Gold Price Forecast: A dead cat bounce for XAU/USD ahead of Powell?

- Gold licks wounds, as the US dollar holds the recent upside.

- US dollar surged on coronavirus curbs-led safe-haven demand.

- Fed’s skepticism on further stimulus added to the weight on gold.

- Sell the bounce ahead of Fed Chair Powell’s testimony?

Gold (XAU/USD) plummeted 3% and reached the lowest levels in six-week at $1882 on Monday, although recaptured the $1900 mark before closing the day. The main catalyst behind the gold slump was the resurgent safe-haven demand for the US dollar after coronavirus-led lockdowns were announced in the Old Continent. Further, the uncertainty over the US fiscal deadlock alongside the US Federal Reserve’s (Fed) skepticism over additional stimulus measures exerted downward pressure on the yellow metal. ‘Sell everything’ returned, as gold was sold-off alongside the US stocks, with the downside exacerbated by the banking sector woes amid compliance failures.

Gold treads water above $1900 in Tuesday’s trading so far, as the dollar bulls take a breather, digesting the release of the Fed Chair Jerome Powell’s prepared remarks ahead of his three-day Congressional testimony. Powell said that the Fed is committed to using all policy tools available to support the post-pandemic economic recovery. The sentiment on the global stocks will remain in focus for fresh impetus on gold. Should the risk-aversion deepen in the sessions ahead, the safe-haven dollar could see a fresh leg higher, weighing once again on the USD-denominated gold.

Gold: Short-tern technical outlook

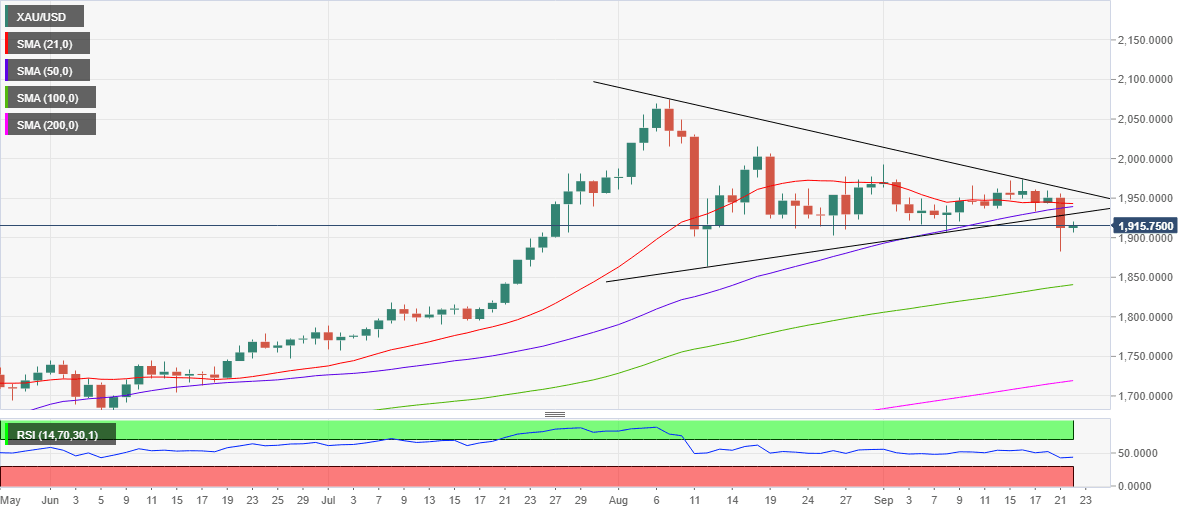

Daily chart

Gold charted a classic symmetrical triangle breakdown on the daily sticks on Monday, having closed the day below the rising trendline (pattern) support at $1928.

With the move lower, the price closed below the 50-day Simple Moving Average (DMA) for the first time since early June. The technical breakdown suggests the metal remains on track to test the August low of $1863.

Although a brief bounce cannot be ruled out before the pair resumes the sell-off. The 14-day Relative Strength Index (RSI), currently at 43.85, has turned flat, backing the case for a temporary pullback, especially given Monday’s slump.

Therefore, the immediate upside barrier is aligned at the pattern support now resistance at $1930. A break above which the confluence of the 21 and 50-DMAs around $1940/41 will limit the recovery attempts.

To the downside, the $1900 level could be once again challenged by the bears. The next downside target at $1882 (Monday’s low) could be put at risk. A failure to defend the latter could expose the August low.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.