Gold Price Forecast: XAU/USD looking to challenge the $2,400 mark

XAU/USD Current price: $2,378.41

- Federal Reserve Chair Jerome Powell repeated his hawkish message before Congress.

- An update on the US Consumer Price Index will be out on Thursday.

- XAU/USD gains upward traction in the near term and aims to extend gains beyond $2,400.

Gold keeps trimming Monday losses and flirts with the $2,380 level in the American session, as a better market mood undermines demand for the US Dollar. In the absence of relevant macroeconomic data, investors maintained the focus on Federal Reserve (Fed) Chairman Jerome Powell, who testified before Congress for a second consecutive day.

Powell repeated the mostly hawkish message delivered on Tuesday, adding that policymakers see the current Fed policy as restrictive, while they believe the neutral interest rate must have moved up, at least in the short term. On a positive note, Powell added that he sees “considerable” softening in the labor market. Finally, Powell said that he has confidence in inflation coming down, but he is not prepared to say he is sufficiently confident in it coming sustainably down to 2% yet.

Stock markets reflect the risk-on mood, with Wall Street posting substantial gains and trading near record highs. Government bond yields, in the meantime, remain depressed near multi-week lows, with the 2-year Treasury note offering 4.62% and the 10-year note yielding 4.28%. The curve shrinks but remains inverted, usually seen as a sign of an upcoming recession. At this point, it may be more like a short-lived setback, as the idea of a US recession has long ago left the market’s minds.

Investors will now focus on the upcoming US Consumer Price Index (CPI) figures to be released on Thursday. Annual inflation is foreseen up 3.1% in June, while the monthly increase is expected to be 0.1%. Finally, the core annual CPI is foreseen unchanged at 3.4%. Easing inflationary pressures may boost speculation the Fed will advance an interest rate cut to September rather than November, as is currently anticipated.

XAU/USD short-term technical outlook

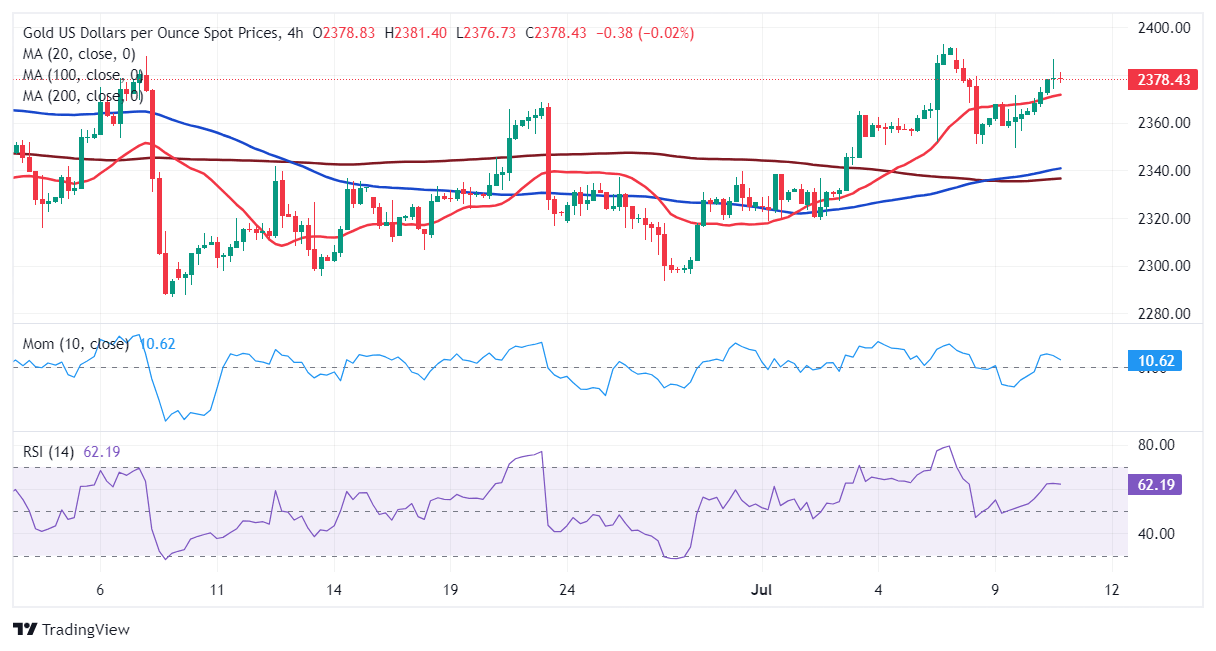

From a technical point of view, the risk in XAU/USD skews to the upside. The daily chart shows that the pair trades above all its moving averages, with a bullish 20 Simple Moving Average (SMA) gaining upward traction at around $2,338 while above the longer ones. Technical indicators, however, lack directional momentum but hold within positive levels, indicating sellers remain side-lined.

In the near term, and according to the 4-hour chart, XAU/USD seems poised to extend its advance. The Momentum indicator aims north and crosses its midline into positive territory, while the Relative Strength Index (RSI) indicator consolidates at around 62. At the same time, the bright metal recovered above the 20 SMA while the 100 SMA crosses above the 200 SMA below the shorter one.

Support levels: 2,363.20 2,349.30 2,335.00

Resistance levels: 2,386.60 2,400.00 2,416.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.