XAU/USD (gold price in terms of USD) kicked-off the week on a bullish note, resuming its recent winning-streak after a temporary reversal seen on Friday. The prices rebounded sharply from the US Q4 GDP induced sharp losses and rose as high as 1241.77 after another round of easing by the Chinese central bank in a bid to spur growth in the world’s top gold consumer. The PBOC slashed the RRR by 0.50%, effective March 1. In addition, the prevalent risk-off sentiment amid falling global equities also boosted the safe-haven bids for the bullion. As explained the day earlier, the prices displayed a bullish falling wedge break and regained almost $ 20 intraday, closing the day near daily highs above 1240 levels.

Gold prices added to the previously rally this Tuesday, having posted daily highs posted at 1248.50 in Asia. The prices are currently making minor-recovery attempts from 1236.61 session lows, and struggles around 1239. The bullion extends its retreat into Europe as markets resorted to profit-taking after the prices failed to take out 1250 barrier. Moreover, the risk-on sentiment persisting amid rallying European stocks lift the demand for riskier assets at the expense of the safe-haven gold. While markets also refraining from placing big bets on gold ahead of the manufacturing PMI reports from the US due later in the NY session. The ISM manufacturing PMI is expected to have improved to 48.5 in Feb versus 48.2 last, while PMI gauge from Markit is expected to remain unchanged at 51.0.

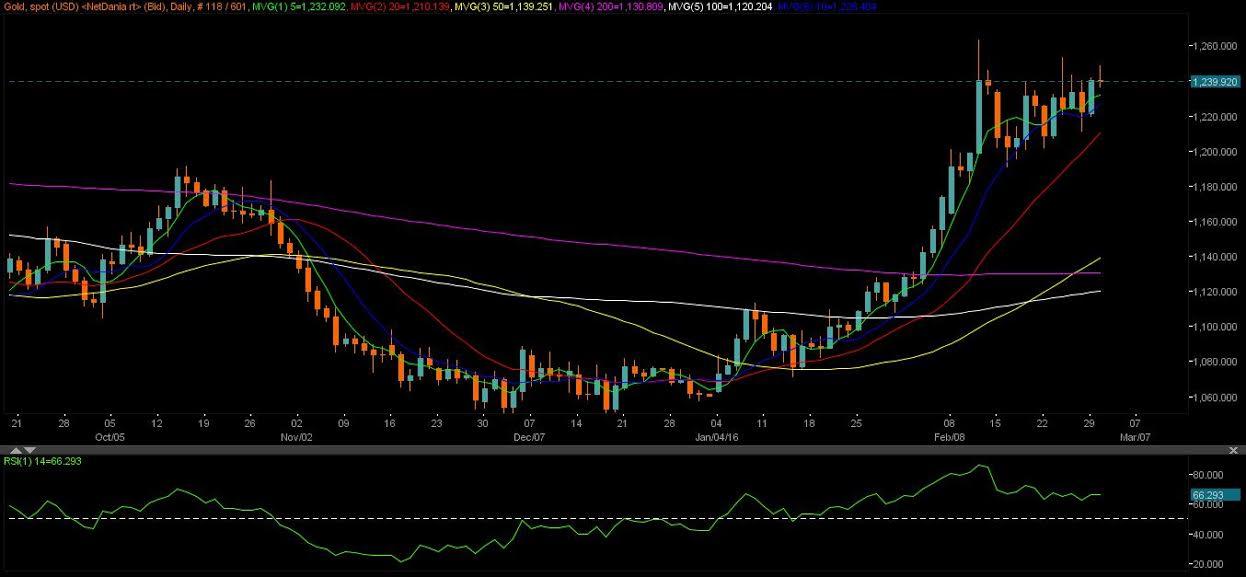

Technicals – Upbeat ISM could push gold to $ 1230-25

The technicals continue to paint a bullish picture for gold, with the golden crossover on the daily chart confirming further upside ahead. The prices hovers above 1240 levels, placed well above the upward sloping 5-DMA support located at 1232.11. A break of the last, the prices could drop further to 1226.42, where the bullish 20-DMA stands. The bulls may find fresh bids near the last and swung back higher to resume its recent upside momentum. To the topside, the next resistance is seen at 1248.50 – daily highs, beyond which 1260 will be back on sight. A daily closing above 1250 barrier is needed to confirm further upside.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.