Hourly

Yesterday’s Trading:

My Monday’s expectations came off fully. The euro/dollar lifted to 1.1055 and then fell to 1.1003. From here it renewed to 1.1067 due to weak US housing data. Sales of new homes fell to 468,000. The previous value was reassessed down from 552k to 529k.

Main news of the day:

At 11:30 EET, the UK is releasing preliminary Q3 GDP data;

At 14:30 EET, the US will release a report on durable goods orders for September;

At 15:00 EET, the US will see S&P/Case-Shiller’s index for housing price changes in August;

At 15:45 EET, the US will see Markit’s October business activity index in the service sector;

At 16:00 EET, the Richmond Fed of the US will release its October consumer confidence index and its manufacturing index.

Market Expectations:

Trader attention this Tuesday is on the publication of economic indicators form the US and UK. Sharp fluctuations on the currency market could be caused by the UK’s preliminary GDP report for Q3. Weak data will cause a growth of the dollar against both the pound and the euro. Correspondingly, strong data will see a dollar correction which will continue until Wednesday.

Today a two-day FOMC meeting commences. The interest rate decision will be made clear on Wednesday. The market expects that the rates will be left unchanged. There will be no press conference, just a press release. The text of the release will be very important for traders and investors.

Technical Analysis:

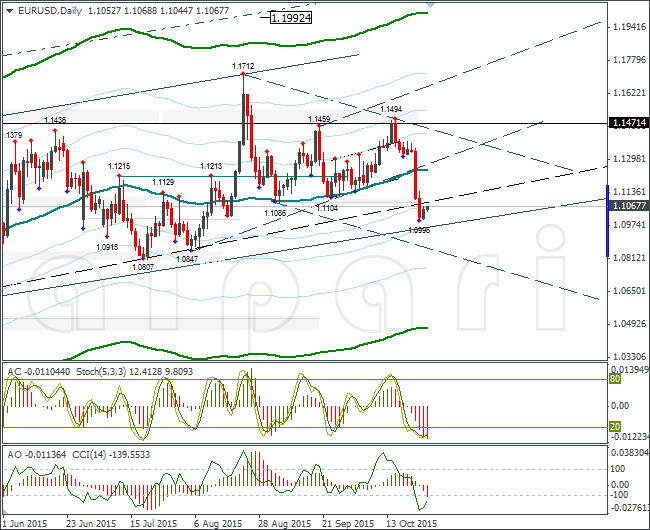

Intraday target maximum: 1.1075, minimum: 1.1005, close: 1.1030;

Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar has slid to the LB. Above it is the 67th degree. Taking the state of the hourly indicators and the lack of euro news into account, in my forecast I’ve gone for a test of 1.1075 and a fall of the rate to 1.1005. A growth to 1.11 will be a negative thing for the dollar across the market as a whole. Realization of the euro trading idea will delay it.

Daily

The euro/dollar has broken away from 1.0996 and is now in a correctional phase. We want to see the rate return to 1.10 on Tuesday but growth higher wouldn’t be ideal. The next support zone is at 1.0807-1.0818 (27th May and 20th July minimums). Now to the Weekly tab.

Weekly

Since the lower limit of the 1.1104 consolidation was broken, I’m waiting for a fall in the euro to 1.0807-1.0818. A close of the day above 1.1115 will mean we will have to wait and see what the Fed comes out with.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.