Gold Price Forecast: XAU/USD keeps sight on $2,277 and high-impact US CPI, Fed

- Gold price holds above $2,300 early Wednesday, downside risks remain intact.

- The US Dollar consolidates the upside while Treasury bond yields lick wounds.

- Gold sellers look to crack the key $2,277 support, as the daily RSI stays bearish.

- The US CPI inflation data and Fed interest rate decision are on Gold traders’ radars.

Gold price is consolidating the two-day upswing while defending the $2,300 level early Wednesday. Gold traders prefer to move on the sidelines amid a typical market caution ahead of the all-important US Federal Reserve (Fed) interest rate decision and the US inflation data release.

Gold price bides time, awaiting the US CPI and the Fed verdict

Gold price advanced for the second straight day on Tuesday, building on the previous rebound even as the US Dollar held its renewed upside. The extended recovery in the Gold price could be attributed to a sharp sell-off in the US Treasury bond yields, on the back of a strong US Treasury auction.

According to Reuters, analysts viewed a $39 billion auction in 10-year notes as strong, “with a well above-average demand of 2.67 times the notes on sale and a high yield of 4.438%, more than two basis points lower than at the close of the auction.”

Gold price defended the previous upswing, despite a risk rally on Wall Street, led by new all-time highs for Apple Inc. The S&P 500 index and the Nasdaq closed at fresh record highs after shares of the iPhone maker touched all-time highs on Tuesday as traders weighed in on the company's recently revealed AI features.

All eyes remain on the upcoming big events, the US Consumer Price Index (CPI) data and the Fed policy announcements, as Gold buyers take a breather early Wednesday. The key US CPI data will help shape the Fed’s view on interest rates, significantly impacting the value of the US Dollar and the Gold price in the near term.

The US CPI is set to rise 3.4% YoY in May, at the same pace as in April while the core CPI inflation is expected to tick down to 3.5% over the year in the same period from April’s 3.6%. The monthly headline CPI and core CPI inflation are foreseen at 0.1% and 0.3% respectively.

Any upside surprise to the inflation readings could add credence to the increased bets for delayed Fed rate cuts, which could trigger a fresh US Dollar rally across the board at the expense of the non-interest-bearing Gold price. On the other hand, softer-than-expected inflation data are likely to revive expectations that the Fed could lower rates as early as September, providing extra legs to the Gold price recovery from four-week troughs.

However, any initial reaction to the US CPI data could be temporary, as Gold traders would quickly reposition themselves in the lead-up to the Fed showdown. With no change to the key rates widely priced in, the focus will remain on the so-called Dot Plot chart to see whether the Fed policymakers predict at least two rate cuts this year. Also, of note will be Fed Chair Jerome Powell’s speech, which will set the tone for markets in the coming months.

Markets are now pricing in a 48% probability that the Fed will reduce rates by 25 basis points in September, slightly up from 43% seen following the NFP data release, the CME Group’s FedWatch Tool showed Wednesday.

Gold price technical analysis: Daily chart

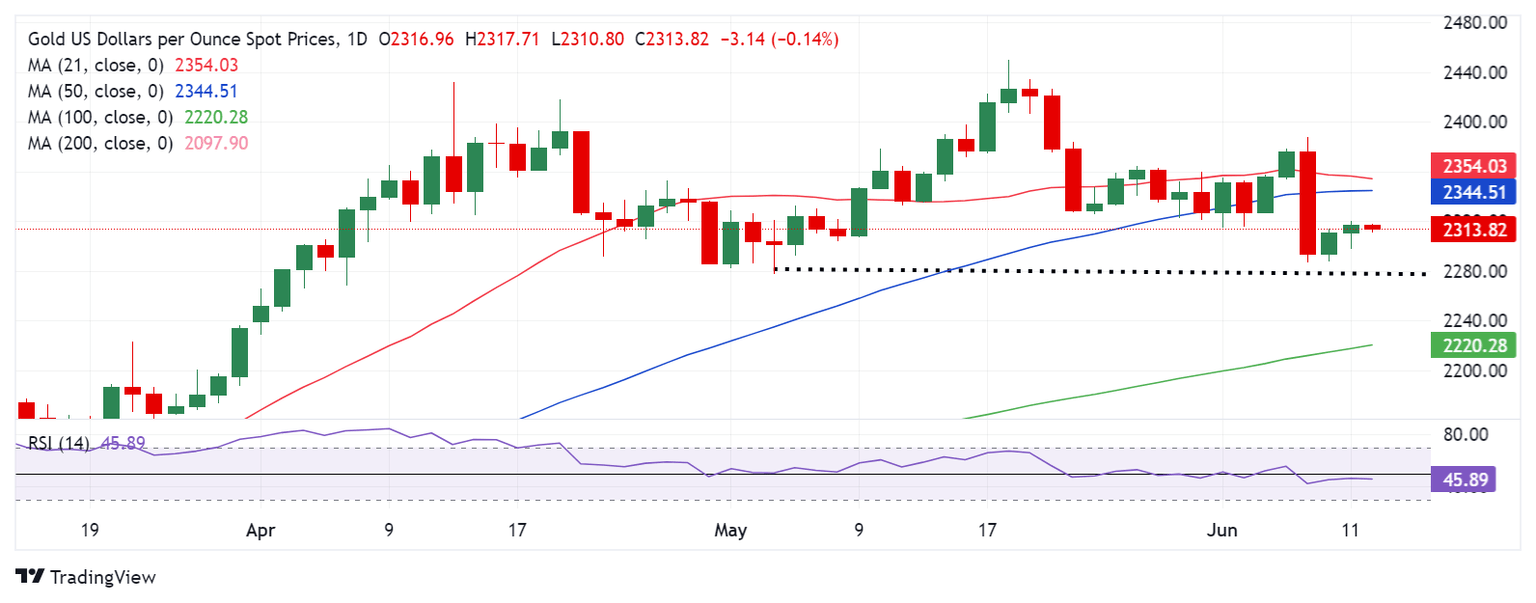

As observed on the daily chart, the Gold price has entered a consolidative phase, following its downside break from the key confluence support zone near $2,350. At that level, the 21-day Simple Moving Average (SMA) and the 50-day SMA close in.

The 14-day Relative Strength Index (RSI) has turned lower once again while below the 50 level, currently near 45.50, suggesting that risks remain skewed to the downside for Gold price.

The immediate support is now seen at the $2,300 threshold, below which the May 3 low of $2,277 will be threatened. A sustained break below the latter is critical to resuming the downtrend.

The next relevant support is aligned at the $2,250 psychological barrier. Additional declines could see a test of the 100-day SMA at $2,220.

Alternatively, the recovery in Gold price will need acceptance above the aforementioned key confluence support-turned-resistance near $2,350.

Gold buyers will then flex their muscles toward the May 24 high of $2,364 on their way to the June 7 high of $2,388.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.