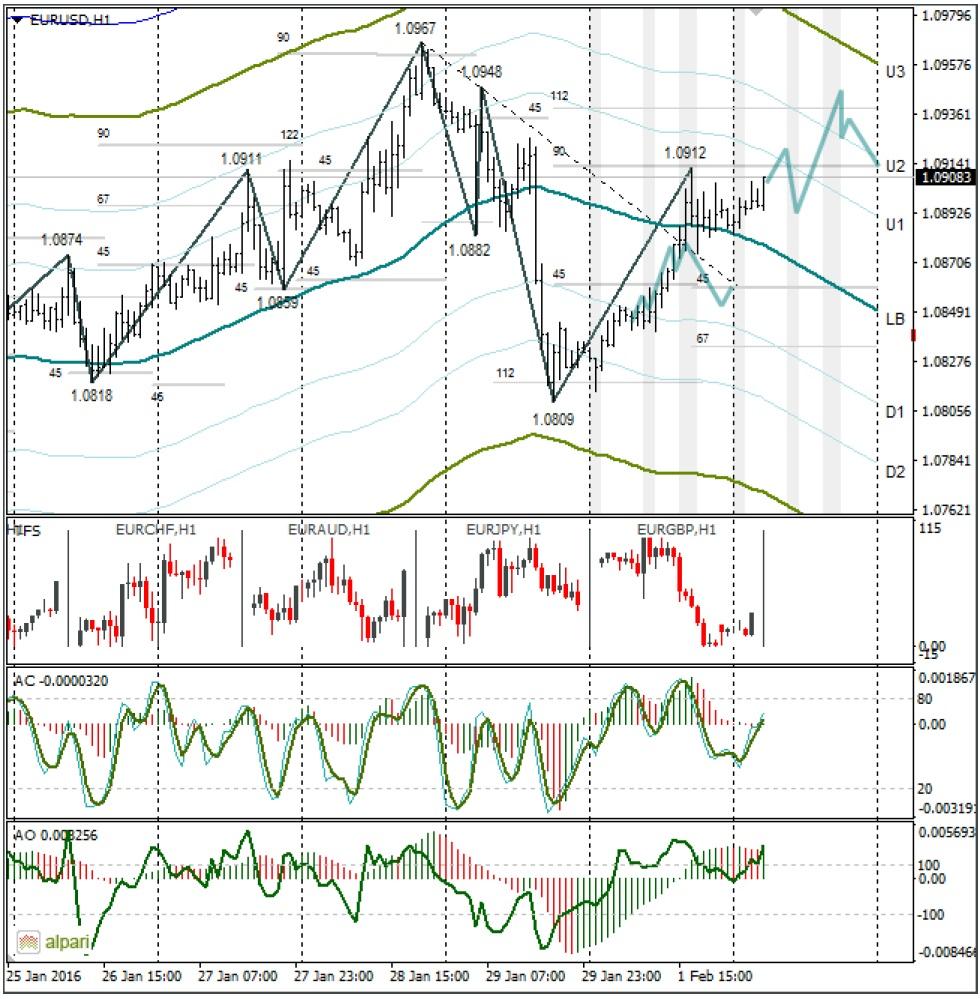

EURUSD 1H

Yesterday’s Trading:

The euro/dollar slid to the balance line by at 1.0885 by American opening on Monday. After varying US data came out, the euro strengthened to 1.0912 against the dollar. The PMI and ISM in the manufacturing sector were in different directions. The PMI was down and the ISM was in line with forecasts, but December’s value was reassessed downwards.

The US business activeness index was set at 48.2 against 48.0 (reassessed from 48.2) the previous month (forecasted: 48.1). The US business activeness index from Markit was down from 52.7 to 52.4 (forecasted: 52.7).

Main news of the day (EET):

10:55, German unemployment changes and unemployment level for January;

11:30, UK business activity index in the construction sector for January;

12:00, Eurozone unemployment level and PMI for December. SNB’s chairman Jordan to speak.

