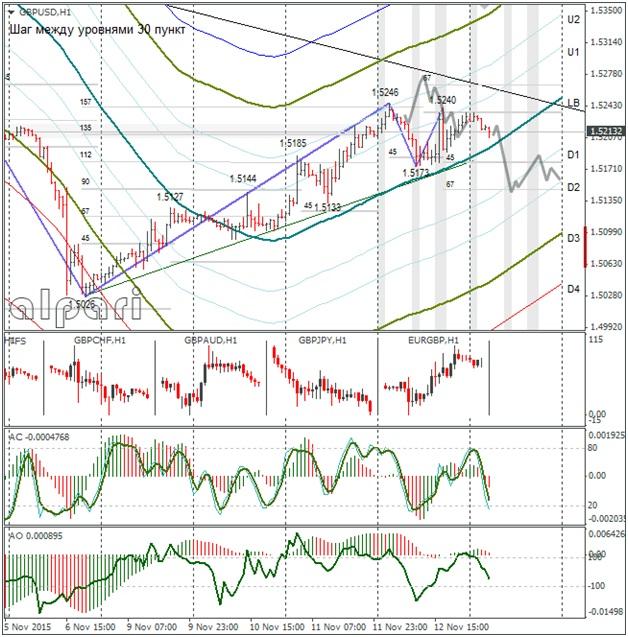

Hourly

On Thursday the pound/dollar was trading above the LB in a range of 70 points. In the first half of the day the rate dropped to 1.5173 and in the second it returned to 1.5240. It’s now at 1.5199. If European trading sees a break of the 1.5191 support (LB and trend), I’ll be expecting a weakening of the pound to the 67th degree at 1.5145 (technical signal without any fundamental news).

There is no important macro-economic data set to come out of the UK today. We could well see a calm correction against the growth from the 1.5026 minimum. The pound so far has corrected too high.

Daily

The pound/dollar has met the trend line with its wall (this trend line was broken on 6th November). The sellers now need to quickly strengthen below 1.5173 (yesterday’s minimum). This would allow them to push the buyers back to 1.5130 and from there we would have to take a look at the setup of market participants. If the buyers run from the market, it means that we will head to 1.5026, if not: we should assess what will come about on the 4h time frame.

Weekly

There’s no change o the weekly graph. The closest target is still at 1.4900.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.