Yesterday’s Trading:

The euro/dollar on Friday closed down. The ECB’s head economist Peter Praet hinted at a possible extension of their current monetary stance. The euro found a support at 1.1255. From here the rate restored to 1.1306. US stats helped it to restore to this level. The strengthening underwent some interference from the euro/pound which had fallen from trade close in the US.

Preliminary figures for US consumer confidence in the university of Michigan’s index for March stood at 90.0 (forecasted: 92.2, previous: 91.7).

Market Expectations:

Today is Monday: correction day. There isn’t much news out. We could even say that the economic calendar is empty. There are no drivers for sharp fluctuations on the key pairs. By the end of the day we should see the EUR/USD at 1.1290.

Day’s News (EET):

13:00, UK industrial order data.

16:00, US February housing sales in the secondary market.

17:00, Eurozone March consumer confidence index.

18:00, FOMC member Lockhart to speak.

Technical Analysis:

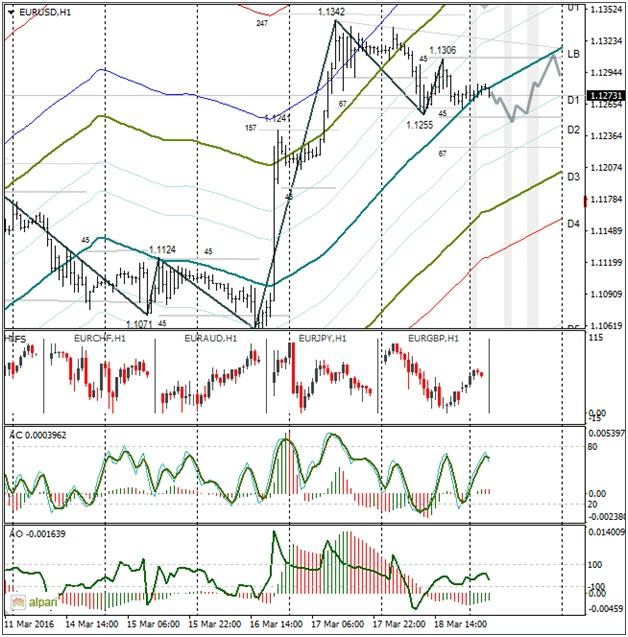

Intraday target maximum: 1.1305, minimum: 1.1250, close: 1.1290.

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar has returned to the LB from the U3. The euro/dollar on the hourly is balanced. Since the oscillator stochastic is up and the AO is down, I first expect the euro to fall to 1.1250 and then to rise to 1.1305. The fluctuations should occur in a 1.1250 – 1.1335 range.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.