Gold Price Forecast: Acceptance above $2,670 is critical for XAU/USD, as US ADP data, Fedspeak loom

- Gold price holds previous gains below record high, as traders digest Israel-Iran geopolitical risks.

- The Dollar pauses recovery amid risk reset, ahead of US ADP data and Fedspeak.

- The daily technical setup favors Gold buyers, as the RSI stays firm in the bullish zone.

Gold price is consolidating the previous recovery near $2,660 in Asian trading on Wednesday, aa buyers catch a breather amid the Iran-Israel geopolitical escalation while awaiting the key US ADP Employment Change data and a flurry of speeches from US Federal Reserve (Fed) policymakers.

Gold price keeps an eye on geopolitics, US events

Despite persisting fears of an Iran-Israel conflict turning into a wider regional war, the Asian markets have calmed down a bit, as they believe that Iran may not pursue a full-fledged war with Israel and that it would urge de-escalation in the same way as it did after the April missile strikes.

Iran’s Revolutionary Guard said early Wednesday that Iranian forces on Tuesday used hypersonic Fattah missiles for the first time and 90% of its missiles successfully hit their targets in Israel.

“Our action is concluded unless the Israeli regime decides to invite further retaliation. In that scenario, our response will be stronger and more powerful,” Iranian Foreign Minister Abbas Araqchi said in a post on X early Wednesday.

Tehran said this attack was in response to Israeli killings of militant leaders and aggression in Lebanon against the Iran-backed armed movement Hezbollah and in Gaza.

If Middle East geopolitical tensions dissipate on no further potential aggression from Israel, the traditional safe-haven, Gold price, will likely come under renewed selling pressure.

However, the US ADP Employment Change data and Fedspeak will be next of note for the US Dollar and Gold price, as the events could provide fresh hints on the size of the next Fed interest rate cut. The US private sector employment is expected to rise by 120K in September, up from a 99K job gain in August.

Tuesday’s mixed US ISM Manufacturing PMI and JOLTS Job Openings data failed to offer any clear signals on the direction of the Fed interest rate outlook. Meanwhile, Atlanta Fed President Raphael Bostic repeated that he is “open to another half-percentage point rate cut if the labor market shows unexpected weakness.”

Markets continue pricing in about a 37% chance that the Fed will lower rates by 50 basis points (bps) in November, down from 53.3% seen at the start of the week, according to CME Group's FedWatch Tool.

Besides, the news of Iranian bombings on Israel dominated markets and triggered a broad risk-aversion wave, spiking up the safety bets in Gold price, the US Dollar and government bonds.

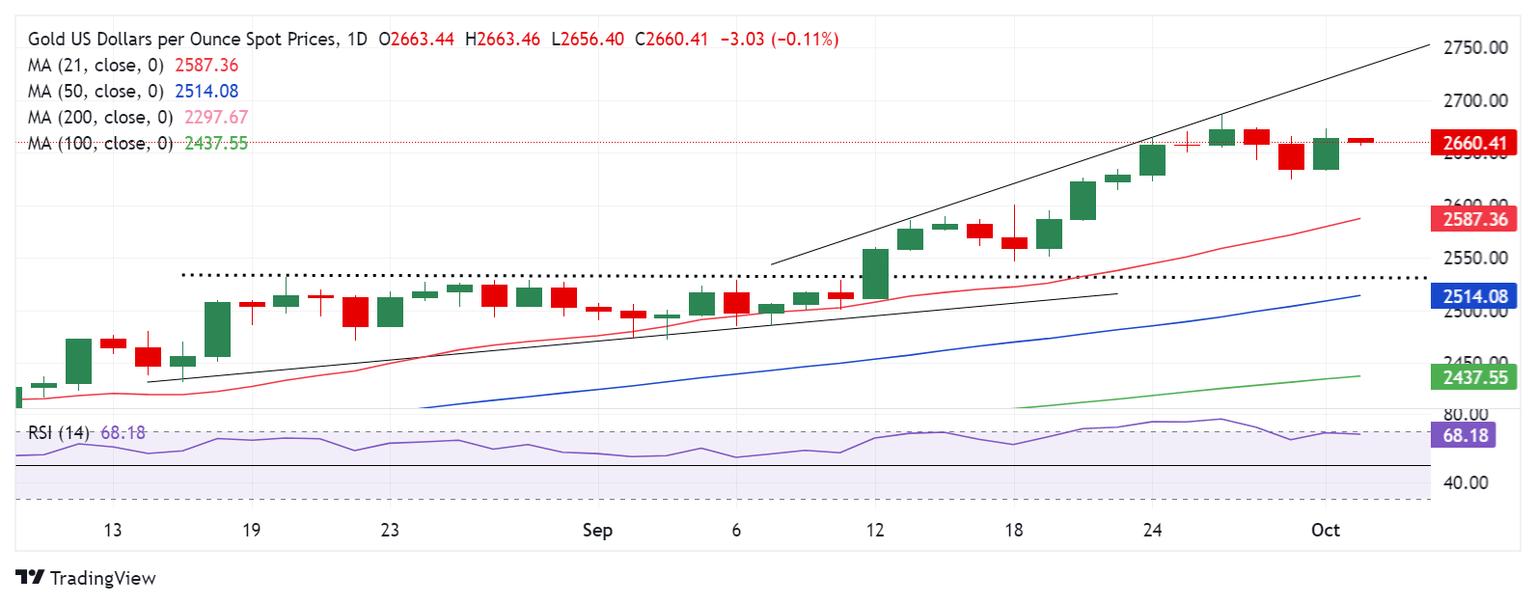

Gold price technical analysis: Daily chart

The daily technical setup for Gold price remains constructive as the 14-day Relative Strength Index (RSI) holds firm near 68.00, despite turning slightly lower.

Gold price needs to yield a daily candlestick closing above the static resistance near $2,670 for a renewed upside. The next resistance is aligned at the record high of $2,686.

Further up, buyers will target the $2,700 round level, followed by the rising trendline resistance at $2,730.

Alternatively, if Gold sellers flex their muscles, acceptance below the September 24 low of $2,623 is critical to unleashing further downside toward the $2,600 threshold.

Gold sellers could then challenge the September 20 low of $2,585, where the 21-day Simple Moving Average (SMA) hangs around.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.