Market Expectations:

Trader attention on Tuesday is on German, UK and Eurozone data. The euro broke from the trend line. It is currently passing through 1.0935. I expect a growth of the rate to here by the close of the European session. On Monday the cross created some interference for the buyers and today it could lend them some support if we see a restoral.

Technical Analysis:

Intraday target maximum: 1.0940, minimum: 1.0883 (current Asian), close: 1.0912;

Intraday volatility for last 10 weeks: 102 points (4 figures).

The euro/dollar was trading at 1.0909 at 06:31 EET. Yesterday I wrote that we could see a break in the 1.0980 resistance if the rate reaches 1.0920.

Today the euro/dollar is in the hands of the buyers. The price is bouncing sharply from 90 degrees (Gann level) so it’s worth expecting the pair lifting to 1.0935/40.

EURGBP 1H

The euro weakened yesterday against the pound to 0.7540. I don’t understand why the cross is acting like it is with the prices of oil and stock indices falling. The euro should strengthen faster than the pound against the dollar. As such, the cross should also rise. On Tuesday I reckon we’ll see a rise of the euro to yesterday’s 0.7620 maximum.

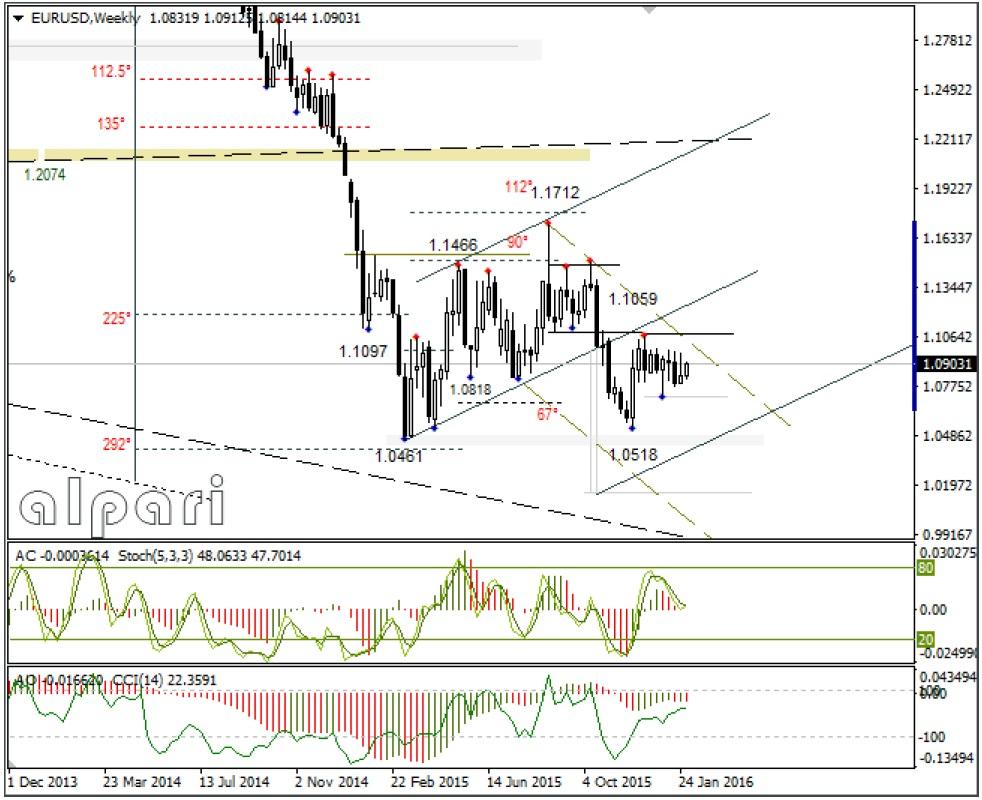

Daily

The euro/dollar has broken away from the trend line and is continuing to move slowly towards the trend line. Based on the set up, the euro bulls intend to test 1.0950. The dot above the i will be the words of the US Fed after the FOMC meeting.

The price has bounced from the trend line. With a growth in the rate to 1.0938, we should prepare for a break in 1.0980/85 and a rise in the pair to 1.1025.

Weekly

Nothing has changed on the weekly: the euro dollar is still trading in a sideways..

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.