Today’s AM fix was USD 1,653.75, EUR 1,261.06 and GBP 1,028.07 per ounce.

Yesterday’s AM fix was USD 1,653.75, EUR 1,267.82 and GBP 1,029.60 per ounce.

Silver is trading at $30.38/oz, €23.25/oz and £18.95/oz. Platinum is trading at $1,569.50/oz, palladium at $672.00/oz and rhodium at $1,150/oz.

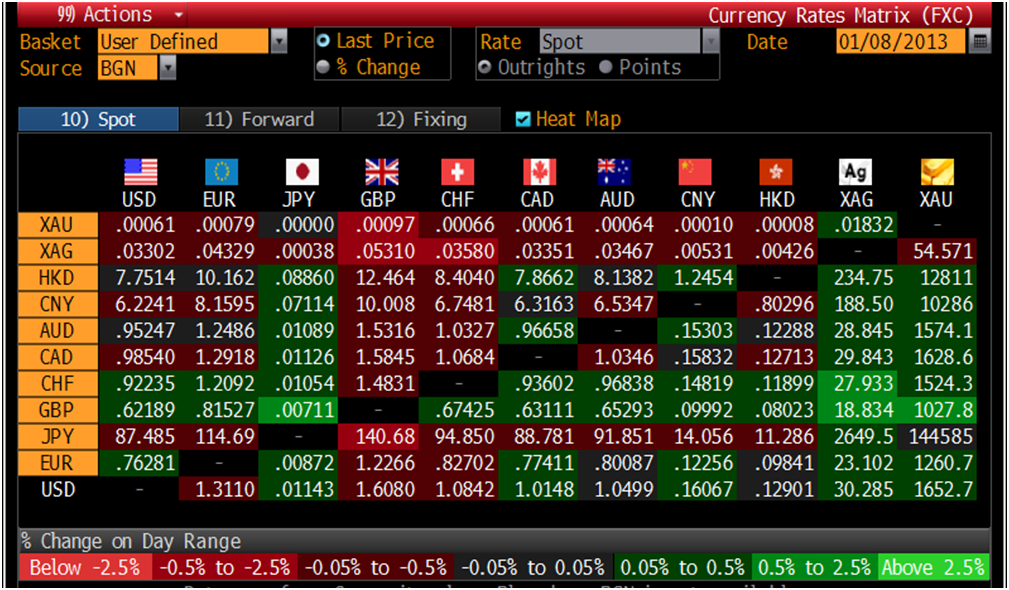

Cross Currency Table – (Bloomberg)

Gold fell $9.90 or 0.6% in New York yesterday and closed at $1,646.40/oz. Silver slipped to a low of $29.84 and finished with a loss of 0.2%.

Gold’s losses in recent days have been more pronounced in dollar terms as gold’s price fall in euros, pounds and other fiat currencies has been far more modest (see charts). Given the challenges facing all currencies in 2013 the price decline is likely another correction prior to further gains.

Gold Spot $/oz, 21 days, 30 minutes – (Bloomberg)

Gold edged up on Tuesday as the euro held steady on to two days of gains on hopes that the European Central Bank will not cut interest rates at a meeting this week.

A Reuter’s poll of economists forecast no rate cut but they cannot agree on whether there will be further cuts in the next few months due to a muddled Eurozone economy.

Data showed Eurozone sentiment improved for its 5th month in a row, based on a drop in Spanish jobless figures and a successful Greek bond repurchase.

Harmony Gold, South Africa’s 3rd biggest gold producer said its Kusasalethu mine remains closed and could be shut permanently with the loss of around 6,000 jobs after managers received death threats and police were shot at.

XAU/GBP, 1 Month – (Bloomberg)

Reuters report that Asia's physical market has picked up so far this year, with buyers tempted by last week's big drop in prices -- when prices retreated to as low as 1,626 per ounce -- and on demand ahead of the Lunar New Year, traders said.

The trading volume on the Shanghai Gold Exchange's 99.99 gold physical contract shot through the roof on Monday, hitting a record of 19,504.8 kilograms, after double-counting transactions in both directions.

XAU/EUR, 1 Month – (Bloomberg)

"Physical demand is very strong," said a Beijing-based trader. "It's a combination of the attraction of lower prices as well as pre-holiday demand."

But such appetite could waver if prices recover towards $1,700, he added.

U.S. gold gained 0.1 percent to $1,648.60. Shanghai's 99.99 gold traded at 331.58 yuan a gram, or $1,658 an ounce - a $10 premium over spot prices, compared to single-digit premium most of last year.

Technical analysis suggested that spot gold could edge higher to $1,665 an ounce, and a previous target of $1,625.79 has been temporarily aborted, said Reuters market analyst Wang Tao.

Bloomberg quoted Feng Liang, an analyst at GF Futures Co., a unit of China’s third-biggest listed brokerage who said “the recent price drop has attracted some purchases, evidenced by the volumes in China,” “Whether this rebound can be sustained depends on the emergence of physical buyers, especially from China and India, at a time when demand is meant to be strong.”

In China, demand typically picks up before Christmas and lasts through the Lunar New Year in February. India’s wedding season, a peak-consumption period for gold jewelry, runs from November to December and from late March through early May. The countries are the two biggest bullion consumers.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.