GBP/USD Weekly Forecast: Risks remain skewed to the downside, with eyes on UK GDP

- Central banks, US NFP failed to keep GBP/USD afloat, down over 300 pips on a weekly basis.

- The focus now shifts toward the United Kingdom’s quarterly GDP data release.

- Technically, the tide seems to have turned in favor of GBP/USD sellers.

Having stalled its upward trajectory in the previous week, GBP/USD lost over 300 pips over the week, as the United States and the United Kingdom's central banks' policy announcements failed to provide any support. Strong US employment data exacerbated the pain in Cable. Markets now look forward to the United Kingdom Gross Domestic Product (GDP) quarterly release amid a relatively quiet week.

GBP/USD: A comeback week for Pound Sterling bears

It was all about the central banks’ decisions in the past week, which motivated the Pound Sterling bears to make a comeback even though the United States Dollar (USD) struggled near ten-month troughs.

The Pound Sterling extended its retreat from seven-month highs of 1.2448 against the US Dollar at the start of the week on Monday, as the US Dollar continued its renewed upside amid firmer US Treasury bond yields. The US Dollar bulls remained unperturbed by a decline in the United States Personal Consumption Expenditures (PCE) Price Index to 5.0% in December. The US Dollar recovery gathered strength in the first half of the week, as investors continued to square off their USD short positions ahead of Wednesday’s US Federal Reserve (Fed) policy announcements. However, the Federal Reserve outcome was perceived as dovish, which changed the course of the US Dollar. The Fed policy statement acknowledged easing inflation but it was Fed Chair Jerome Powell’s words that acted as a party spoiler for the US Dollar optimists.

Powell said repeatedly at the post-policy meeting news conference that the "disinflationary" process now appeared to be underway. His comments hinted at the Fed likely turning a corner on its tightening cycle. Meanwhile, Powell’s refraining to push back against easing financial conditions while opening the door for rate cuts, conditional on faster falls in inflation, ramped up expectations of a dovish ‘Fed pivot’ narrative and smashed the US Dollar alongside the US Treasury bond yields, sending GBP/USD back to test the 1.2400 hurdle.

However, Pound Sterling sellers lurked at that supply zone, triggering a fresh sell-off in the GBP/USD pair, mainly led by the dovish 50 bps rate hike delivered by the Bank of England (BoE) on ‘Super Thursday’. The Bank of England’s downgraded its language in the policy statement by removing the word "forcefully" related to raising rates. This was read outrightly dovish, although the central bank hinted at a 25 bps rate hike next before a likely pause. The vote split, with two BoE policymakers favoring no rate change, added to the GBP/USD downfall.

In light of the central banks’ decisions, markets largely ignored the top-tier US economic data releases such as the ISM Manufacturing PMI, JOLTS Job Openings and the weekly US Jobless Claims. But downbeat earnings reports from the American tech giants, Apple Inc., Amazon.com Inc. and Google parent Alphabet Inc., rattled markets at the end of the week, enabling the US Dollar recover some ground.

The US Dollar recovery further gained traction on a strong US labor market report, which revived expectations that the US Federal Reserve will continue to hike rates in March and May. Markets also pared bets on potential Fed rate cuts by the end of this year. The US economy added 517K jobs in January as against the expected 185K increase and the 260K previous figure. The US Unemployment Rate dropped to 3.4% in January vs. 3.6% expected and 3.5% previous while the Labor Force Participation rate ticked higher to 62.4% in the reported month. The annual wage inflation, as measured by Average Hourly Earnings, came in at 4.4%, compared to the estimate of 4.9%. The stunning US jobs report intensified the sell-off in GBP/USD, smashing it to the lowest level in three weeks near the 1.2100 mark.

The week ahead: What to watch out for

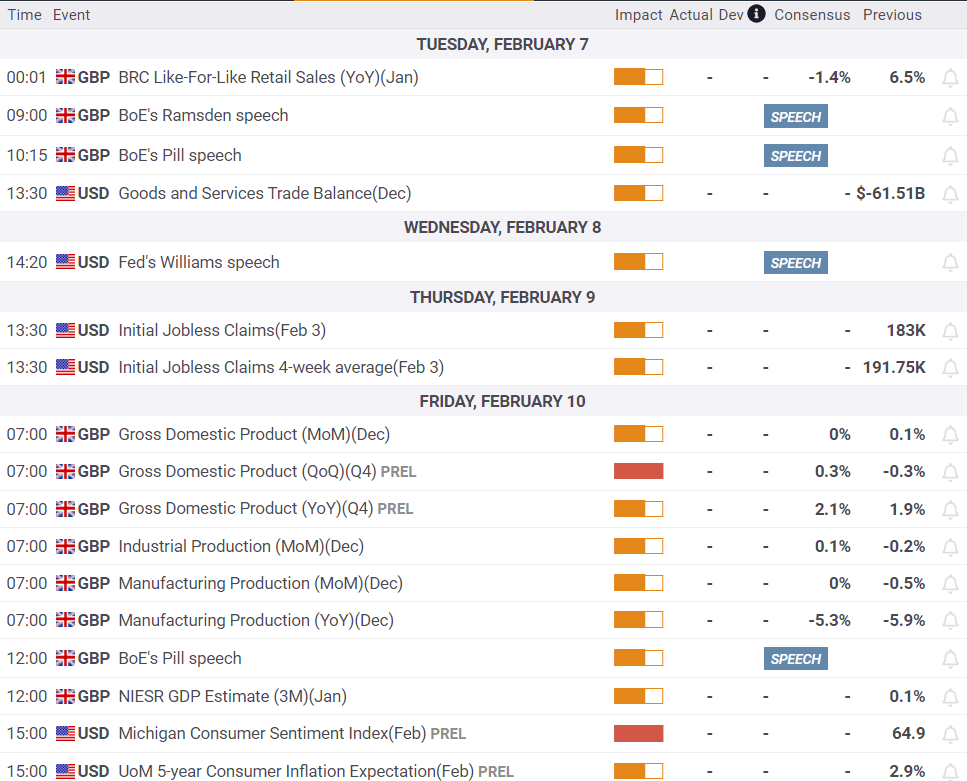

It’s a relatively calm week, as the key central banks’ events are out of the way. The focus shifts back to the fundamentals, as both the Federal Reserve and the Bank of England remain data-dependent in their policy approach.

