The XAU/USD pair (gold prices in terms of the US dollar) continued its winning streak and reached fresh two-week highs on Tuesday at 1151.42, although failed to surpass the falling trend line resistance of the potential symmetrical triangle pattern and retraced slightly to 1146.59 on close. However, the prices managed to hold above the 100-DMA located at 1143.87. The prices rallied to fresh peaks after the dismal US trade data further fuelled concerns over the US economic outlook, resulting in markets to believe that the 2015 Fed rate hike is out. Adding to this, the IMF slashed the global growth forecasts to 3.1% from 3.3% previous, the second downgrade for this year, amid China slowdown fears and falling commodity prices.

As for today’s trade so far, XAU/USD extends its upward march and remains heavily bid, scoring fresh 2-week highs 1153.07, with 1156.70 ( Sept 24 High) on sight. The yellow metal was caught by a renewed bid wave in the European morning and completely ignored the rising treasury yields along with the US dollar. The USD index jumps 0.18% to 95.69 levels. Further the latest weak German industrial figures added to the recent dismal macro news from the EU docket, which also dampens investors’ sentiment and lure them towards safe-havens such as gold. Later in the day, the pair may continue to remain underpinned by dropping Fed rate hike bets awaiting further direction from the FOMC minutes, which in all case is expected to reflect a dovish tilt.

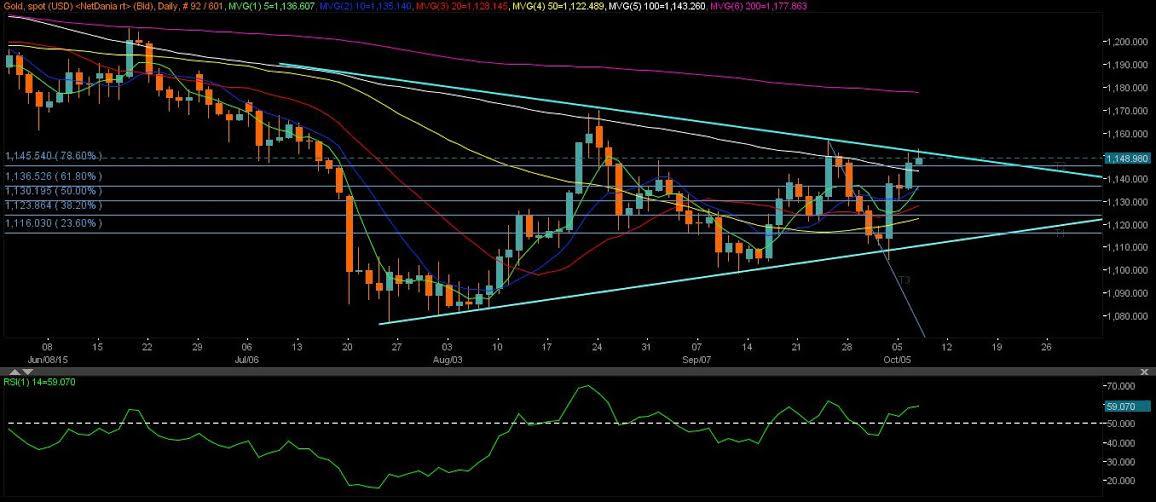

Technicals – a triangle bullish break-out on closing basis could drive the pair toward 200-DMA

On daily charts, the prices remain well above the Fib 78.60% resistance (last week’s fall) located at 1145.54. Also, the pair breached the falling trend line resistance of the symmetrical triangle pattern. However, a daily closing above the same would confirm a bullish breakout and point to further upside in the short to medium term. The daily RSI around 60 has inched slightly lower, suggesting a minor correction could be expected before the broader uptrend resumes.

To the downside, the pair could test the above-mentioned Fib 78.60% support, below which the crucial 100-DMA support is place at 1143.27. To the upside, if the pair manages to surpass the daily highs at 1153.07, the next barrier could be faced at 1156.70 (previous highs). A break beyond the last, the prices could climb further towards the Aug 24 high at 1170 levels. This might hold true if the Fed minutes are read as more dovish than expectations.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.