Gold Price Forecast: Will US Nonfarm Payrolls trigger a sustained XAU/USD recovery?

- Gold price off seven-month lows, recovers ground above $1,820 early Friday.

- The US Dollar consolidates amid cautious optimism, firmer US Treasury bond yields.

- Gold price eyes a sustained rebound and critical US Nonfarm Payrolls data.

Gold price is attempting a tepid bounce above $1,820 early Friday, in a replication of a move seen in Thursday’s Asian trading. Markets turn cautiously optimistic heading toward the all-important Nonfarm Payrolls (NFP) data from the United States due later in the day.

All eyes on US Nonfarm Payrolls, Treasury bond yields

Gold price is briefly coming up for fresh air, as the United States Dollar (USD) has entered a phase of consolidation after two straight days of downside correction from an 11-month top. The subdued tone around the US Dollar could be attributed to a slightly upbeat mood in the Asian session this Friday, despite mixed Chinese property market developments.

Shares of Sunac China Holdings Ltd. surged after the property giant became one of the rare firms to obtain approval for a debt restructuring plan. Meanwhile, Shares of China Evergrande Group fell over 10%, limiting the gains in the Asian indices. Hong Kong’s Hang Seng, however, is rallying 2% on the day.

The extended decline in Oil prices combined with a pause in the US Treasury bond yields upsurge is offering some comfort to investors. Although they refrain from placing any fresh directional bets on Gold price and the US Dollar ahead of the US labor market data release.

Economists are expecting the US economy to have added 170K jobs in September, slowing from 180K additions reported in August. The Unemployment Rate is seen a tad lower from 3.8% to 3.7% in September while Average Hourly Earnings are likely to rise 4.3% YoY in the reported period, at the same as seen previously.

Following a much smaller-than-expected US private job growth, as reported by the ADP, to 89K in September, downside risks remain intact to the headline NFP number, which could weigh further on the November rate hike expectations by the US Federal Reserve (Fed), in the face of loosening labor market conditions.

In case of a downbeat US NFP report, the US Dollar correction could gain additional traction alongside the US Treasury bond yields, bolstering the recovery attempts in Gold price toward $1,850 and beyond. Conversely, if the US labor market data, including the wage inflation, suggest that the Fed can go for one more rate hike by year-end, the US Dollar could resume its uptrend at the expense of the non-interest-bearing Gold price.

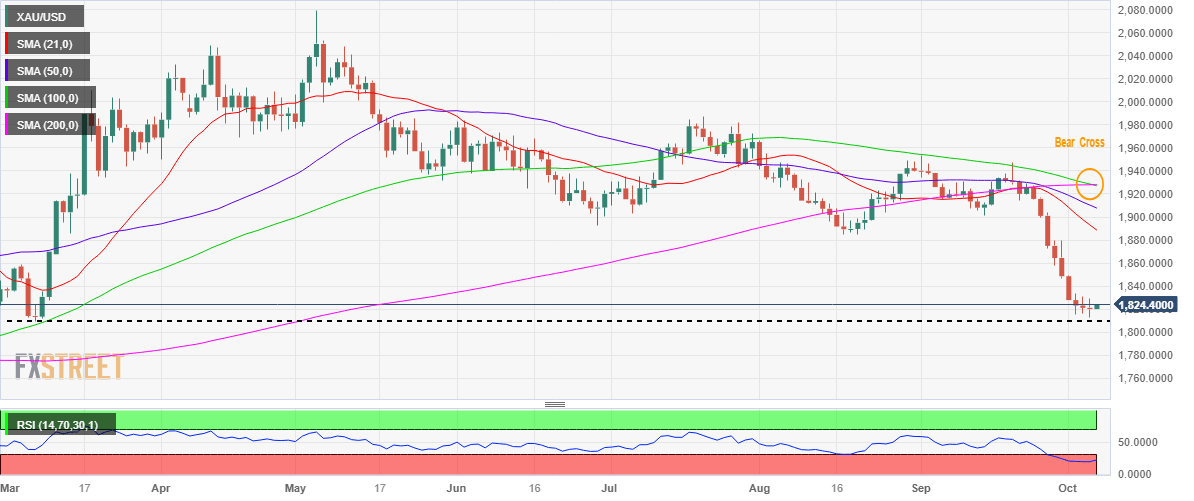

Gold price technical analysis: Daily chart

Technically, the next directional move in the Gold price hinges on the US NFP outcome.

The daily technical setup appears mixed for the immediate term, as a Bear Cross confirmation counters any scope for a rebound on oversold Relative Strength Index (RSI) conditions.

The 100-Daily Moving Average (DMA) crossed the 200 DMA from above on a daily closing basis on Wednesday, validating a bearish crossover.

On the upside, if the recovery upholds, Gold buyers will look to the support-turned-resistance at the $1,850 level should the powerful resistance near $1,830 give way. Further up, the Gold price could challenge bearish commitments at the September 28 and 29 highs of $1,880.

Alternatively, Gold price needs to find acceptance below the crucial support at the $1,810 level, where the March 8 low aligns. The $1,800 threshold will be the level to beat for Gold sellers, opening floors toward the psychological level of $1,750.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.