Never before in modern history have central banks gone all out en masse with negative interest rates. First the US, then the Japanese, then the ECB, Swiss, English and then the Chinese joined the party; all trying to rear back inflation under control; throwing out the rule book and reopening the text books to get financial markets moving. As a result, yields on bonds worth over $6 trillion have headed negative. It is unsurprising that investor capital has run for precious metals.

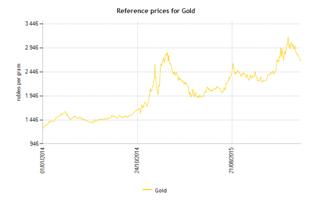

At the European Central Bank’s 10th March meeting there were some radical monetary policy measures introduced to stimulate the economy: they dropped the base rate from 0.05% to zero and set the interest rate for deposits at minus 0.4%. The monthly asset purchasing program was increased from 60 to 80 billion euros, thereby increasing the money in circulation on the market. So what was gold’s reaction? A thirteen-month maximum against the dollar and a five-year maximum against the euro.

The price of gold correlates with the regulators’ interest rates, but not exactly as seems at first glance. To get a good idea, we need to take consider the US Fed’s rates. In theory, tightening monetary policy means increased yield on instruments on the stock market and leads to capital fleeing the gold market. Furthermore, a rise in interest rates theoretically leads to a strengthening of the dollar, meaning a fall in the price of gold as it is the currency in which the metal is sold.

The historical data tells us the opposite though. From 1970 to 1980, the Fed rate rose from 4% to 20%. In the same period, gold rocketed from $35 to $675 per ounce. Another example: before the period of financial crisis from 2003 to 2006, the federal fund interest rate increased from 1% to 5.5%. Gold quotes during this period reacted by growing from $355 to $650.

But a rise in interest rates from the Fed does not mean a rise in gold prices: it actually holds the price back. In both circumstances above, the rise in interest rates was preceded by inflation. Real negative interest rates in the States (federal fund rate minus CPI) have practically forever led to a new price maximum for gold.

In this there is nothing surprising since a widespread fall in interest rates in different countries has a positive effect on the price of precious metals. If we take into account the fact that the Fed, based on the Phillips curve, is trying to stimulate inflation, we receive a factor which is possible to support gold price growth over a sustained period of time.

The higher the price of gold, the stronger it will stand on its own two feet in light of the avalanche of demand which follows rises in gold prices. A fall of the stock market indices, negative interest rates for deposits, meagre growth of the world economy, in addition to rising political tensions have forced investors to search for a safe haven which has come in the form of gold.

So, as the purchases of precious metals gather pace with new players, the higher the price will rise for gold and silver. The situation will escalate when gold traded on the stock market in paper form begins to exceed the physical amount available.

So there is a precursor for a technical default. It wasn’t so long ago that COMEX, the largest precious metals market in the world, saw its reserves of accessible gold for immediate delivery fall by 73% due to a single and unexpected withdrawal. As such, at the end of January 2016, 99.81% of tradeable futures ended up unsecured by physical metal.

Now let's not forget about the central banks buying up record amounts of gold over the last eight years and joining the gold rush with the other market participants. Taking into account that the diverging demand and supply on the market (gold production in 2015 fell 4%, whilst demand rose by 4%), in addition to the modest size of global markets of physical gold and silver, we could well see a deficit come about.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.