Gold Price Forecast: XAU/USD finds buyers on dips, aims to conquer the $2,700 mark

XAU/USD Current price: $2,692.42

- A better market mood puts pressure on US Treasury yields and the Greenback.

- The December United States Consumer Price Index came in line with market’s expectations.

- XAU/USD maintains its bullish strength and aims to extend gains towards record highs.

Spot Gold peaked at $2695.96 on Wednesday, helped by a bout of risk appetite. The upbeat sentiment was a combination of encouraging United States (US) earnings reports and the country’s Consumer Price Index (CPI) report. On the one hand, major US banks reported results that exceeded expectations. Goldman Sachs’ profits doubled in Q4, while JP Morgan announced that large asset and wealth management grew in the same period.

Inflation in the US, as measured by the change in the CPI rose 2.9% on a yearly basis in December from 2.7% in November, the US Bureau of Labor Statistics (BLS) reported, matching expectations. When compared to the previous month, the CPI was up 0.4%, after adding 0.3% in the previous month. The annual core CPI, which excludes volatile food and energy prices, rose 3.2%, below the expected 3.3%. The news sent stocks skyrocketing and bond yields lower as investors lifted bets on the Federal Reserve's (Fed) upcoming rate cuts.

The macroeconomic calendar will have little to offer in the upcoming days, beyond US Retail Sales scheduled for Thursday. Sales are expected to have grown by 0.6% in December after adding 0.7% in November.

XAU/USD short-term technical outlook

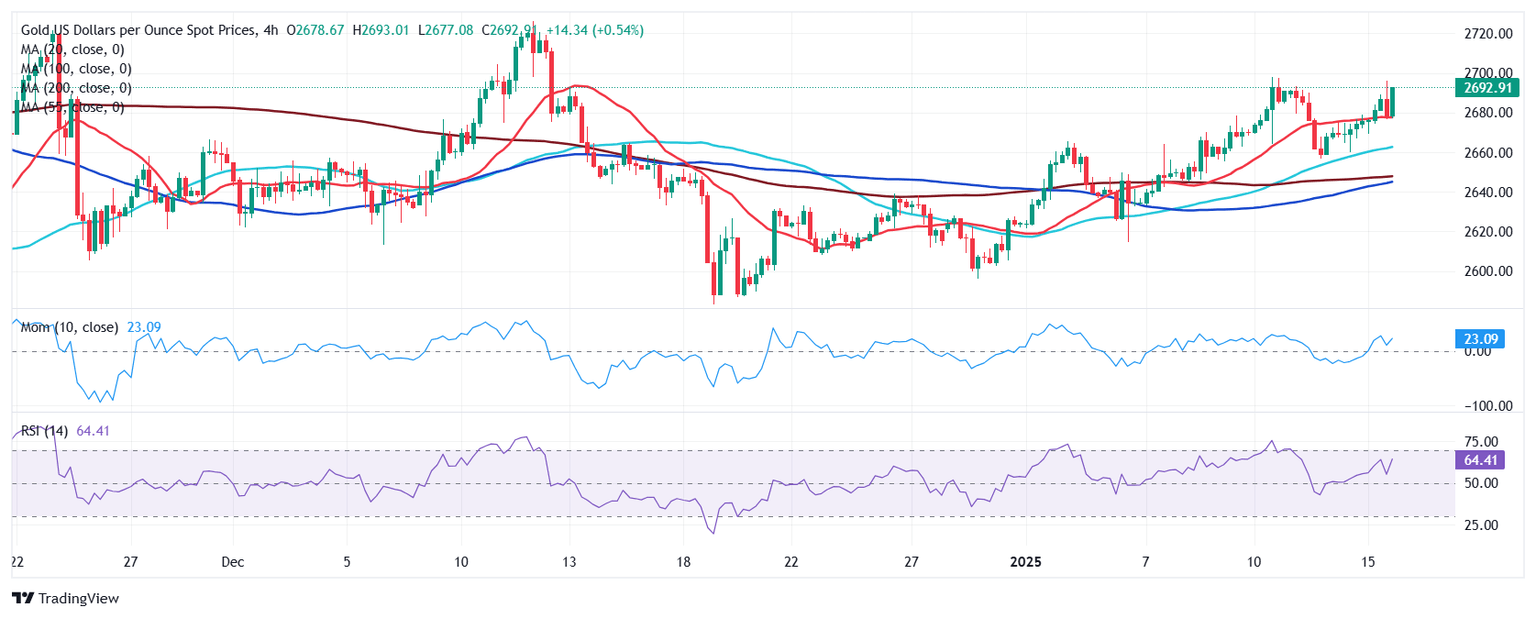

The daily chart for XAU/USD shows it trades around $2,690 maintaining the bullish tone, as it keeps developing above all its moving averages, although the 20 Simple Moving Average (SMA) and the 100 SMA converge around $2.635 with no directional strength, yet acting as dynamic support. At the same time, technical indicators head north within positive levels, reflecting buyers still hold the grip.

In the near term, and according to the 4-hour chart, Gold is neutral-to-bullish. The XAU/USD quickly recovered after a dip towards a flat 20 SMA, currently providing dynamic support at around $2,677. The longer moving averages post tepid advances below the shorter one. Technical indicators, in the meantime, lack directional strength, with the Momentum indicator stuck to its 100 level and the Relative Strength Index (RSI) indicator easing at around 60.

Support levels: 2,675.00 2,660.70 2,645.15

Resistance levels: 2,697.90 2,725.00 2,738.15

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.