Yesterday’s Trading:

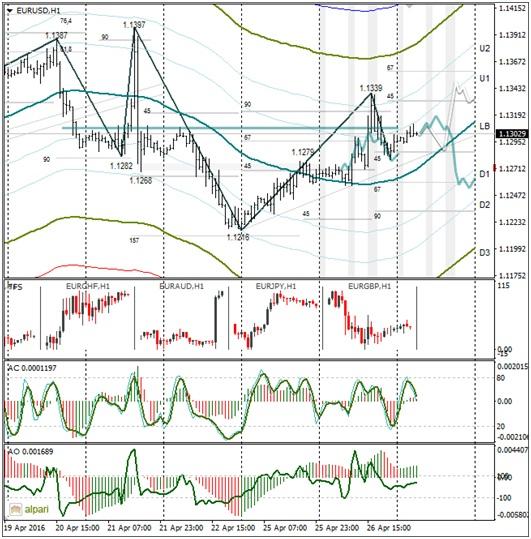

The euro dollar on Tuesday restored 61.8% from a fall from 1.1397 to 1.1216. The euro strengthened after US stats on durable goods orders came out. The stats were worse than expected and the value for February was lessened.

Orders for durable goods in March were up 0.8% against a forecasted 1.8%. February’s value was dropped from -3% to -3.1%. Without accounting for the defence industry, orders were down 1.0%, whilst a growth was expected of 0.4%. The previous value was reassessed from -2.1% to -2.3%.

After an update of the maximum, the euro/dollar by trade close in the US was back to 1.1285.

Market Expectations:

Trading in Asia saw the Australian currency at the centre of attention, with it weakening against the dollar by 120 points due to inflation data. Deflation in Q1 was a surprise for most and it gave real credence to the likelihood of an RBA interest rate drop.

The fall in the rate of the Aussie has the ability to force down the rates of other currencies against the USD. Taking into account that the euro against pound is still under pressure and the US Fed will keep their rate unchanged, I’ve come up with two different scenarios. The main one is for a fall in the euro though.

Day’s News (EET):

-

9:00, German March import prices and Gfk’s April consumer confidence;

-

11:30, UK preliminary 2016 Q1 GDP and service sector business activity in February;

-

13:00, UK retail sales according to CBI in April;

-

17:00, US incomplete housing sales in March;

-

17:30, US oil reserves for week ending 23rd April;

-

21:00, Fed interest rate decision.

Technical Analysis:

The euro is receiving support from the euro/Aussie in Asia. The wallaby is down throughout the market after the publication of Australian inflation data. The euro/dollar is trading around 1.1302. The euro/pound is trading in a sideways.

The 45th degree and the balance line are looking to be decent levels of support for the bulls and from these they will need to switch into attack. The daily stochastic has flipped up and the CCI is crossing the -100 level downward. There are signs of a euro strengthening on the horizon.

The technical picture between the old time frames is contradictory, so before the FOMC meeting I’ve got two different scenarios. For me though, I reckon the euro will fall to 1.1255.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.