Gold Price Forecast: XAU/USD needs acceptance above 2,660 to unleash additional recovery

- Gold price sits at eight-day highs above $2,650 early Thursday, eyeing a weekly rebound.

- Geopolitical risks continue to support the traditional safe-haven Gold price ahead of Fedspeak.

- Gold price must scale 50-day SMA resistance at $2,660 as daily RSI peeps into the bullish zone.

Gold price is sitting at the highest level in over a week above the $2,650 barrier in the Asian trading hours on Thursday. All eyes remain on the speeches from several US Federal Reserve (Fed) policymakers and Russia and Ukraine geopolitical updates, in the absence of top-tier US economic data releases.

Gold price buyers appear unstoppable

Gold price extends its recovery mode into a fourth straight session early Thursday, helped by a modest pullback in the US Dollar (USD) and the US Treasury bond yields.

The USD rallied hard on Wednesday, tracking the sharp gains in the US bond yields as traders reinforced the Trump trades optimism, digesting hawkish Fed commentary and poor 20-year bond auction results.

Most of the Fed officials who spoke on Wednesday sound a bit hawkish, prompting markets scale back their expectations of a 25 basis points (bps) interest rate cut in December.

Fed Governor Michelle Bowman said that “the US central bank should pursue a cautious approach on monetary policy.” She was the most hawkish of the lot. Fed Governor Lisa Cook noted that timing of further interest-rate cuts will depend on coming data, leaving the central bank’s decision at its December meeting uncertain.

However, Kansas Fed President Jeffrey Schmid said that “now is the time to dial back restrictiveness of policy. I see full employment, inflation trending lower and solid growth.” Boston Fed President Susan Collins also sounded dovish, saying that “some additional rate cuts are needed as the policy is still restrictive.”

Markets are now pricing in a 52% chance of 25 bps Dec Fed rate cut, the CME Group’s FedWatch Tool shows, down from about 83% seen a week ago.

Despite the hawkish shift in the Fed expectations and Trump trades optimism, Gold price stood tall and benefited from intensifying geopolitical tensions between Russia and Ukraine.

Russia, on Wednesday, staged “a massive information-psychological attack” against Ukraine by spreading a fake warning, purportedly from Ukrainian military intelligence, about an imminent mass air attack.

This response came in after Russia's Defence Ministry confirmed Tuesday that Ukraine fired six US-made Army Tactical Missile Systems (ATACMS) missiles at Bryansk region, just days after US President Joe Biden allowed the Ukrainian use of American-made weapons to strike inside Russia. The Kremlin also threatened a nuclear response to Ukranian’s non-nuclear attacks.

Amidst rife Russia-Ukraine conflict, Gold price is likely to stay supported but the upcoming Fed commentaries could reinforce sellers. Additionally, if risk-aversion hits the roof in the sessions ahead, the USD could regain traction on a flight to safety, capping the Gold price upside.

Traders remain nervous after the American AI giant Nvidia Corp.’s lackluster revenue forecast. Nvidia’s revenue rose 94% to $35.1 billion in the fiscal third quarter with the data centre unit, the biggest division, seeing its revenue double from a year earlier to $30.8 billion.

Gold price technical analysis: Daily chart

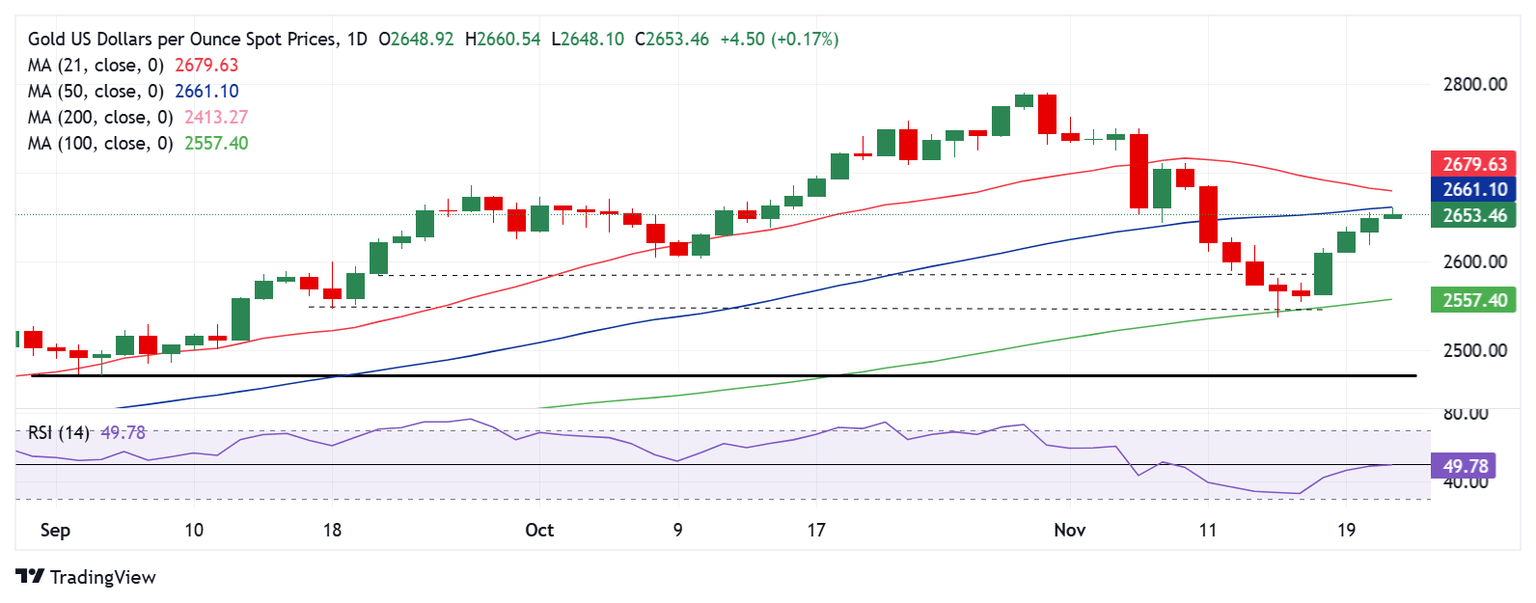

The short-term technical outlook for Gold price appears to lean in favor of buyers as the 14-day Relative Strength Index (RSI) prods the 50 level to the upside. The indicator is currently just above 50.

However, an impending Bear Cross could be a headwind for Gold price. The 21-day Simple Moving Average (SMA) is closing in to cut the 50-day SMA from above. If that happens on a daily closing basis, it will validate the bearish crossover.

Gold buyers need a daily candlestick closing above the 50-day SMA at $2,660 to unleash additional recovery toward the 21-day SMA at $2,680.

The $2,700 threshold will be the next significant target for buyers.

Conversely, failure to find acceptance above the 50-day SMA at $2,660 on a daily closing basis could reinforce sellers toward the $2,600 threshold.

Tuesday’s low of $2,610 will be tested ahead of that.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.