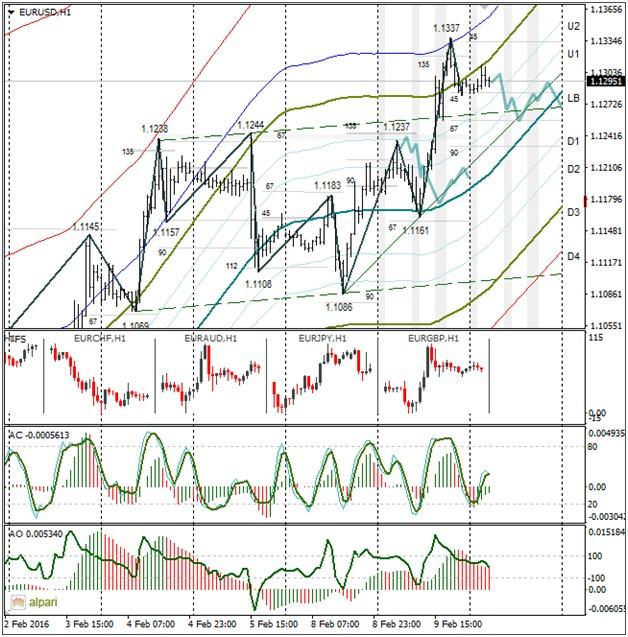

EURUSD 1H

Yesterday’s Trading:

Falls in the stock and oil markets again offered support to the euro and yen. Brent fell to $30.26 and the euro/dollar fell to 1.1337. When the US indices stopped falling, a rally on the euro began: the euro weakened against the dollar to 1.1280.

Oil fell after the IEA (International Energy Agency) published a report in which the media saw the agency’s view as sceptical. “With the market already awash in oil, it is very hard to see how oil prices can rise significantly in the short term,” it noted.

Oil is trading at around $31 on Wednesday. The growth is 0.85% which isn’t much, but enough to stop the European indices from falling.

Main news of the day (EET):

11:30, UK industrial production and production in the manufacturing sector for December;

17:00, UK GDP from NIESR for January;

17:00, Yellen speaks;

17:30, US Ministry for Energy oil reserve figures.

Market Expectations:

Market participant attention on Wednesday will be on Janet Yellen’s two-day speech before the banking committees of the Senate and the House of Representatives. Many expect her words to be neutral and not cause a spike of volatility on the financial markets. We expect to see a fall of the euro to 1.1256 before the US session opens. I’ve not taken Yellen’s speech into account in my forecast.

Technical Analysis:

Intraday target maximum: 1.1311 (current Asian), minimum: 1.1256, close: 1.1295;

Intraday volatility for last 10 weeks: 102 points (4 figures).

In the first half of Wednesday I expect the euro to fall to the LB at 1.1256. Brent is trading up (+0.85%). The euro/pound is at the upper limit of the MA channel. The conditions are ripe for a correction.

Traders are used to the daily fall of the stock indices so I reckon that the indices will switch into a growth at market opening (a correction). This will have a negative effect on the euro. The US oil reserve report from the Ministry for Energy is out this evening. If Brent holds above $30, it’s likely the euro/dollar will begin a downward correction.

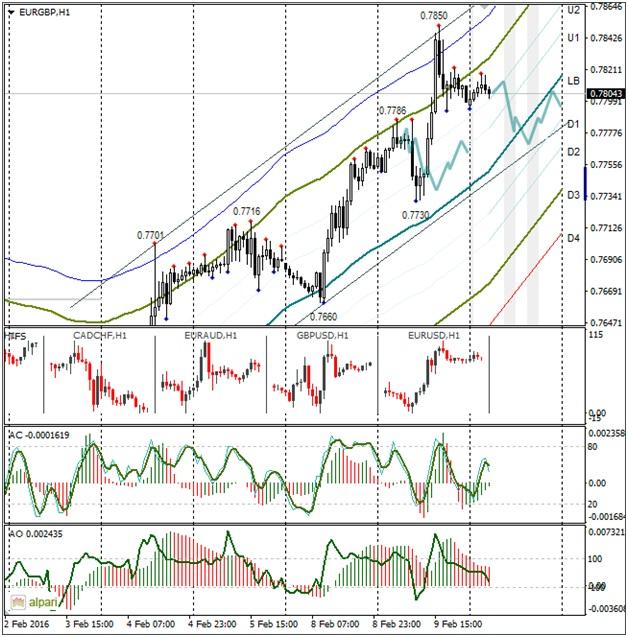

EURGBP 1H

The running from risk was caused by a rise in demand for euro throughout the market. After a fall to 0.7730. the euro/pound lifted above the U4. The price is now below the U3. The market is considered balanced when the price is at the LB. Due to this I expect a weakening of the euro to 0.7770 against the pound. A fall of the cross will put negative pressure on the euro/dollar.

Daily

The stock indices’ fall hastened and the euro/dollar rose to 1.1337. I set the target at 1.1370. A correction may start without reaching this target. All the more so since no one knows what Yellen is to come out with.

Weekly

The euro/dollar has neared the upper limit of the channel. The target is still 1.1366/70. The daily fall of the stock indices is supporting the buyers.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.