Gold Price Forecast: XAU/USD needs to reclaim $2,340 for a sustained recovery

- Gold price holds recovery from four-week lows, as focus shifts to more US data.

- US Dollar bounces with US Treasury bond yields and the USD/JPY pair.

- Gold price capitalizes on RSI flipping to the bullish zone on the daily chart.

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States (US) for fresh trading impetus. Traders also digest the US Federal Reserve (Fed) interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Gold price jumps as the Fed upholds rate cut bets

Gold price staged an impressive comeback from four-week lows of $2,282 on Wednesday, as the US Dollar and the US Treasury bond yields got sold off into Fed Chair Powell’s dovish signals on the interest rate outlook. The US stocks witnessed a relief rally and dented the haven demand for the Greenback after Powell ruled out the possibility of rate hikes while indicating that policymakers are still leaning toward eventual rate cuts this year.

As expected, the Fed held the Fed Funds Rate steady in the range of 5.25% to 5.5% at its May policy meeting. Powell, however, said that central bankers want “greater confidence” that inflation is falling toward 2%. “It is likely that gaining such greater confidence will take longer than previously expected. We are prepared to maintain the current target federal funds rate for as long as appropriate,” Powell added.

The probability of the first Fed rate cut, likely to be in September, rose to 53% from about 47% pre-Fed announcements. Gold price tends to benefit in a low interest-rate environment.

Meanwhile, the US Dollar was also hit by yet another suspected intervention by the Japanese authorities overnight, which saw USD/JPY crash nearly 450 pips in a span of 45 minutes. Gold price, therefore, holds on to the recent gains but the further upside appears capped should the US Dollar recover further ground, tracking the turnaround in the USD/JPY pair from near 153.00 region.

Later in the day, the weekly US Jobless Claims and the preliminary Unit Labor Cost data for the first quarter will hold relevance ahead of Friday’s Nonfarm Payrolls release.

Gold price technical analysis: Daily chart

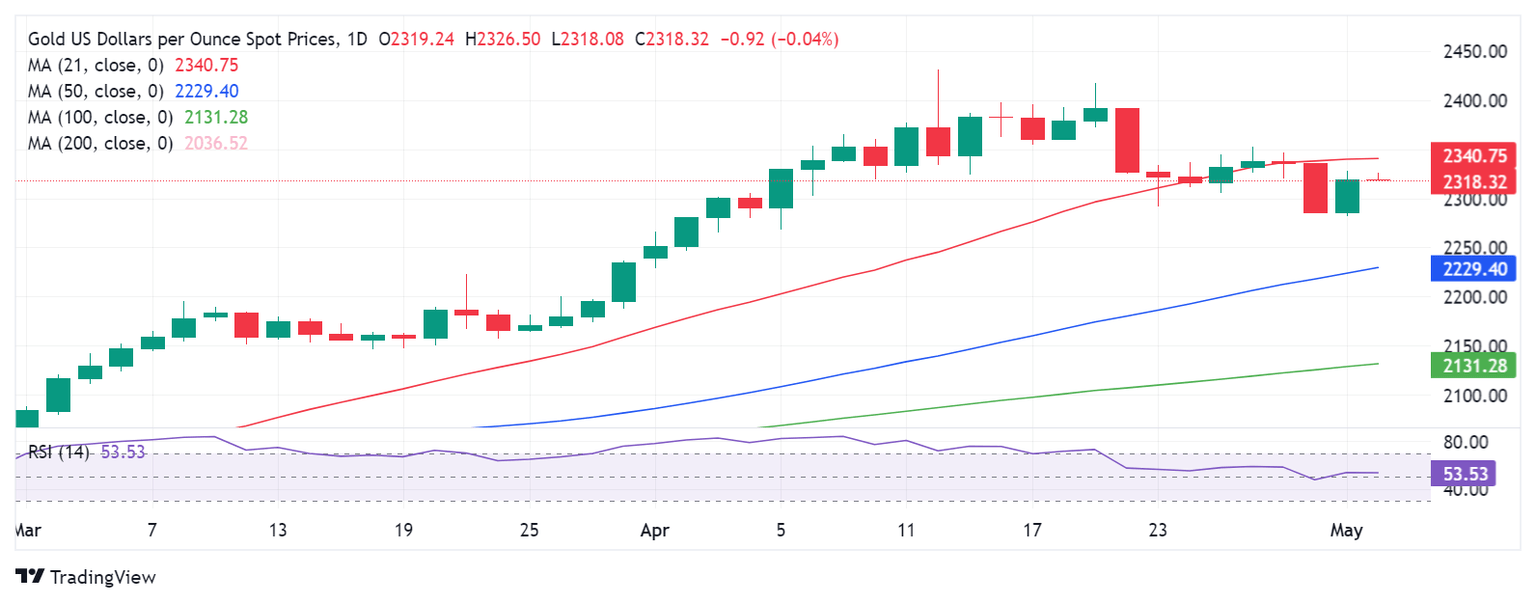

As observed on the daily chart, Gold price found buyers near $2,280 and recaptured the $2,300 level on a daily closing basis, as the 14-day Relative Strength Index (RSI) flipped back into the bullish territory, currently sitting above 53.50.

However, Gold price faces stiff resistance at the 21-day Simple Moving Average (SMA) at $2,340. A sustained move above that level will revive the bullish interests, calling for a test of the $2,370 round level.

The next topside target is seen at the April 22 high of $2,392.

Alternatively, the immediate support is seen at the $2,300 threshold, below which the multi-month low of $2,282 will come into play.

Failure to defend the latter will trigger a fresh downtrend toward the 50-day SMA at $2,229.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.