Gold Price Forecast: XAU/USD bulls remain at the mercy of USD price dynamics

- A combination of factors prompted some selling around gold on Monday.

- Rising US bond yields, Friday’s upbeat NFP report undermined the buck.

- The risk-on mood further dented demand for the safe-haven commodity.

Gold struggled to capitalize on last week's goodish rebound from the $1,677-76 region, or multi-month lows and traded with a negative bias through the Asian session on Monday. This marked the first day of a negative move in the previous three and was sponsored by a combination of factors. The US dollar was back in demand on the back of Friday's blockbuster US monthly jobs report and a fresh leg up in the US Treasury bond yields. This was seen as a key factor that exerted some downward pressure on the dollar-denominated commodity. The headline NFP showed that the US economy added 916K new jobs in March – the largest gain since last August. Adding to this, February's reading was revised higher to 468K as against 379K reported previously and the unemployment rate fell to 6.0% from 6.2% previous.

The explosion in hiring was led by the impressive pace of coronavirus vaccinations and the gradual reopening of the economy, which added to the narrative of a strong US economic recovery from the pandemic. This, along with the Biden administration's planned stimulus of more than $2 trillion, spurred economic optimism and fueled speculations about an uptick in US inflation. This, in turn, raised doubts that the Fed would retain ultra-low interest rates for a longer period and pushed the yield on the benchmark 10-year US government bond back above the 1.70% threshold. Hence, the key focus will remain on Wednesday's release of the FOMC meeting minutes and a scheduled speech by Fed Chair Jerome Powell on Thursday, which will influence the non-yielding yellow metal in the near term.

Apart from this, a generally positive risk tone – as depicted by a bullish trading sentiment around the equity markets – further undermined the safe-haven XAU/USD. That said, the downside remains cushioned, at least for the time being, amid relatively thin trading conditions on the back of a holiday in most European markets. This makes it prudent to wait for some strong follow-through selling before confirming that the recent recovery move has run out of steam and positioning for the resumption of the prior/well-established downward trajectory. Moving ahead, the release of the US ISM Services PMI will now be looked upon for some impetus later during the early North American session. Traders might further take cues from the broader market risk sentiment, the US bond yields and the USD price dynamics for some meaningful opportunities on the first day of the week.

Technical levels to watch

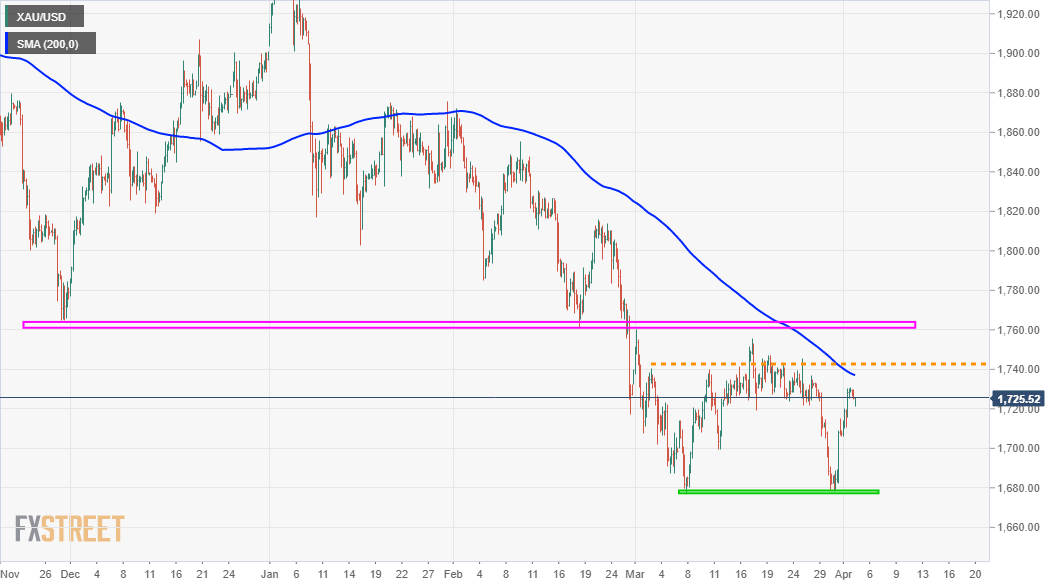

From a technical perspective, the latest leg up constituted the formation of a bullish double-bottom near the $1,677-76 region. The pattern, however, will be confirmed once the metal breakthrough a previous strong support breakpoint, now turned resistance near the $1,760-65 region. In the meantime, the $1,742-44 supply zone might act as a stiff resistance and cap the immediate upside for the commodity.

On the flip side, a subsequent slide below the $1,720 area should find decent support near the $1,700 mark. Some follow-through selling might accelerate the fall back towards the double-bottom support near the $1,677-76 region. A convincing breakthrough will negate the bullish set-up and drag the commodity further towards the $1,625 intermediate support en-route the $1,600 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.