Gold Price Forecast: XAU/USD defends $2,350 support, as Powell’s testimony grabs attention

- Gold price rebounds early Tuesday after the pullback from six-week highs of $2,393 on Monday.

- The US Dollar holds the downside in sync with Treasury bond yields, as risk appetite returns.

- Gold price stays ‘buy-the-dips-‘ trade on increased Fed rate cut bets, Powell’s testimony is next on tap.

Gold price is attempting a tepid bounce while defending the $2,350 psychological support in Asian trading on Tuesday.

The renewed uptick in Gold price could be attributed to the downside consolidation phase of the US Dollar and the US Treasury bond yields. Traders eagerly await US Federal Reserve (Fed) Chairman Jerome Powell’s congressional testimonies for fresh hints on the interest-rate cut timing.

Markets are pricing a 77% chance that the Fed will lower rates in September, according to the CME Group’s FedWatch Tool. Another cut is expected by December.

Friday’s disappointing US labor market report affirmed a Fed rate cut in September after the headline Nonfarm Payrolls (NFP) increased by 206,000 in June, beating the market forecast for a 190,000 gain but April and May readings were significantly revised down by a combined 111,000. Average hourly earnings rose 3.9% year-on-year, as expected, registering its lowest since the second quarter of 2021.

Fed Chair Powell’s words could reinforce dovish Fed expectations, lifting Gold price to all-time highs beyond $2,400 at the expense of the US Dollar and the Treasury bond yields. Powell delivers two days of testimony before the Senate Banking Committee, beginning later on Tuesday and followed by the House Financial Services Committee on Wednesday.

Besides, several other Fed policymakers are also likely to speak on Tuesday, which could drive the Gold price action amid a data-light US calendar.

Gold price tumbled on Monday due to profit-taking and concerns over China’s Gold demand. Gold traders resorted to profit-taking after the bright metal failed at the $2,400 threshold while some repositioned ahead of Powell’s testimony and US inflation data due this week.

The People’s Bank of China (PBOC) said on Sunday, China held 72.80 million troy ounces of Gold at the end of June, unchanged from the end of May, the data showed. This was the second month in a row that the PBOC refrained from adding Gold to its reserves.

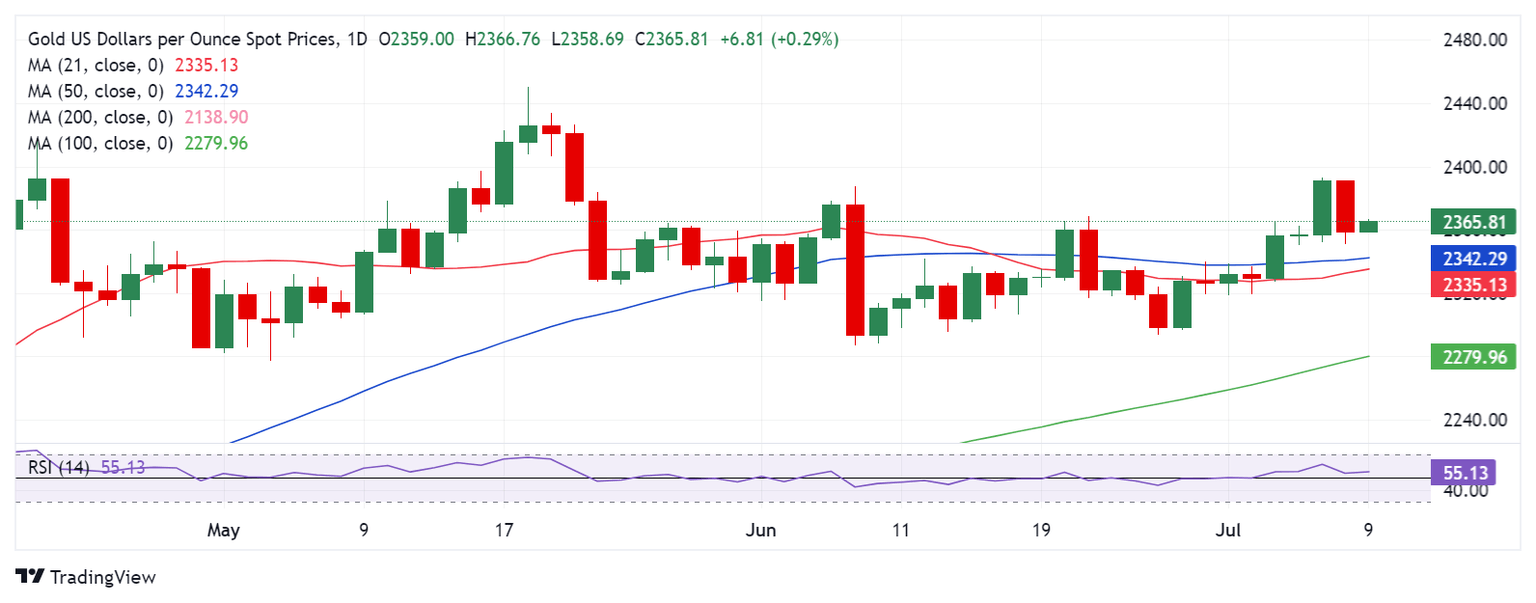

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive, as the 14-day Relative Strength Index (RSI) turns north again, above the 50 level.

Gold buyers must take out the six-week high of $2,393 to resume the uptrend toward the all-time high of $2,450. Ahead of that, the $2,400 level could act as a tough nut to crack for them.

On the flip side, Gold price could face immediate support at the $2,350 psychological barrier, below which the $2,340 demand area will be challenged.

Around that level, the 50-day Simple Moving Average (SMA) and the 21-day SMA close in. A sustained move below the latter could trigger a fresh downtrend toward the $2,300 round level.

Economic Indicator

Fed's Chair Powell testifies

Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy. Powell's prepared remarks are published ahead of the appearance on Capitol Hill.

Read more.Next release: Tue Jul 09, 2024 14:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.