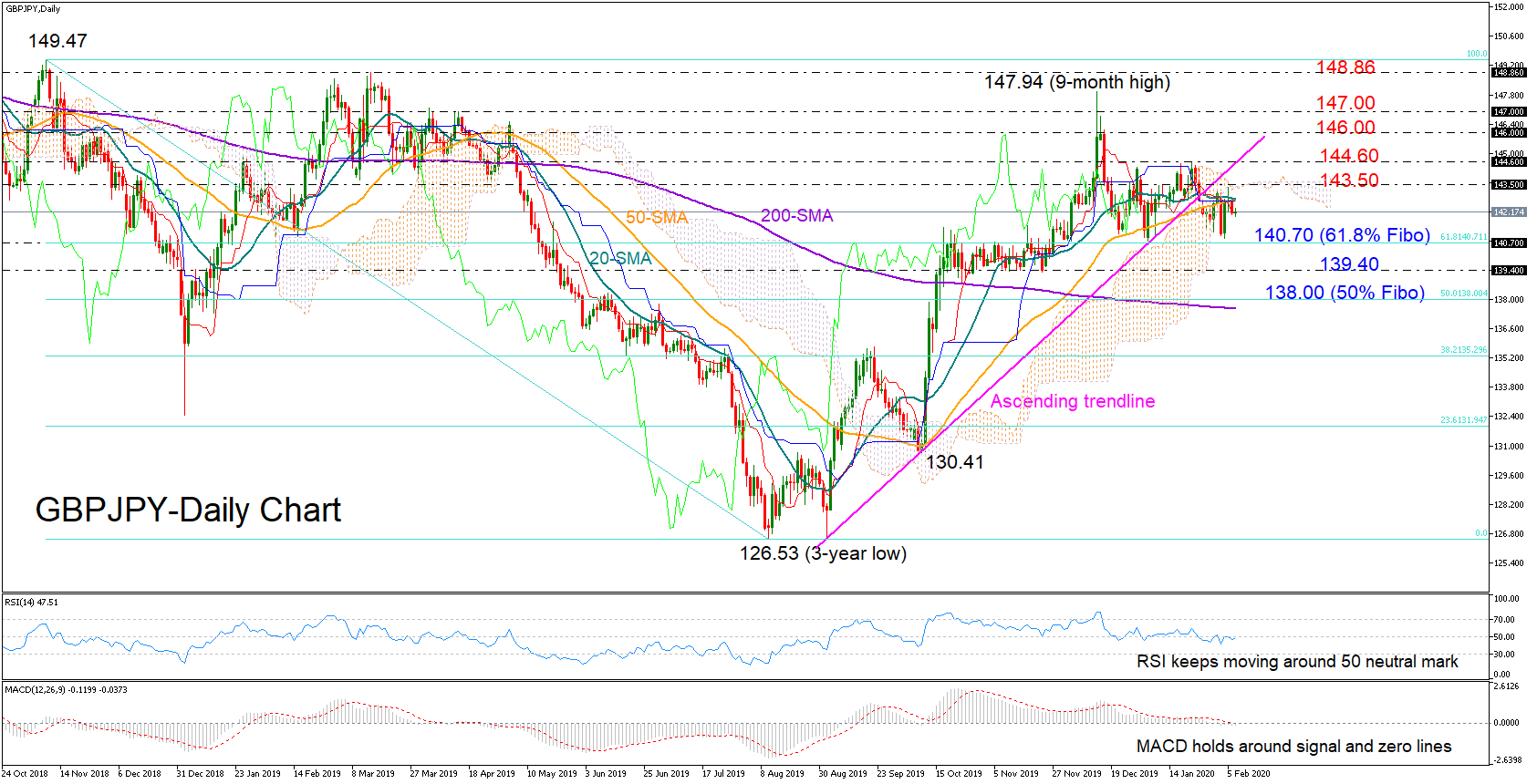

GBP/JPY keeps trading sideways but short-term trend signals seem skewed to the negative side as the pair has already crossed below the supportive trendline, the 50-day simple moving average (SMA) is preparing to cross above the 20-day SMA, while the price itself is fluctuating marginally below the Ichimoku cloud.

The neutral mood is likely to stay in the short-term if the RSI and the MACD continue to lack direction, with the price expected to be congested between the 61.8% Fibonacci of 140.70 of the downleg from 149.47 to 126.53 and the 143.50 resistance area.

In case selling pressure strengthens below 140.70, nearby support could be found around the 139.40 barrier, where any break lower would confirm the start of a downtrend and a bearish outlook in the medium-term picture, especially if the 50% Fibonacci of 138.00 and the 200-day SMA fail to hold as well.

On the upside, the broken ascending trendline could act as immediate resistance if the 20- and 50-day SMAs and the 143.50 mark prove easy to get through. A decisive close above the trendline and the previous high of 144.59 could send the price towards the December peaks between 146.00 and 147.00. Should buying pressure persist, the next turning point could be within the 147.94-148.86 area.

In brief, GBPJPY is expected to hold neutral within the 143.50-140.70 zone. Medium-term traders could also remain indecisive unless the price falls below 139.40 or rises above 144.60.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.