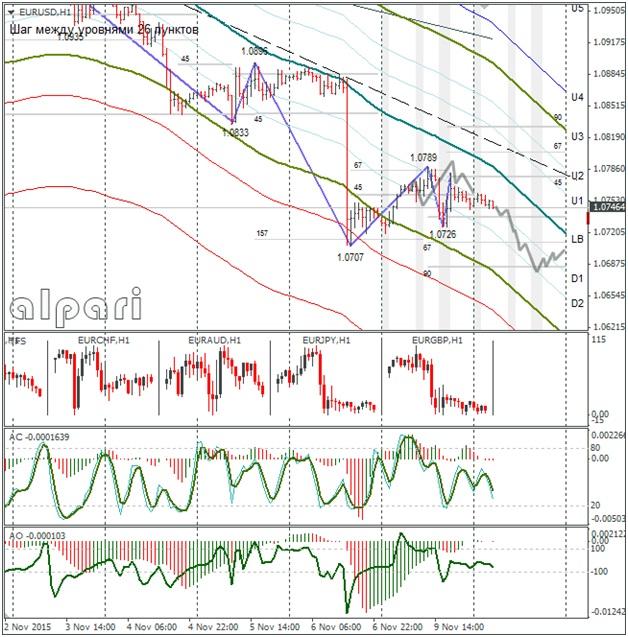

Hourly

Yesterday’s Trading:

On Monday the euro/dollar was trading in a sideways. After a growth to 1.0789, the euro fell to 1.0726. This was caused by talk of the need for interest rates on deposits to be dropped below -0.20%. I’m not so sure what caught market participants by surprise; Mario Draghi spoke of reducing rates at the last press conference.

Main news of the day:

- No events planned.

Market Expectations:

Trader activeness on the Forex market was down after the NFP came out. The hourly indicators offloaded yesterday. The pair is ready to shift towards Friday’s maximum. The calendar is empty, so nothing should stop a straight fall for the euro.

Technical Analysis:

Intraday target maximum: 1.0761 (Asian current), minimum: 1.0684, close: 1.0705;

Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar has bounced by 67 degrees from the 1.0707 minimum. The rebound against the trend really came off. The AC indicator is up and the AO is by the zero line. The CCI indicator is ready to head to the zone below -100. As we can see, the conditions for the euro’s fall are ripe. My Tuesday’s target is 1.0684 (90 degrees).

Daily

We’re looking at the price dropping below 1.0700. Then to 1.0650 and below to 1.0520. The interim target is 1.0650. Now to the Weekly.

Weekly

The euro/dollar is trading at a support which formed from 1.0818 and 1.0807 minimums. I think that it will be passed in the coming days and the euro will fall to 1.0520 (14th April minimum).

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.