Gold Price Forecast: XAU/USD looks to $2,400 again as $2,350 support holds

- Gold price extends the previous rebound early Wednesday, awaits Powell’s second testimony.

- The US Dollar holds recovery gains with Treasury bond yields even as Fed rate cut bets remain intact.

- Gold price looks north toward $2,400 amid bullish daily RSI, as $2,350 holds the fort.

Gold price is looking to build on the previous rebound above $2,350 in Wednesday’s Asian session, as the US Dollar (USD) consolidates its recovery gains alongside the US Treasury bond yields.

Gold awaits more Powell and Fedspeak

Gold traders weigh US Federal Reserve (Fed) Chairman Jerome Powell’s testimony delivered before the Senate Banking Committee on Tuesday, awaiting his second round in front of the House Financial Services Committee later on Wednesday.

Besides, Powell’s testimony, the focus will also remain on a bunch of speeches from several Fed policymakers, which could help markets seal in a September interest rate cut.

Even though Powell sounded prudent on the policy outlook, during his testimony on Tuesday, saying that inflation had been improving in recent months and that "more good data would strengthen" the case for the rate cut. However, he told lawmakers that he did not want "to be sending any signals about the timing of any future actions" on rates.

Markets continued pricing in over a 70% probability that the Fed will lower rates in September, according to the CME Group's FedWatch Tool. Another rate cut in December is also on the table.

Gold price stalled its rebound near $2,370 on Tuesday, following Fed Chair Jerome Powell’s testimony, as the US Treasury bond yields jumped and propelled US Dollar back on the bids.

Market participants also took Powell’s speech as an excuse to book profits on their US Dollar shorts heading into Thursday’s critical US Consumer Price Index (CPI) inflation release.

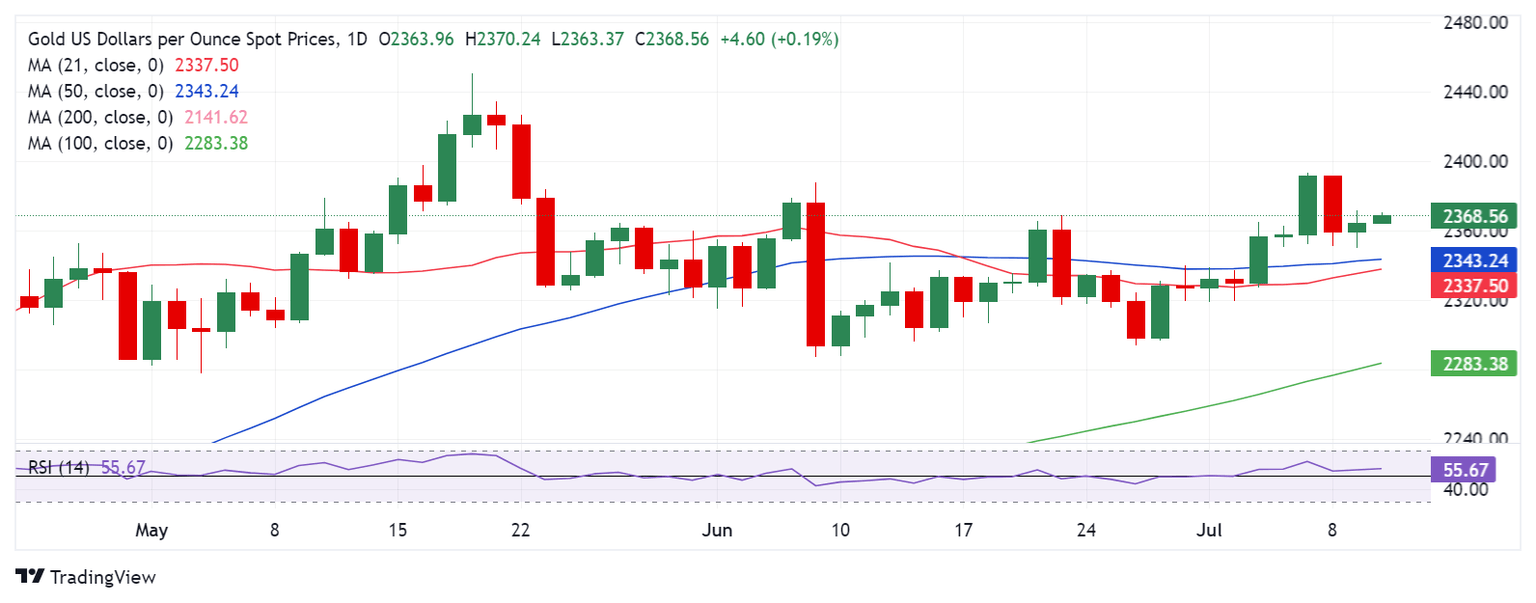

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive, as the 14-day Relative Strength Index (RSI) holds firm above the 50 level.

Gold buyers need to find acceptance above the six-week high of $2,393 to resume the uptrend toward the all-time high of $2,450. Ahead of that, the $2,400 level could act as a tough nut to crack for them.

Alternatively, Gold price could face immediate support at the $2,350 psychological barrier, below which the $2,340 demand area will be challenged.

Around that level, the 50-day Simple Moving Average (SMA) and the 21-day SMA close in. A sustained move below the latter could trigger a fresh downtrend toward the $2,300 round level.

Economic Indicator

Fed's Chair Powell testifies

Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy. Powell's prepared remarks are published ahead of the appearance on Capitol Hill.

Read more.Next release: Wed Jul 10, 2024 14:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.