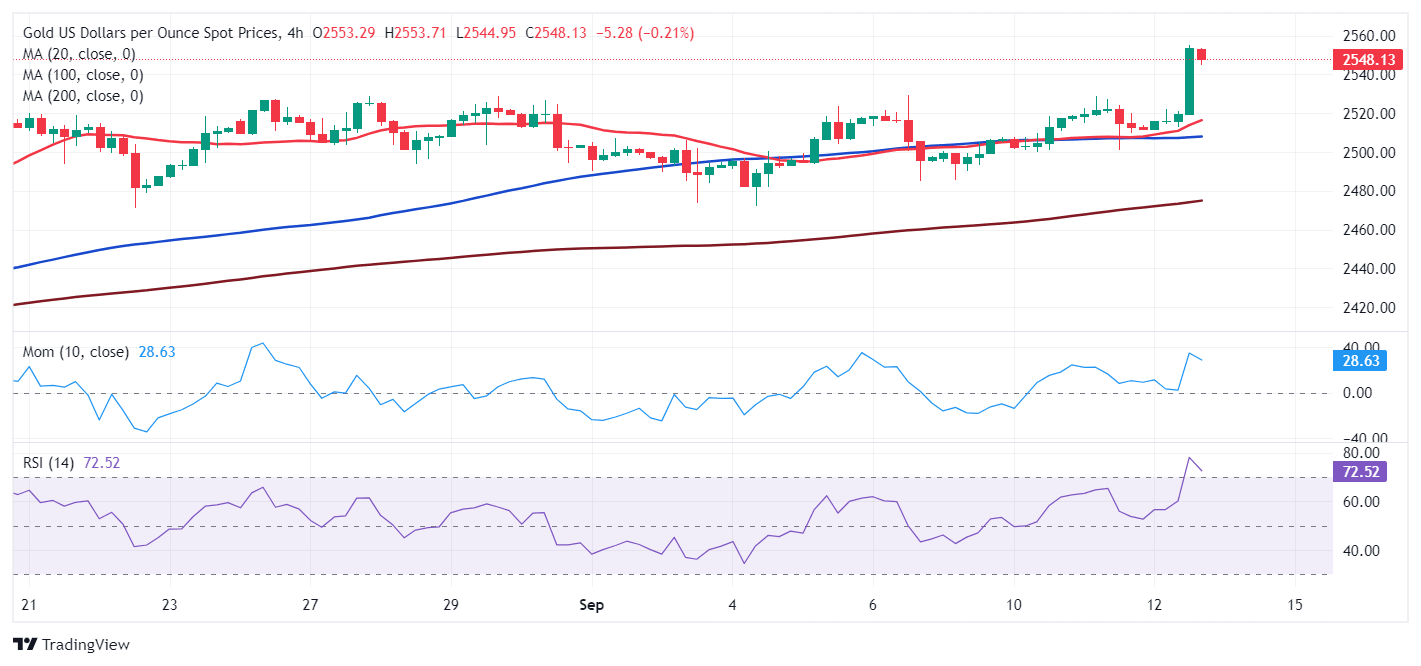

XAU/USD trades a handful of $ below the aforementioned record high, retaining its bullish stance. The daily chart shows it met buyers around a bullish 20 Simple Moving Average (SMA) for the sixth consecutive day, while the 100 and 200 SMAs keep heading north, far below the shorter one. Technical indicators, in the meantime, picked up bullish momentum with plenty of room to extend gains.

The 4-hour chart for the XAU/USD pair shows the risk skews to the upside. The 20 SMA is picking up above a flat 100 SMA over $30 below the current level, while the 200 SMA grinds north well below the other two. Finally, technical indicators maintain their sharp upward slopes, with the Relative Strength Index (RSI) indicator approaching overbought readings. Nevertheless, there are no signs of bullish exhaustion, with buyers likely adding on pullbacks and aiming for higher highs.

Support levels: 2,535.10 2,521.85 2,507.20

Resistance levels: 2,555.10 2,570.00 2,585.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.