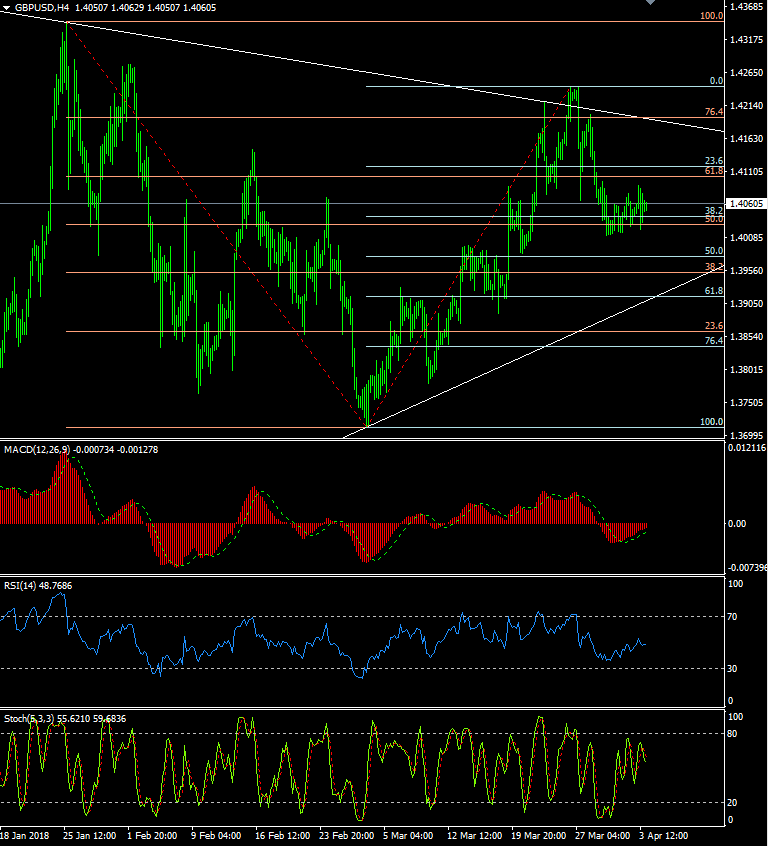

GBPUSD: 1.4060

Cable traded a choppy session on Tuesday (1.4020/1.4088) but has generally been underpinned against the Euro following the better than expected UK Manufacturing PMI. The Services PMI will be the local focus ahead today.

1 hour/4 hour indicators: Neutral.

Daily Indicators: Neutral

Weekly Indicators: Turning Neutral

Preferred Strategy: A neutral stance seems wise again today and a range of 1.40/1.41 would seem to have it covered. Brexit headlines, both good and bad, are always around the corner and so a longer term cautious outlook it also required and right now there seem to be better things to trade.

| Resistance | Support | ||

| 1.4200 | 28 Mar high | 1.4020 | Session low |

| 1.4560 | 100 HMA | 1.4010 | 28 Mar low |

| 1.4130 | Minor | 1.4000 | Minor |

| 1.4100 | 200 HMA | 1.3977 | (50% of 1.3715/1.4243) |

| 1.4088 | Session high | 1.3950 | Minor |

Economic data highlights will include:

UK Construction PMI

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0700 after US data

EUR/USD lost its traction and turned negative on the day near 1.0700 in the American session on Tuesday. The data from the US showed that Employment Cost Index rose more than expected in Q1 and provided a boost to the USD.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar gathers strength following the strong wage inflation data, forcing the pair to stay on the back foot.

Gold extends daily slide toward $2,300 after US data

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.