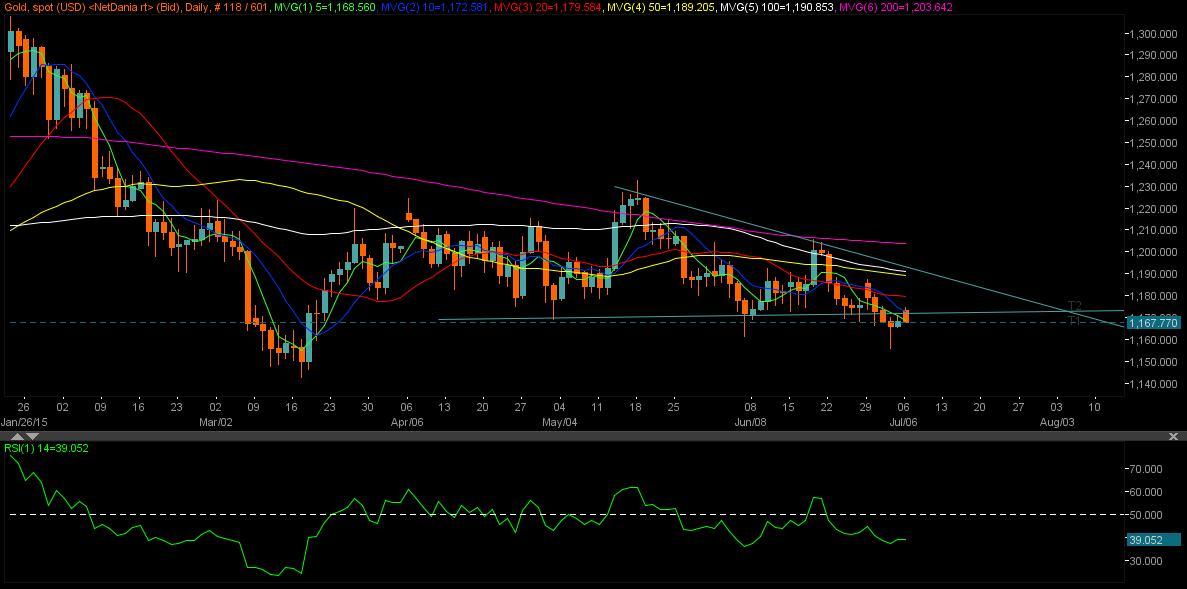

XAU/USD pair – Daily Chart

Gold prices in terms of US dollar (XAU/USD) rebounded on Friday from fresh four month lows reached at 1156.01 on Thursday and ended the week on a firmer note at 1168.16. The recovery in XAU/USD was capped at 5-DMA and trend line support-turned resistance confluence at 1071 levels. The pair rebounded on Friday as traders booked profits on their gold longs after the recent weakness while US markets remained closed on Independence day holiday, providing no fresh triggers for the yellow metal.

XAU/USD kicked-off the week on a stronger note, piercing through the 10-DMA resistance located at 1172.62 and printed daily highs at 1174.36. The pair jolted higher largely driven by Greek referendum results which showed a landslide NO victory for Tsipras’ government implying, rejection of austerity measures offered by its international creditors. While the yellow metal gained on increased safe-haven bids as market evaluate the aftermath of this referendum results. Although the recovery in gold prices was stalled just under 1175 levels and the pair rebounded lower to 1167.91 lows as traders preferred the reserve currency ahead of the emergency Euro group meeting to discuss the Greek plebiscite scheduled later today.

Technically, the daily RSI at 39.25 has turned flattish, keeping range in an oversold zone and suggests a weak recovery. To the downside, the pair is likely to test 1161.29 (June 5 Low) level, below which floors would open for a test of 1159.50 (March 19 Low). While to the upside, we may see gold prices climbed back higher towards 1175 levels in case of a break below 1165.41 (July 3 Low). Overall, XAU/USD is likely to keep the range between 1175-1160 levels against a back drop of impending Greek talks.

XAU/EUR pair – Daily Chart

Gold prices in terms of Euro (XAU/EUR) closed the week higher on Friday at 1052.09 levels, failing to breach the descending triangle resistance located at 1056.45 for yet another time. The pair consolidated losses from Thursday after the shared currency was broadly supported following disappointing NFP print which dragged the greenback lower across the board. XAU/EUR bounced-off a dip to 1050.34 lows, finding good support at 20-DMA located at 1051.19 and closed above the last. The pair traded cautious ahead of Sunday’s Greek referendum which was expected to provide fresh cues.

Currently, XAU/EUR did give a descending triangle bullish breakout for the second time within the past 7 trading sessions, although failed to sustain at 1067.09 - higher levels and fell back to familiar range around 1056-1058 levels. The pair tested the triangle resistance-turned support located at 1055.65 levels, having bounced-off lows at 1056.49. However, the pair remains supported on broad based EUR sell-off amid a NO vote clear victory in the Greek referendum which spooked markets over possible outcomes such as Grexit and ECB bankruptcy.

The daily RSI just above the midlines around 50.86 aims higher indicating upside bias intact. Hence, the pair is likely to swing back higher and retest 50-DMA located at 1064 levels. A break above the last, the pair may retest daily highs at 1067.09. However, the recovery is expected to be weak and may remain capped below 1070 levels. To the downside, the pair could once again test the triangle resistance-turned support, below which the pair could drop to 10-DMA support located at 1052.92. Overall, a generalized intraday upside bias is likely to persist on the back of a broadly weaker euro ahead of key Euro group meeting scheduled later today.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.