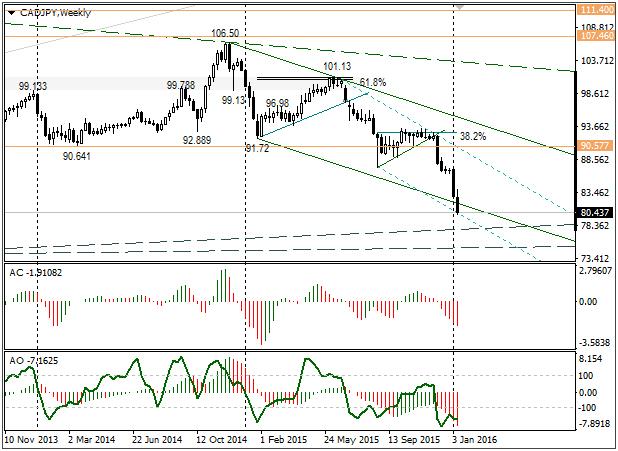

Trading opportunities for currency pair: the CAD/JPY is stuck in a bear trend due to the Chinese stock market crash and a fall in oil prices. If you’re looking to sell the Canadian, then 81.15/30 is your marker. After a rise of the rate to 82.43 we should stave off selling. Whilst the oil and Chinese markets are down in the dumps, expect the CAD to weaken to the 76.61-74.78 support zone. If the price returns to 82.44 over the next couple of days (before Wednesday), this falling scenario will be cancelled. The pair is likely to switch into a long consolidation phase.

Background

The last CAD/JPY idea I made came out on 22nd June of last year. When the idea was published, the rate stood at 99.93. Expectations were for the Canadian to fall to 98.25 according to a double top pattern against a four-month trend. The idea worked out and the target was met.

Current situation

The CAD’s weakening against the JPY was caused by a fall in the Shanghai Composite index and a fall in oil prices. The fall in the index began on 15th June, 2015 from 5,174. The dates of the fall in the index coincide with the fall in the CAD/JPY rate (15/06/15, 18/08/15 and 26/11/15). The Shanghai Composite has now fallen by 40.53% to 3,086.06 and the CAD/JPY is down 19.5% to 80.43.

Chinese shares are being sold off due to weak stats and the devaluation of the yuan. China is experiencing capital flight. The Bank of China has spent over $512.6 billion USD from its gold reserves on stabilising the country’s financial markets.

Oil prices are falling due to China’s problems and a growth in oil reserves in the USA. Brent has fallen to $28.81. Oil extraction companies are increasing their extraction in order to compensate for losses from a fall in demand and cost. In addition, Iranian sanctions have just been lifted.

Iran can now increase its daily oil exports by 500,000 barrels and within six or seven months this will be up to a million, as was announced by the Iranian oil minister Bijan Zaganeh.

So what can we expect from the Canadian?

There are two downward channels on the weekly graph. The first passes through 106.50 – 101.13 – 91.72 and the second through 101.13 – 93.07 – 87.36. The price has left the first channel and is now at the lower limit of the second channel. If you’re looking to sell the Canadian, then 81.15/30 is your marker. After a rise of the rate to 82.43 we should stave off selling. Whilst the oil and Chinese markets are down in the dumps, expect the CAD to weaken to the 76.61-74.78 support zone. If the price returns to 82.44 over the next couple of days (before Wednesday), this falling scenario will be cancelled. The pair is likely to switch into a long consolidation phase.

Since Sunday’s opening of the Saudi market, the Tadawul fell by 7% to 5,398.35 due to the Iranian sanctions being lifted. By the end of the day, the Tadawul had shed 5.44%. The CAD/JPY opened with a gap at 79.87 and, according to most recent data, is trading at around 80.61. Today is Martin Luther King day (a day off) in the US, so it’s better to sit on the side lines as a spectator.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.