Gold Price Forecast: XAU/USD buyers look to $2,670 amid Middle East risks, ahead of key US data

- Gold price bounces back early Tuesday, helped by mounting Israel-Iran geopolitical risks.

- The Dollar stalls upswing, despite a cautious mood, awaiting top-tier US data and Fedspeak.

- The daily technical setup turns in favor of Gold buyers again, as RSI re-enters the bullish zone.

Gold price is back in the green early Tuesday, snapping a two-day correction from record highs of $2,686. Gold buyers capitalize on intensifying Middle East tensions, anticipating the top-tier US ISM Manufacturing PMI and JOLTS Job Openings survey for fresh directives.

Gold price remains at the mercy of risk trends, US data

Geopolitical tensions mount between Israel and Iran after the former announced a “limited” ground operation against the Iranian-backed militant group - Hezbollah targets in the border area of southern Lebanon, sending its soldiers across the border.

This comes after Iran vowed to strike back against the killing of Hezbollah leader Hassan Nasrallah Nasrallah. Israel continued to strike Lebanon over the weekend and claimed to have killed another senior Hezbollah figure after the killing of leader Nasrallah.

Markets turn cautious amid heightened risks of retaliation by Iran, allowing the traditional safe-haven Gold price to recover some ground. Further, US Dollar buyers take a breather before a fresh batch of US statistics while US Treasury bond yields reverse the previous upswing on deteriorating risk sentiment, capping the downside in Gold price.

Upcoming US ISM Manufacturing PMI data is likely to provide fresh hints on the state of the economy while the JOLTS survey could signal a further cooldown in the US labor market. Discouraging data could revive expectations of a large interest cut by the US Federal Reserve (Fed) in November.

Markets expectations of a 50 basis points (bps) rate cut in November were washed off after Fed Chair Jerome Powell pushed back against increased bets of an outsized rate cut at the next meeting, during his speech at the National Association for Business Economics (NABE) Annual Meeting in Nashville on Monday.

Powell said that “this is not a committee that feels like it’s in a hurry to cut rates quickly.” He added, "if the economy performs as expected, that would mean two more cuts this year," both by a quarter-point, aligning with the forecasts officials penciled in at the September 18 meeting.

Powell leaning in favor of less aggressive policy easing by the Fed triggered a notable upswing in the US Dollar, as US Treasury bond yields also rebounded across the curve. Gold price tumbled to the lowest level in four days in Powell’s aftermath.

Gold price, however, stalled its correction after Atlanta Fed President Raphael Bostic cautioned that the Fed may have to make further outsized rate moves if the US labor market deteriorates.

Markets now price in only a 36% chance that the Fed will lower rates by 50 bps in November, down from 53.3% a day earlier, according to CME Group's FedWatch Tool.

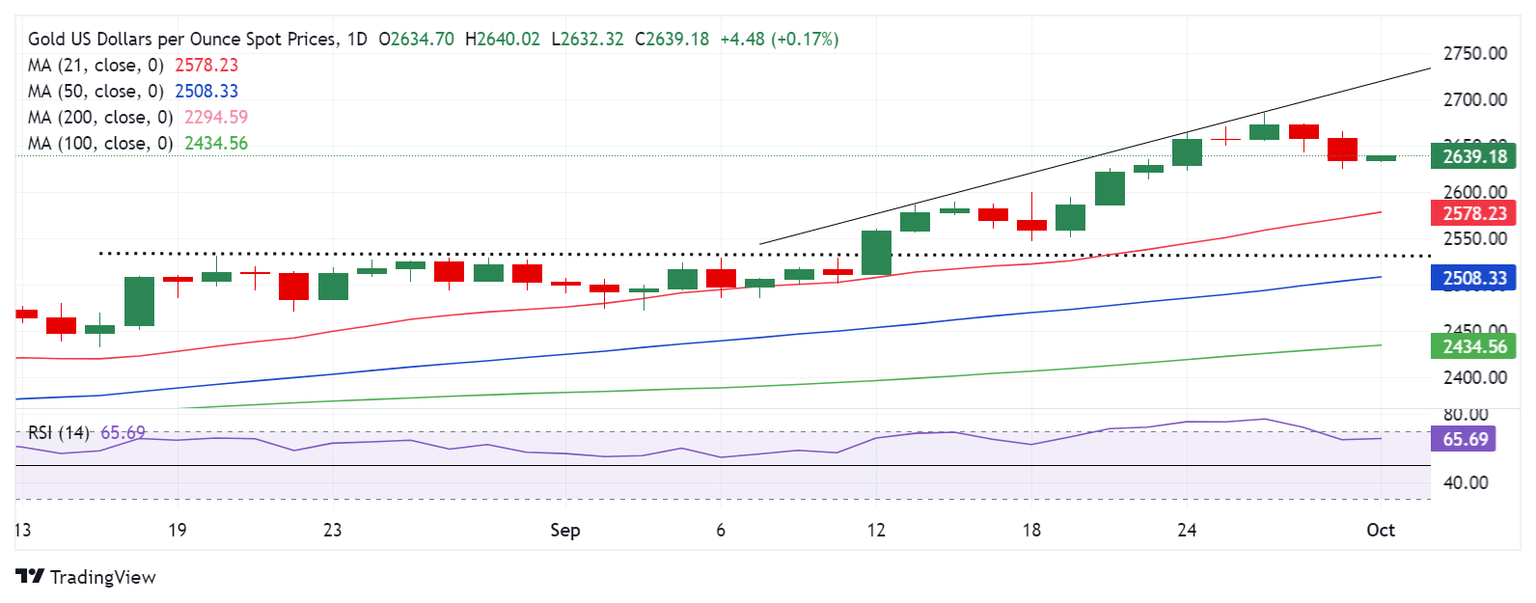

Gold price technical analysis: Daily chart

Gold price looks north once again, as the 14-day Relative Strength Index (RSI) holds well in the bullish zone, currently near 65.50.

If buyers find footing, the static resistance near $2,670 will need to be scaled in order to retest the record high of $2,686.

Furrther up, the next topside hurdles are seen at the $2,700 level, followed by the rising trendline resistance at $2,720.

On the other hand, if Gold sellers regain control, acceptance below the September 24 low of $2,623 is critical to unleashing further downside toward the $2,600 threshold.

Further south, Gold sellers could target the September 20 low of $2,585 and the 21-day Simple Moving Average (SMA) at $2,578.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.