Gold Price Forecast: Panic leads to speculation of a US Fed rate cut

- The market is not yet done with buying safe-haven assets.

- US official ISM PMI to confirm or deny increased odds for a rate cut.

- Spot gold stabilized well into bullish territory, speculative interest to buy dips.

- The FX Poll is showing a mixed picture looking forward.

Gold prices soared at the beginning of the week, with spot hitting on Monday $1,689.27 a troy ounce, a level that was last seen in January 2013. Safe-haven assets, the bright metal included, gave up in favor of the American dollar, as generally encouraging US data provided support to the greenback.

However, the sentiment toward the dollar took a turn to the worse on Wednesday, amid collapsing equities and Treasury yields. Wall Street plummeted, with the DJIA losing roughly 3,000 points these last few days, and the yield on the benchmark 10-year Treasury note falling as low as 1.21%. Odds for a US Federal Reserve rate cut soared, now above 70% for March, according to the CME Group FedWatch tool.

Recession sounds out loud

The coronavirus spread through Europe like wildfire, and Italy now has the third-largest number of contagions, above Japan. The outbreak sparked concerns about a global economic downturn, but it’s not just about the virus. Economies such as the EU and Japan have been flirting with recession for most of 2019, while the world suffered from US-China trade tensions. Markets were already worried about growth before the COVID-19 hit the world.

Given that the virus is still far from contained, uncertainty will likely persist, and so will demand safe-haven assets.

Macroeconomic releases passed unnoticed, mainly due to the data being collected before the market become fearing a pandemic. News confirming that the US economy grew 2.1% in the final quarter of 2019 wasn’t enough to offset growth concerns.

Growth data in the spotlight

The US will publish its official February ISM Manufacturing PMI next Monday, foreseen contracting to 49.8 from 53.3. Markit estimate for the same month dropped to 50.8 from 51.9 in January, while the Markit Services PMI plummeted to 49.4, its lowest in six years. The official ISM Non-Manufacturing Index will be out next Wednesday, foreseen unchanged from the January reading at 55.5. If the official figures came as expected or better, for sure will cold down expectations for a rate cut in the US, at least in the nearest term. In the upcoming week, Markit will release the final versions of its output estimates.

On Friday, the country will publish February Nonfarm Payrolls. At this point, the country is expected to have added 178K new jobs, while the unemployment rate is seen stable at 3.6%. Wages are seen posting a modest advance. Anyway, and given that jobs’ creation hasn’t been an issue for long, the report has the limited potential of shaking the greenback, mainly if it comes better than expected. A dismal outcome, on the other hand, would fuel speculation of a rate cut, and hurt the greenback further.

Spot Gold Technical Outlook

Spot gold has been stable around 1,630/50 in the last three trading days, down roughly $60.00 from its weekly high, but holding on to its long-term bullish trend. The weekly chart shows that technical indicators have reached overbought levels, where they are currently consolidating. Also, the commodity is developing far above bullish moving averages, with the closest being the 20 SMA, which stands at around 1,526.

In the daily chart, technical indicators have corrected extreme overbought conditions, and despite heading lower, they remain well above their midlines. The 20 DMA has extended its advance above the 61.8% retracement of the long-term slump between 2011 and 2015 at 1,585.98, while the larger MA picked up momentum below the shorter one.

The metal may lose some ground should odds for a US rate cut decrease, but given the risk-averse background, speculative interest will be willing to buy the dips. The immediate support is the weekly low at 1,621.15, followed by 1,603.81 ahead of the mentioned Fibonacci level. Resistances this week come at 1,651.80 and 1,662. Beyond this last, there’s nothing in the way toward the multi-year peak at 1,689.27.

Gold Sentiment

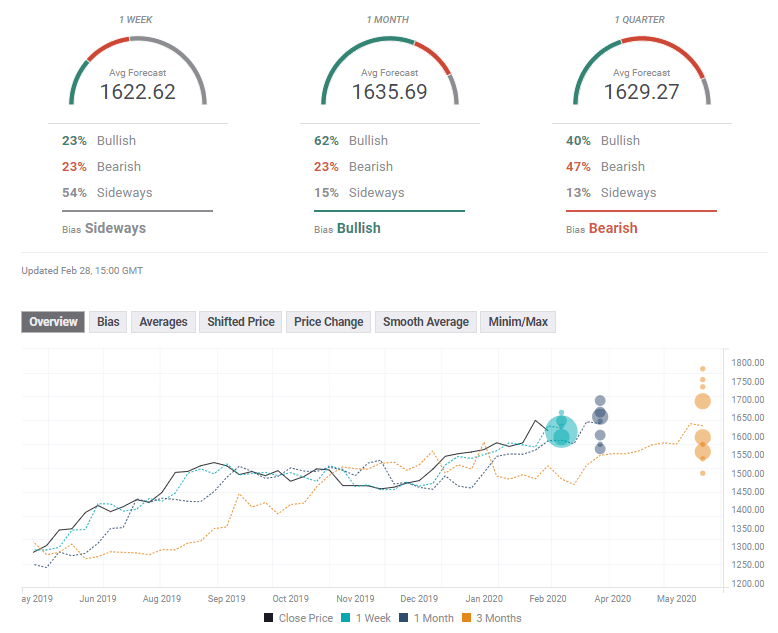

The FXStreet Poll is showing sideways moves in the short term, rises later on and moderate slides afterward. Overall, it seems that experts are seeing through the recent volatility. Targets are little changed in comparison to last week.

Related Forecasts

- EUR/USD Forecast: Coronavirus comeback may end abruptly in a chaotic week, two critical caps

- GBP/USD Forecast: Potential upside from Brexit talks competes with coronavirus concerns

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.