GBP/USD was sticking to the 1.5550 area. The bears were not very active despite good news from the US. The reason is that like the Federal Reserve, the Bank of England is also close to raising interest rates. In line with expectations, British economic growth has accelerated in Q2. Although growth is fueled by the service sector and not manufacturing, recent hawkish comments of the central bank’s official make investors rather positive about the pound.

Next week the UK will release three PMIs – manufacturing, construction and services. On Thursday, the Bank of England will publish its quarterly inflation report. As you may remember, British inflation was heavily hit in the previous months, but, according to the regulator, it was due to the falling oil prices, and without their disturbing impact inflation is OK. Moreover, for the first time ever the Bank of England’s meeting minutes will be released right after the meeting. The market will expect at least two members of the Bank of England’s Monetary Policy Committee to vote for the rate hike, which is bullish for GBP. Surely, such abundance of data on Thursday will need comments from the top officials, so Governor Mark Carney will give a press conference.

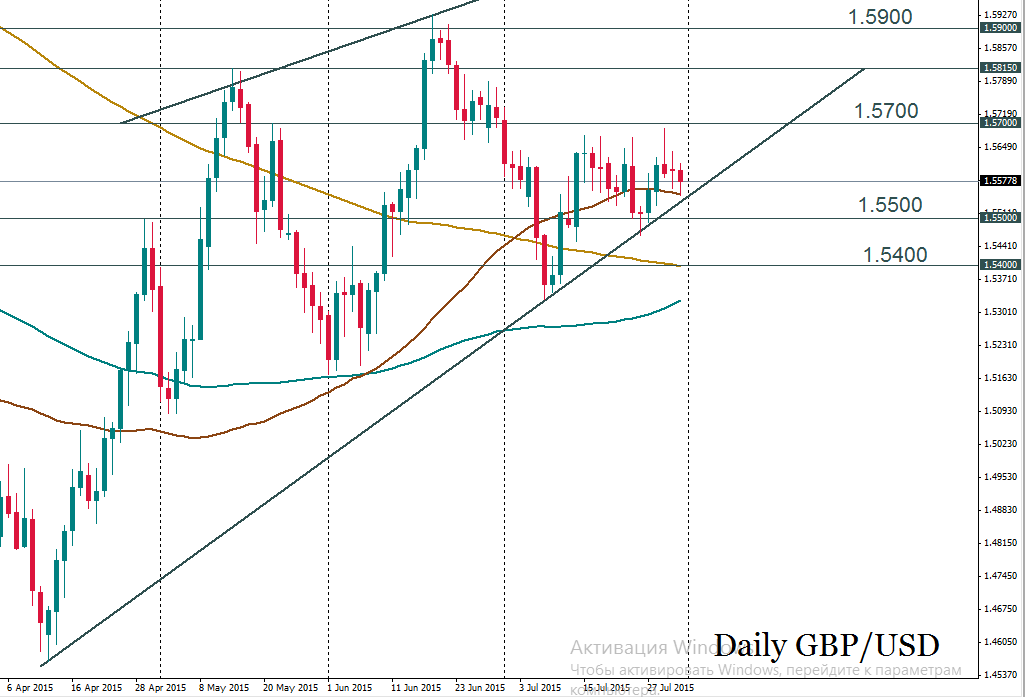

We expect great volatility in GBP/USD. The risk for pound will be to the upside. Strong resistance lies at 1.5700 – many times the bulls failed to overcome this psychological mark. If GBP/USD manages to fix above this point, it could rise to 1.5900/30 (June high). Support is seen at 1.5500 and 1.5400.

GBP/USD, Daily

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.