Trading opportunities for currency pair: There’s no point rushing for the moment. The pound managed to return to the trend line on Friday issuing support from the euro/pound cross. Monday will be decisive since the price will either recoil from the trend or will break through it. We could see a false break before the Bank of England convenes so be careful. If the pound bounces back, the target is 1.5150, if it breaks: 1.5554. I’m not looking at it going any higher for the moment.

Background:

The last GBP/USD idea I made came out on 21st September. When the idea was published, the GBP was trading at 1.5522. A candle pattern then formed which weakened the pound’s position. Due to this I was expecting to see a return of the rate to the trend line. In fact, the pound/dollar fell by 416 points to 1.5106 with recoiling for nine days.

What’s interesting at the moment?

On Friday, the pound/dollar renewed to 1.5467. The buyers used the weakening of the euro after the ECB meeting and the ambiguous US data to their own interests. The sellers began to worry and the buyers were washing their hands, expecting to see a return to 1.5675. Although, for this we needed to see a break in 1.5555 (main trend line from the 1.7190 maximum).

The buyers didn’t manage to get back their Wednesday’s losses and close the week in profit. But for how long? On Thursday the BoE is set to convene. After the conclusions of the meeting are released, the minutes will come out, accompanied by a speech from the Bank’s governor, Mark Carney.

Traders are most of all worried about the results of the voting on interest rates. An increase in votes for an increase in rates will spark a growth in the pound against the trend. The technical side is powerless against fundamental factors.

Normal 0 false false false RU X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin-top:0in; mso-para-margin-right:0in; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0in; line-height:115%; mso-pagination:widow-orphan; font-size:11.0pt; font-family:"Calibri","sans-serif"; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin; mso-ansi-language:RU;}

Daily Graph

The pound/dollar is underneath the trend line. Since the pound closed Friday up against the USD and the upward movement was strong, expect a return to the hourly LB at 1.5340 on Monday.

A full covering of Friday’s body will see the forming of a pound sell signal. Later we’ll need to act as the situation develops. The week is full of important events so, for those not trading before the NFP, it’d be better to stave off trading until next Monday. A break in 1.5505 will see the pair shift to 1.5658.

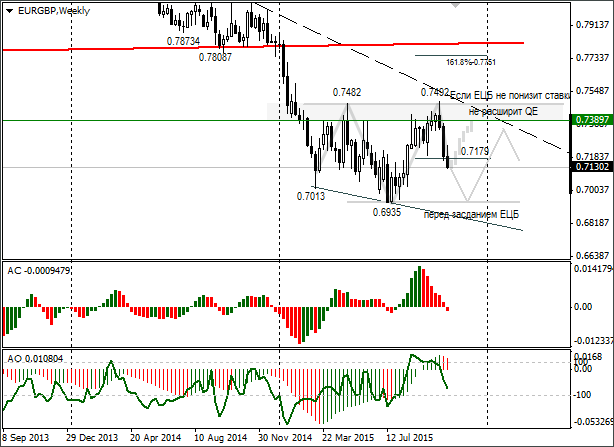

EUR/GBP cross

Traders having been buying pound against euro for three weeks in a row. After Draghi’s press conference, the euro’s fall hastened. A fall in the EURGBP will offer real support to the pound. Though this will depend this week on whether the pound weakens against the dollar or not.

I’m leaning towards saying the euro will stay under pressure before the ECB meeting (4th December). A correction is possible, but the indicators are saying otherwise.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.