Gold Price Forecast: XAU/USD buyers appear non-committal ahead of US labor data

- Gold price nurses losses below $2,650 early Tuesday, awaits US JOLTS survey for fresh impetus.

- US Dollar recovers from Fedspeak-induced pain as market mood sours on China concerns, looming Trump tariffs threat.

- Technically, Gold price stays below the 21-day SMA at $2,641 with a bearish daily RSI.

Gold price is nursing losses below $2,650 in Asian trades on Tuesday, though remaining in the recent range, awaiting the key US employment data for further trading directives. The US JOLTS Job Openings data will set off the critical week of top-tier labor data, offering hints on the US Federal Reserve’s (Fed) future interest rate cuts.

Gold price awaits US data for fresh cues on the Fed policy

The focus now seems to have shifted toward the sentiment surrounding the Fed policy outlook following the latest speeches from several Fed policymakers and ahead of Friday’s Nonfarm Payrolls (NFP) data.

The US Dollar (USD) returned to the red in American trading on Monday after Fed Governor Christopher Waller said that "policy is still restrictive enough that an additional cut at our next meeting will not dramatically change the stance of monetary policy and allow ample scope to later slow the pace of rate cuts, if needed, to maintain progress toward our inflation target.”

The Greenback erased gains from the first half of Monday’s trading, spurred by broad risk-aversion as traders took account of US President-elect Donald Trump's weekend warning against the so-called 'BRICS' nations. Trump threatened 100% tariffs on Brazil, Russia, India, China and South Africa if they create a new currency or support another currency that would replace the Greenback.

However, the revival of the haven demand for the USD early Tuesday keeps Gold buyers on the back seat. Persistent China’s economic concerns and the global tariff threat from Trump remain a drag on investors’ sentiment.

The next direction in Gold price will likely hinge on the upcoming US employment data and their impact on the Fed rate cut expectations. Markets are currently pricing in a 75% probability of a 25 basis points (bps) rate cut later this month, the CME Group’s FedWatch Tool shows, up from about 65% seen a day ago. Dovish Fed expectations tend to benefit the non-interest-bearing Gold price.

Meanwhile, Gold traders also remain wary of the geopolitical tensions between Russia and Ukraine and Israel and Iran, which could have a strong bearing on the traditional safe-haven asset, Gold price.

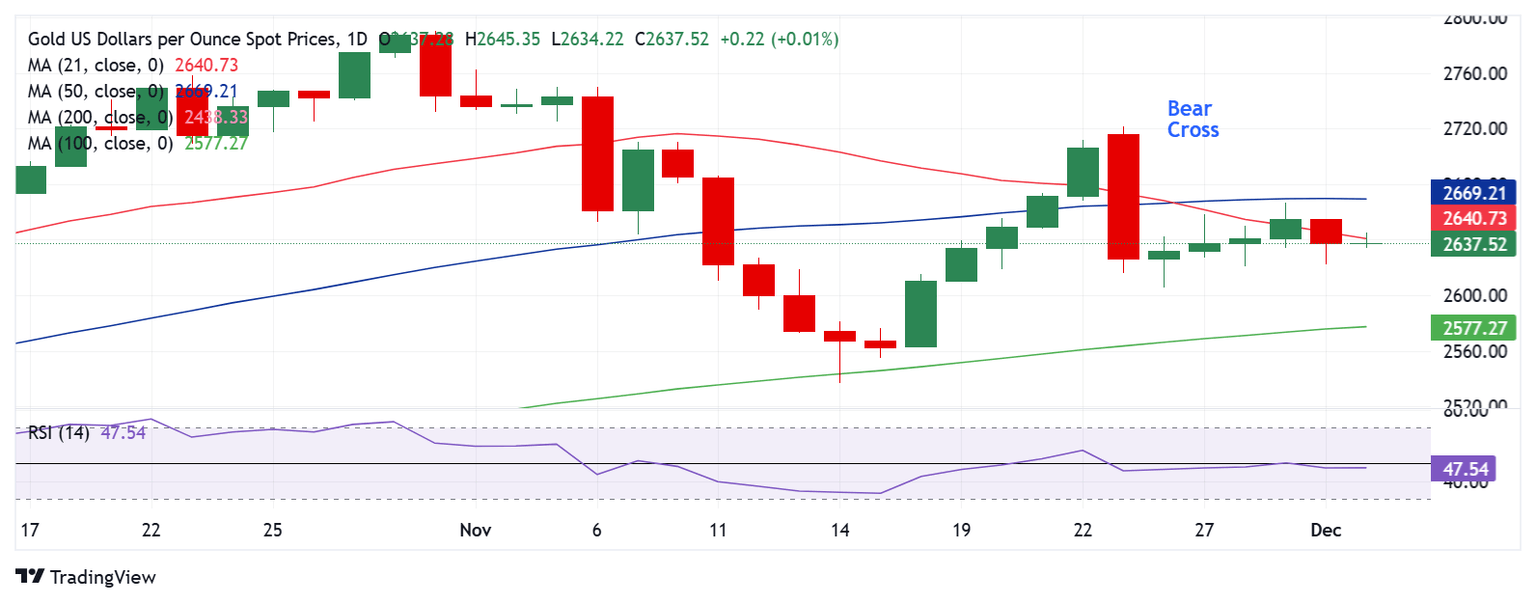

Gold price technical analysis: Daily chart

Having closed below the critical short-term 21-day Simple Moving Average (SMA) support, now at $2,641, Gold buyers seem reluctant to step in.

The 14-day Relative Strength Index (RSI) sits beneath the 50 level, justifying the cautious approach.

The previous week’s Bear Cross also remains in play, adding to the downside risks in Gold price.

Gold sellers need to crack the $2,621 static support to challenge the previous week’s low of $2,605.

A sustained drop below that level could expose the 100-day SMA at $2,577.

Conversely, recapturing the 21-day SMA support-turned-resistance at $2,641 is critical to reviving the recent recovery.

The next relevant resistance aligns at the 50-day SMA at $2,669, above which the $2,700 level will be on buyers’ radars.

Economic Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month.

Read more.Next release: Tue Dec 03, 2024 15:00

Frequency: Monthly

Consensus: 7.48M

Previous: 7.443M

Source: US Bureau of Labor Statistics

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.