Gold Price Forecast: XAU/USD rebound needs acceptance above $2,645 ahead of Fedspeak

- Gold price attempts to bounce from two-month lows of $2,611 as Fedspeak awaits on Tuesday.

- The US Dollar holds Trump trades-led upside despite sluggish Treasury yields and a better mood.

- Gold price recovery must find a foothold above $2,645 as the daily RSI stays bearish.

Gold price is seeing a dead cat bounce early Tuesday after being hammered down to two-month lows of $2,611 on Wednesday. Attention now turns to speeches from several US Federal Reserve (Fed) policymakers due later in the day for fresh hints on the central bank’s interest rate cut outlook.

Gold buyers try their luck yet again

In the meantime, Gold traders are likely to take cues from the prevalent market sentiment and the US Dollar price action, as they continue to digest the latest measures under consideration by China to support its housing sector.

Citing people familiar with the matter, Bloomberg News reported that Chinese authorities are outlining a plan enabling major cities, such as Shanghai and Beijing, to reduce the deed tax for buyers to as low as 1%, down from the current rate of up to 3%.

Following the market’s disappointment over China’s 10 trillion yuan ($1.4 trillion) debt package, any additional supportive measures are unlikely to have any positive market impact, as traders remain wary of potential trade tariffs that could be imposed by US President-elect Donald Trump when he returns to office in January next year.

Also, traders refrain from placing fresh bets on the Gold price heading toward Wednesday’s high-impact US Consumer Price Index (CPI) inflation data, which could significantly impact the Fed’s path forward on rates and the US Dollar (USD).

That said, any upside attempt in Gold price could likely be limited as markets continue to favor the USD amid the ‘Trump trades’ and fading expectations of future rate cuts by the Fed.

A solid win for Trump in the US presidential race and a likely Republican majority in Congress have boosted expectations for a more straightforward path to implement his policies. Trump’s policies on foreign trade and tax cuts are seen as inflationary, which could dissuade the Fed from continuing its easing cycle. This, in turn, could support the USD at the expense of Gold price.

Markets are currently pricing in a 67% chance that the Fed will lower rates by 25 basis points (bps) in December, the CME Group’s FedWatch Tool showed, down from about 83% seen at the start of the month. Therefore, Fedspeak is eagerly awaited to seek more clues on the Fed’s rate cut outlook.

Gold price technical analysis: Daily chart

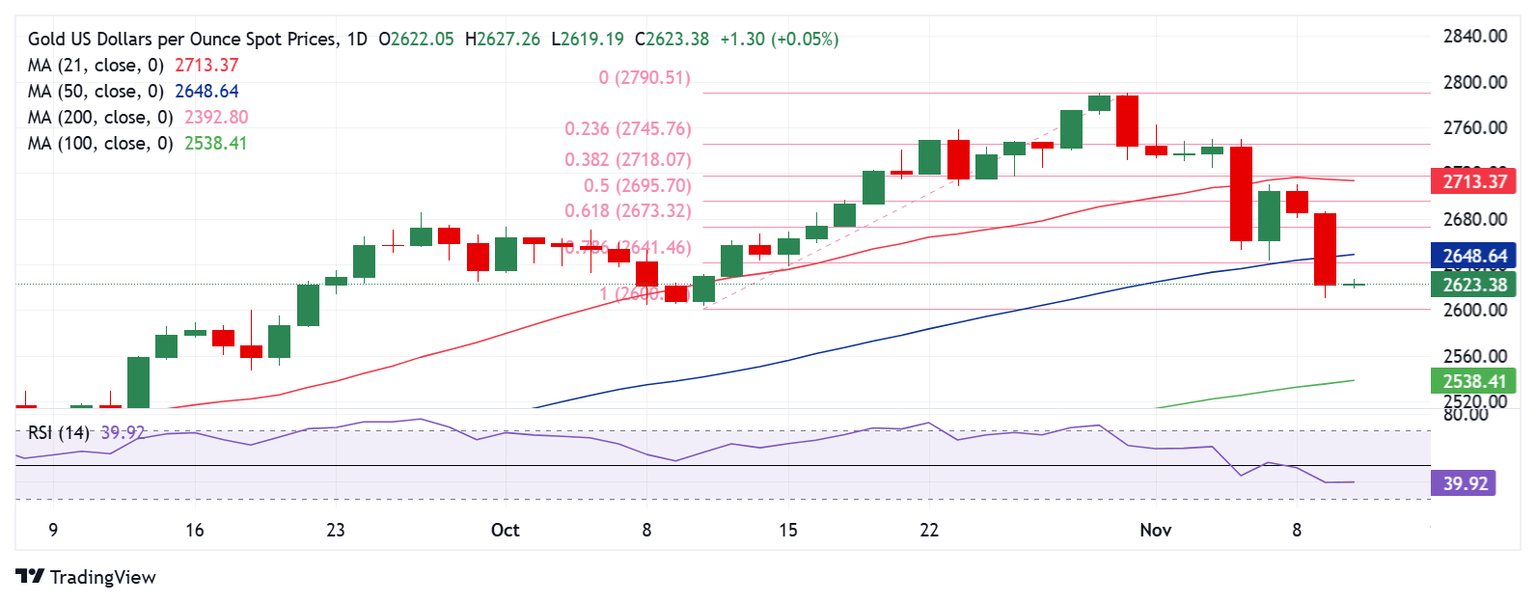

Having taken down all the major Fibonacci Retracement (Fibo) levels recently, Gold price Is consolidating the downside before the next push lower.

In doing so, Gold price has retraced the entire advance from the October 10 low of $2,604 to the all-time high of $2,790.

The 14-day Relative Strength Index (RSI) remains below the 50 level, keeping the downside risks well in place.

Any recovery in Gold price will need to find acceptance above the strong resistance near $2,645, where the 50-day Simple Moving Average (SMA) and the 78.6% Fibo level of the same ascent close in.

The next topside barriers are 61.8% Fibo and 50% Fibo supports-turned-resistances at $2,673 and $2,695, respectively.

If the downtrend regains traction, sellers will attack the October 10 low of $2,604, below which a test of the 100-day SMA at $2,538 will be inevitable in the coming days.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.