Gold Price Forecast: XAU/USD rebounds but not out of the woods yet

- Gold price rebounds toward $1,830, snapping an eight-day downtrend.

- Oil price sell-off, bond market recovery and weak US data comfort markets, Gold price.

- Gold price awaits Friday’s US Nonfarm Payrolls to confirm a likely dead cat bounce.

Gold price is trading in the green for the first time in nine trading days early Thursday, as sellers take a breather after finding a floor near $1,815. A positive shift in risk sentiment on the back of multiple fundamental catalysts is saving the day for Gold price but the further recovery remains elusive heading toward Friday’s all-important Nonfarm Payrolls (NFP) data from the United States.

Gold price cheers US bond market relief

Gold price is holding the renewed upswing, snapping an eight-day losing streak so far this Thursday. Gold price is capitalizing on the US bond market relief, although awaits a fresh batch of US economic data for extending the recovery. The US Treasuries rallied hard, as the bond market was rescued by a 5% sell-off in Oil prices, weak US ADP jobs data and the ISM Services PMI.

Softer-than-expected US labor data dialed down expectations of a November US Federal Reserve (Fed) rate hike and triggered a sharp correction in the US Treasury bond yields across the curve, aiding the upturn in the bond market and Gold price.

According to an ADP report on Wednesday, the US private sector added just 89,000 in September, down from an upwardly revised 180,000 in August and far below the 160,000 estimate. US ISM Services PMI fell from 54.5 to 53.6 in September, although matched expectations. Following the data release, odds of a Fed rate hike in November dropped to 23% from about 31% pre-release. Markets also began raising doubts about the US economic resilience and the Fed’s ‘higher for longer’ rate view.

Against this backdrop, the US Dollar is extending the three-day pullback across its major currencies, currently trading near 106.50 while the benchmark 10-year US Treasury bond yields challenge the 4.70% level.

However, it remains to be seen if Gold price will extend the recovery momentum, as traders look to the mid-tier US weekly Jobless Claims data for a fresh impetus. Friday’s US NFP report will hold the key to determining whether it’s a dead cat bounce or a bullish reversal for Gold price. The US economy is likely to have added 170k jobs in September, down from the 187k reported in August. The Unemployment Rate is seen a tad lower at 3.7% while Average Hourly Earnings are expected to rise 4.3% in the reported period, at the same pace as seen in August.

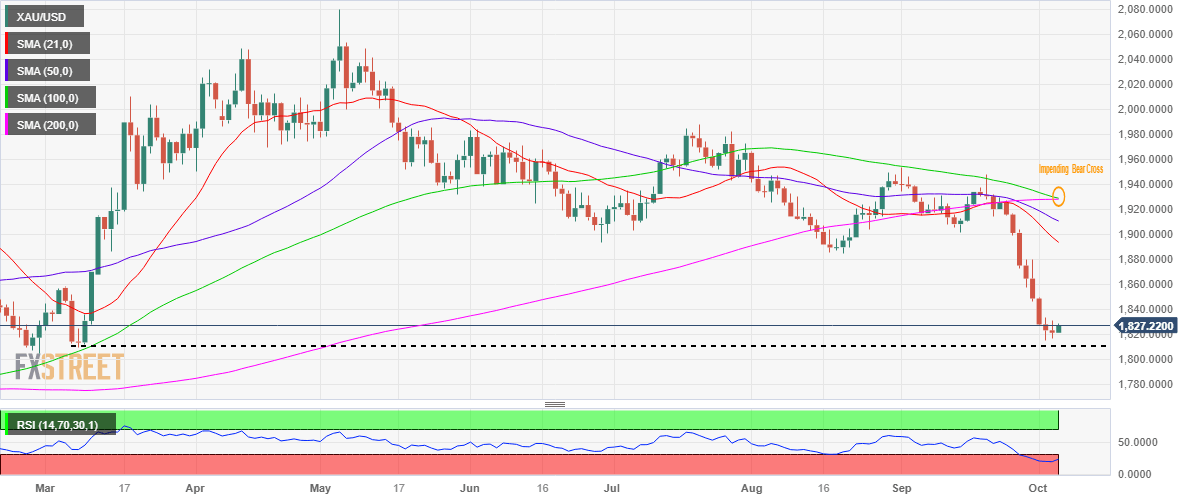

Gold price technical analysis: Daily chart

The near-term technical outlook for Gold price remains more or less the same, as a rebound from a seven-month trough remains intact.

The 14-day Relative Strength Index (RSI) indicator still remains oversold, supporting the ongoing uptick in Gold price.

Gold buyers now target the support-turned-resistance at the $1,850 level should the immediate resistance near $1,831 give way. Further up, the Gold price recovery could challenge the September 28 and 29 highs of $1,880.

However, the 100-Daily Moving Average (DMA) is on the verge of crossing the 200 DMA from above, suggesting that Gold price appears a ‘sell on bounce’ trade.

Gold buyers need acceptance above the $1,850 mark to negate the bearish pressures in the near term. On the downside, Gold price will need to crack Tuesday’s low of $1,815 to tale on the crucial support at the $1,810 level, where the March 8 low is registered. The $1,800 threshold will be the level to beat for Gold sellers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.