Gold Price Forecast: XAU/USD consolidates gains around $2,450

XAU/USD Current price: $2,444.19

- Concerns about the United States' economic health spurred risk aversion.

- Wall Street plummeted following a poor US ISM Manufacturing PMI.

- XAU/USD retains gains near fresh two-week highs, aims to extend advance.

Financial markets remain volatile on Thursday as economic headlines flood news feeds. Meanwhile, risk-aversion dominates trading boards mid-American afternoon, helping XAU/USD retain most of its intraday gains.

Asian shares suffered amid plummeting Japanese equities, with the Nikkei losing 2.49% or 975 points amid speculation the Bank of Japan (BoJ) will continue hiking interest rates in the upcoming months. The US Dollar accelerated its advance mid-European morning, as local share markets also traded on the backfoot following softer-than-anticipated local data, pointing to an economic slowdown in the region at the beginning of Q3.

Furthermore, the Bank of England (BoE) trimmed interest rates by 25 basis points (bps), although local policymakers refrained from anticipating the next move. The decision was seen as a hawkish cut and had a limited impact on the market sentiment.

Finally, dismal United States (US) data took its toll on Wall Street. The country unveiled mostly weak employment-related figures, while the ISM Manufacturing PMI fell in July to 46.8 from 48.5 in the previous month, missing expectations of 48.8. The ISM report also showed a concerning uptick in Prices Paid, as the sub-index jumped to 52.9, higher than the 51.8 anticipated by market players. The data spurred concerns over the state of the American economy and sent stocks nose-diving. The US Dollar surged across the FX board, while XAU/USD entered a near-term consolidative phase amid prevalent demand for safety.

XAU/USD short-term technical outlook

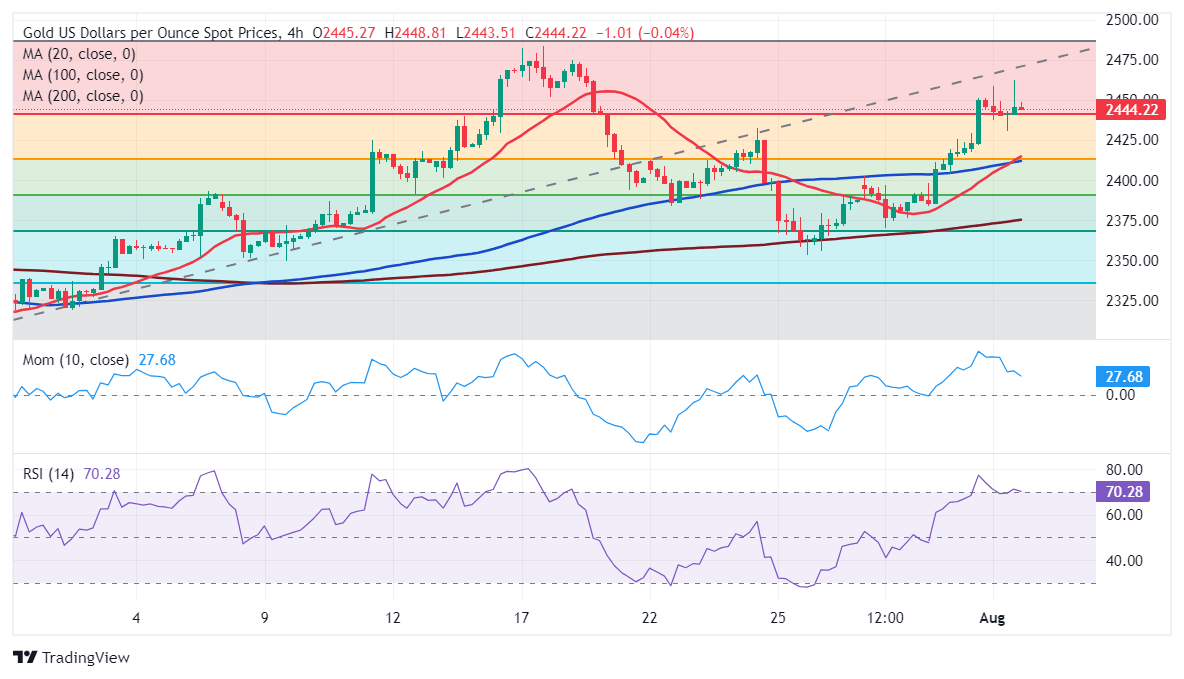

The daily chart for the XAU/USD pair shows it remains comfortable above the 23.6% Fibonacci retracement of the June/July rally at $2,438,75, the immediate support level. The pair met buyers around the 61.8% retracement of the same run last week, suggesting bulls are looking to push it higher while they are willing to add on dips.

The same daily chart shows that the pair develops above all its moving averages, with XAU/USD developing above bullish moving averages. The 20 Simple Moving Average (SMA) provides near-term support around $2,410 while accelerating north above the longer ones. At the same time, technical indicators lack directional strength but remain within positive levels, in line with bulls’ dominance.

In the near term, and according to the 4-hour chart, bulls paused but retain control. A bullish 20 SMA is crossing above the 100 SMA at around $2,410.80, as well as the 38.2% retracement of the aforementioned rally. Finally, technical indicators have lost momentum, but remain near overbought readings, far from signaling a potential decline.

Support levels: 2,438.75 2,422.90 2,410.80

Resistance levels: 2,462.30 2,477.20 2,490.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.