Gold Price Forecast: XAU/USD pulls back before resuming uptrend, focus shifts to US data

- Gold price extends corrective decline early Thursday, challenges $2,500.

- The US Dollar rebounds with US Treasury bond yields after dovish Fed Minutes-induced sell-off.

- All eyes turn to US Preliminary PMI data on Thursday ahead of Friday’s Fed Chair Jerome Powell’s speech.

- Gold price pullback to pave the way for fresh record highs, as the daily technical setup favors buyers.

Gold price is looking to build on the previous correction in Thursday’s Asian session, challenging the key $2,500 level. Gold traders resort to profit-taking ahead of the top-tier US Preliminary S&P Global business PMI data, which could throw fresh light on the US Federal Reserve (Fed) interest-rate outlook in the countdown to Chair Jerome Powell’s Jackson Hole appearance on Friday.

Gold price awaits US PMI data for fresh buying boost

Besides, a profit-taking decline, Gold price is also bearing the brunt of a broad-based US Dollar (USD) recovery early Thursday, tracking the uptick in the US Treasury bond yields. The Greenback capitalizes on a negative shift in risk sentiment amid looming Chinese economic concerns and the Middle East geopolitical risks.

Markets also remain wary of lingering US recession fears, as they anticipate the flash S&P Global Manufacturing and Services PMI data later in the North American session. Additionally, they are adjusting their positions before Friday’s key even risk – Fed Chair Jerome Powell’s speech. Powell could use the Jackson Hole address to double down on the Fed’s dovish stance, recently highlighted by the Minutes of its July policy meeting published on Wednesday.

Most policymakers thought that "if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting," the Minutes said. Further, the Minutes read that several of them would have even been willing to reduce borrowing costs in the July meeting itself.

The outrightly dovish Fed Minutes spelt doom for the US Dollar while lifting the demand for the US government bonds and the non-interest-bearing Gold price. This helped Gold price recover losses and settle modestly flat above $2,500 on Wednesday.

Earlier in the day, the US Labor Department said that Nonfarm Payrolls (NFP) for the period from April 2023 to March 2024 was lowered by 818,000. The revision represented a total downward change of about 0.5%, implying that monthly job gains during the period averaged roughly 174,000, compared to the previously reported figure of 242,000.

The NFP March benchmark revision added to the September Fed rate cut bets, weighing further on the Greenback across the board.

Markets are currently pricing in a 35% probability of 50 basis points (bps) cut at the Fed's September 17-18 meeting and a 65% chance of a 25 bps reduction, according to the CME Group's FedWatch Tool.

All eyes also remain centered on Fed Chairman Jerome Powell’s keynote speech in Jackson Hole on Friday for any hints on the likely size of a cut next month and whether borrowing costs are likely to be lowered at each subsequent policy meeting.

In the meantime, the Gold price downside could remain cushioned amid lingering tensions in the Middle East between Hamas and Israel after the latter did not agree to withdraw its troops from the Philadelphi corridor on the Egypt-Gaza border, Prime Minister Benjamin Netanyahu's office said on Wednesday.

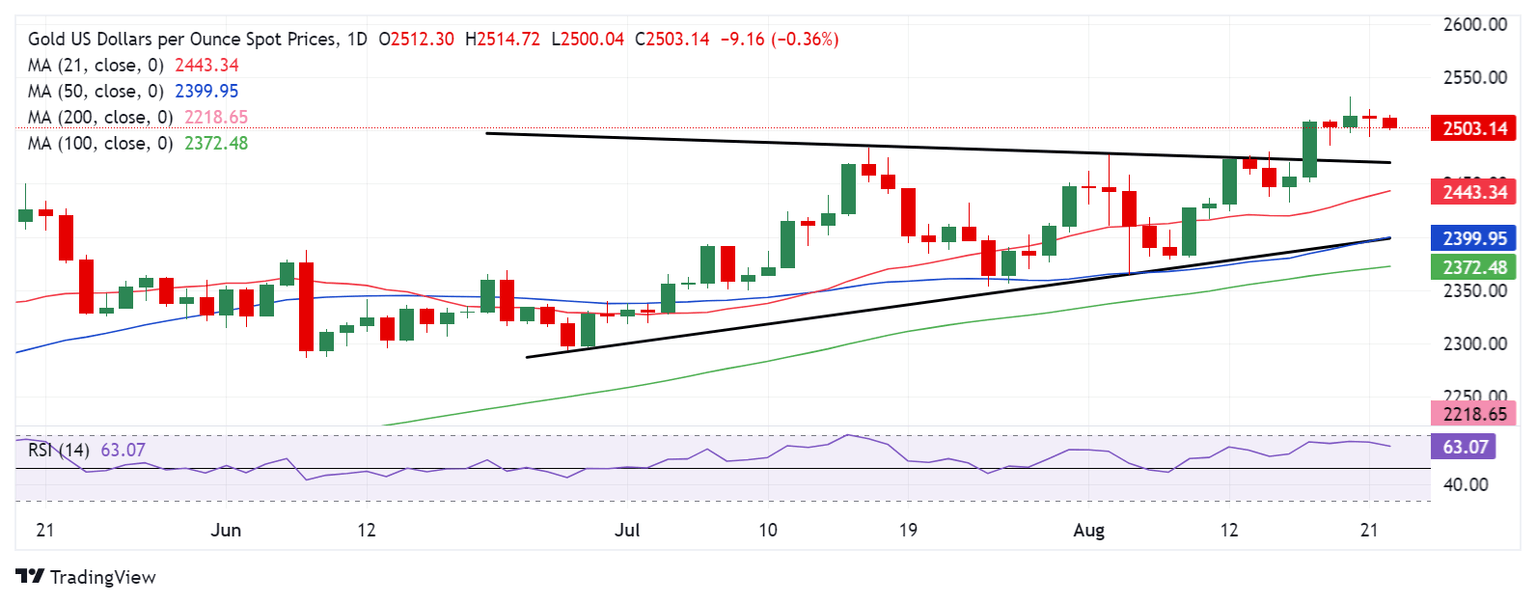

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive, as buyers refuse to give up amid a symmetrical triangle breakout in play and a bullish 14-day Relative Strength Index (RSI)

The 14-day RSI points lower but holds well above the 50 level, currently near 63, suggesting that Gold price remains a ‘buy-the-dips’ trading opportunity.

If the Gold price retracement gathers steam, the immediate support is seen at Monday’s low of $2,486.

A breach of the latter will call for a test of the triangle resistance-turned-support, now at $2,467. Further south, the $2,450 psychological barrier will come to the rescue of Gold optimists.

Conversely, should Gold buyers recapture the record high of $2,532, the next relevant topside target is seen at the $2,550 level.

Acceptance above the latter could challenge the $2,600 round level en route to the triangle target, measured at $2,660.

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Aug 22, 2024 13:45 (Prel)

Frequency: Monthly

Consensus: 49.6

Previous: 49.6

Source: S&P Global

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.