Monday will draw attention toward speeches from a couple of Bank of England policymakers – Catherin Mann and Chief Economist Huw Pill. Their comments on the policy outlook could have some impact on the Pound Sterling, in absence of any high-impact data on both sides of the Atlantic.

Fed Chairman Jerome Powell’s speech will take center stage on Tuesday, which is another day of no significant economic releases on the docket. Powell is due to participate in a moderated discussion at the Economic Club of Washington. His words on the future policy path could drive fresh US Dollar trades.

Wednesday seems fairly quiet data-wise but speeches by the Fed policymakers will keep GBP/USD traders entertained. On Thursday, hearings on the Bank of England (BoE) Monetary Policy Report (MPR) will be closely examined. Governor Andrew Bailey and several MPC members will testify on inflation and the economic outlook before Parliament's Treasury Select Committee (TSC). The weekly Jobless Claims will also feature in the US economic calendar that day.

The final trading day of the week is a busy one, with China’s Consumer Price Index (CPI) due to be reported in Asia, followed by a slew of top-tier economic data from the United Kingdom. The UK preliminary Gross Domestic Product data will be published for the fourth quarter of 2022 alongside the monthly growth and Industrial Production figures. A negative GDP print could point confirm a technical recession in the UK economy, after a -0.3% clip seen in the third quarter.

BoE Chief Economist Huw Pill will make his second appearance for the week on Friday ahead of the United States Preliminary University of Michigan (UoM) Consumer Sentiment and Inflation Expectations data. The Federal Budget Balance and Fed speeches will be also on the cards.

GBP/USD: Technical outlook

GBP/USD: Daily chart

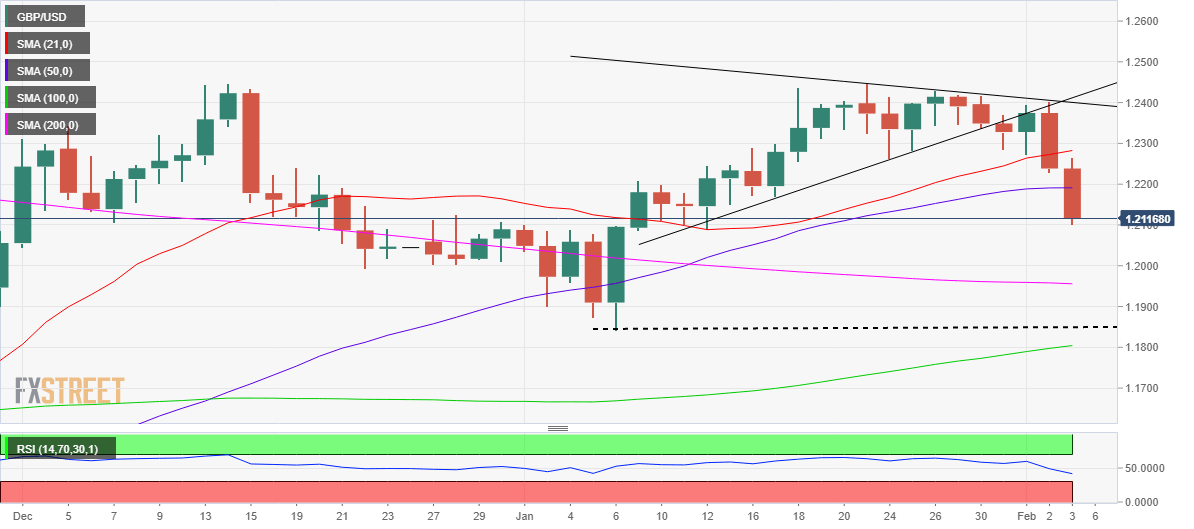

Having confirmed a symmetrical triangle breakdown on the daily sticks on Tuesday, the path was set for the GBP/USD downfall.

The central banks’ frenzy and strong US employment data encouraged the Pound Sterling sellers to flex their muscles, as GBP/USD cracked through a couple of major support levels.

The sell-off extended after the pair closed Thursday below the bullish 21-Daily Moving Average (DMA) at 1.2282, with bears having found a strong footing beneath the ascending 50DMA, pegged at 1.2191.

The 14-day Relative Strength Index (RSI) is seeing a sharp descent below the midline, approaching the oversold territory and suggesting that the downside remains more compelling for the major in the near term.

The next three crucial support levels are now aligned at the flattish 200DMA at 1.1955, the January low of 1.1841 and the bullish 100DMA at 1.1804.

Alternatively, any recovery attempt will meet initial resistance at the 50DMA barrier, above which the Pound Sterling bulls will need acceptance above the 21DMA to negate the near-term bearish bias.

The next stop for buyers will be then seen at the weekly highs just above the 1.2400 level.

GBP/USD: Forecast poll

The FXStreet Forecast poll offers a mixed outlook for GBP/USD in the short term with the one-week target aligning at 1.2122. Although there is a slight bullish bias in the one-month outlook, the average target of 1.2050 suggests that experts who are bearish on the pair expect large losses.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.