Market will release the flash manufacturing Purchasing Managers' Index (PMI) for China and Euro Zone this week, and the outcome is likely to show some divergent moves between the two regions.

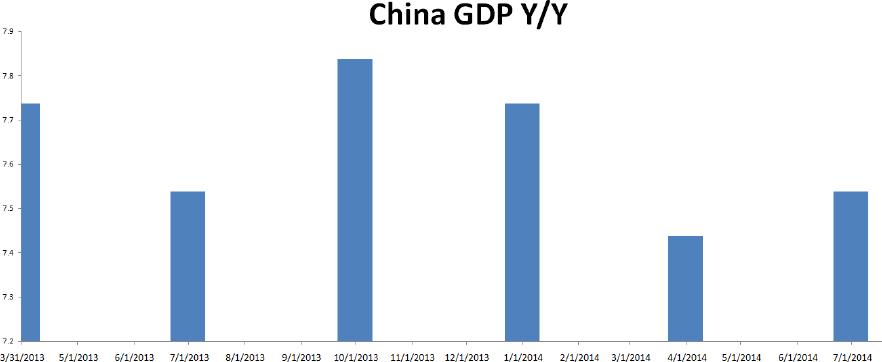

Chinese economy has been stabilized since early second quarter this year. The growth pickup in the second quarter was largely benefited by various easing measures, such as rural banks reserve ratio cut, liquidity injection and railway infrastructure building. The officials have made the statement clearly that the growth target for 2014 will remain at around 7.5%. This supports the view that the targeted currency stimulus will continue on and further more aggressive measures shouldn't be ruled out in achieving the 7.5% growth rate in the next six months. Below is the chart for the quarterly growth numbers in 2013, and we noticed that the base of the second half last year was higher.

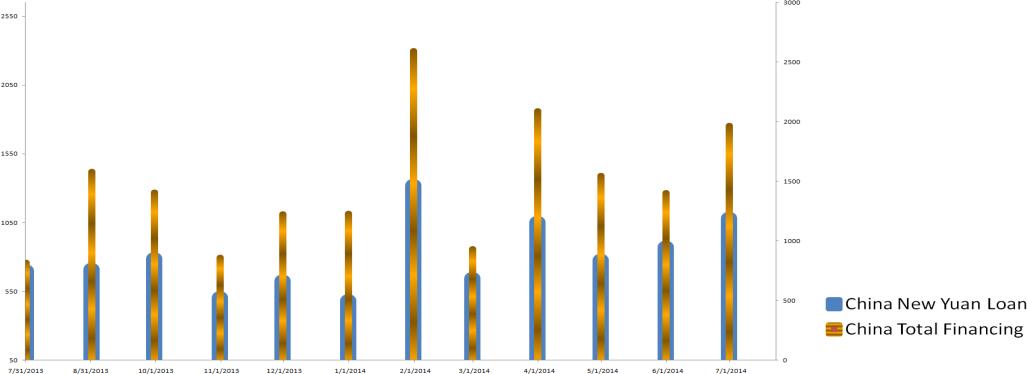

Hence, the economy may not be able to achieve a 7.5% Y/Y growth in the next six months without various policy supports. Government is unlikely to ignore the recent falling of housing prices, but introducing more easing measures by offering a "bottom" to the property prices, otherwise it will bring a huge risk for the short-term in the Chinese economy. The surge of lending data in June could support this view. Monthly banks' lending rose to 1080 billion Yuan and the aggregate lending nearly hit the level of 2000 billion Yuan. The country could also start issuing Mortgage Backed Securities to revive the property market, after majority of the cities' housing prices dropped.

In other words, "pro-growth" measures continue and it is likely to lead the manufacturing activities much higher this month. New Orders, Output continues to rise in June, suggesting that the uptrend since April hasn't ended yet. The flash reading could reach around level 51.

However, manufacturing PMIs in the Euro zone could continue to stay in the downtrend which formed since beginning of the year although it could be staying in the expansion territory in the rest of the year. Euro Zone manufacturing PMI dropped to 51.8 in June from 52.2 in May. Recent falling of the single currency is not sufficient to boost the fading corporate confidence, while the regional geopolitical risk escalated after the Malaysian Airline jet was shot down. Germany is Russia's second largest trading partner by end of 2013, further sanction on Russia is not a positive news on the economic point of view for EU. Besides that, German IFO Survey may fall as well in a few days; if so, it implies the Germany is unlikely to lead the entire Euro zone 2Q Gross Domestic Product (GDP)higher such as in 1Q.

We like to overweigh on AUD and NZD this week on a possible sound China PMI, and high possibility on the Reserve Bank of New Zealand (RBNZ) to hike the Official Cash Rate (OCR) to 3.5%. On the other side, we would underweight the EURO for the short term when the economic releases are likely to suggest more easing from the European Central Bank (ECB) is needed.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.