Gold analysis: Plummets due to US data

Gold

The price for gold plummeted. From a Fundamental Analysis perspective the drop occurred due to various reasons, which can be read in this article.

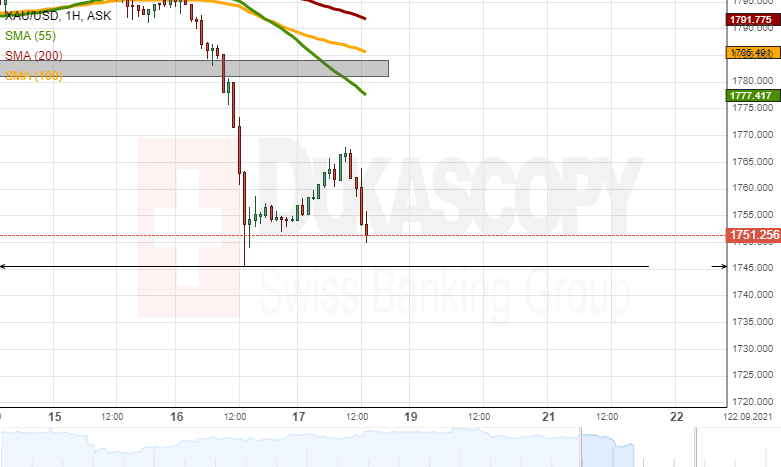

Meanwhile, from a technical analysis perspective the decline has its own reasons and could have been forecast. Namely, the initial drop occurred due to the price failing to pass the resistance zone above the 1,800.00 mark.

Afterwards, after a period of sideways trading below the 55 and 100-hour SMAs, the bullion confirmed the 55-hour SMA as resistance and bounced off it. This resulted in a decline, which was slowed down for three hours by the support zone at 1,781.00/1,784.00. However, the support zone failed due to the a lot better than forecast US Retail Sales strengthening the US Dollar. This resulted in the steep drop to the 1,745.50 level. Note that round price levels failed to slow down the decline.

By the middle of Friday's European trading hours, the yellow metal's price had recovered above 1,765.00.

If the recovery of the metal continues on, the price could reach for the resistance of the hourly simple moving averages near the 1,780.00/1,790.00. On the other hand, a decline of the price would most likely once again look for support in the 1,750.00 level and the 1,745.50 mark.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.