Gold Price Forecast: XAU/USD eyes a range breakout, as Fed Minutes looms

- Gold price oscillates in a familiar range near $2,330 early Wednesday.

- The US Dollar licks wounds with US Treasury yields amid a cautious mood.

- Fed Chair Powell touts inflation progress, boosts September rate cut prospects.

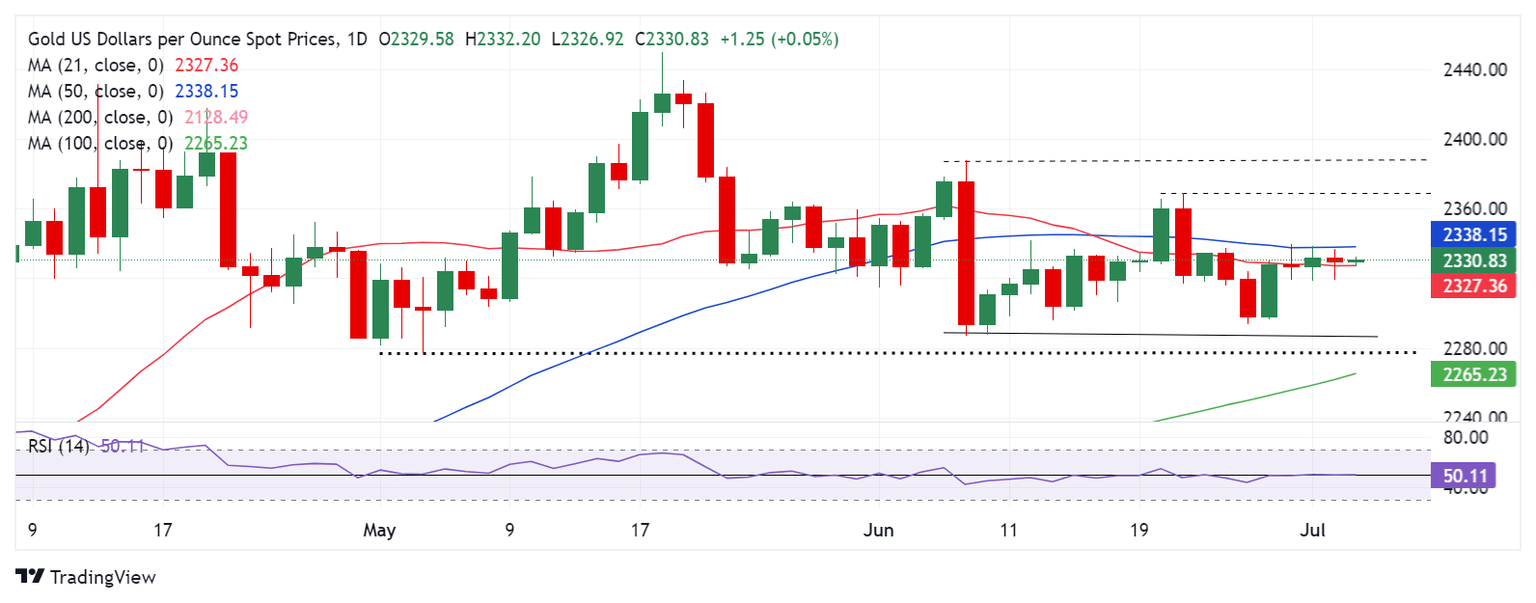

- Gold price needs to crack the 50-day SMA for a sustained recovery, as the daily RSI prods 50 level.

Gold price is trading around a flatline near $2,330 early Wednesday, as traders consider the recent US jobs data and Federal Reserve (Fed) Chairman Jerome Powell’s speech, bracing for yet another busy US calendar.

Gold price awaits US ADP jobs data and Fed Minutes

Asian markets are trading mixed, shrugging off the positive close on Wall Street overnight. Weaker-then-expected China’s Caixin Services PMI rekindles economic growth concerns and dents the sentiment around the domestic stocks. The negative shift in the market mood somewhat helps limit the US Dollar decline while keeping Gold price slightly on the back foot.

However, the downside in Gold price remains capped, as the US Treasury bond yields continue to reel from the pain of dovish comments from Fed Chair Jerome Powell delivered on Tuesday at the European Central Bank (ECB) Forum on central banking in Sintra. The benchmark 10-year US Treasury yields nudged lower to 4.43% on Tuesday after one of its largest single-day gains of the year on Monday.

Though Powell cheered the recent inflation data, which clearly points to a disinflationary path, he quickly added that he wants to see more before being confident enough to start cutting interest rates.

Markets scaled up bets for a September rate cut slightly after Fed Chair Powell acknowledged progress in disinflation, as they perceived his comments as dovish. Currently, markets see a 67% chance of the Fed lowering rates in September, a tad higher than about 63% seen before Powell’s commentary.

Renewed dovish Fed expectations could continue to provide ‘dip-buying’ demand for Gold price, also as the latest World Gold Council (WGC) report showed a net 10 tons of Gold buying by central banks in May. The National Bank of Poland was the biggest Gold purchaser in May, adding 10 tons of gold to its reserves, the WGC report said.

All eyes now turn to the US ADP Employment Change report after the Job Openings and Labor Turnover Survey (JOLTS) showed Tuesday that the job openings rose to 8.14 million at the end of May, an increase from the 7.92 million job openings in April. The ADP data is expected to show 160K jobs gains in the US private sector last month, against a 152K increase in May.

Next of note for Gold price remains the Minutes of the Fed’s June 11-12 policy meeting, which could shed more insights on the central bank’s rate and inflation outlook, having a considerable impact on the value of the US Dollar and the Gold price.

Gold price technical analysis: Daily chart

With the 14-day Relative Strength Index (RSI) flirting with the 50 level and Gold price defending the 21-day Simple Moving Average (SMA) at $2,328, risks appear evenly split for traders.

Gold buyers need a sustained break above the 50-day SMA barrier at $2,338 to restart a meaningful recovery from the monthly low of $2,287.

The next topside barrier is seen at the $2,350 psychological level, above which the two-week high of $2,369 could be challenged.

Conversely, if the 21-day SMA resistance-turned-support at $2,328 fails to hold the fort, sellers could extend their control for a test of this week’s low of $2,319.

The $2,300 threshold will come into play should the selling momentum gather pace. The next strong support is aligned at the June low of $2,289.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.