GBP/USD Weekly Forecast: Pound Sterling’s battle with 1.2800 extends into the Fed week

- The Pound Sterling consolidated at three-month highs near 1.2800 against the US Dollar but failed to hold onto gains.

- GBP/USD buyers gather pace for the next push higher as the Fed decision looms.

- The Pound Sterling eyes a weekly close above 1.2800 to extend the bullish momentum.

The Pound Sterling (GBP) continued its battle with the 1.2800 level against the US Dollar (USD) this week, as the GBP/USD pair lost momentum after clinching a fresh three-month top near 1.2820.

Pound Sterling capitalized on renewed US Dollar supply

GBP/USD booked the fourth straight weekly gain, courtesy of the downbeat tone around the US Dollar, as markets brought bets for the US Federal Reserve (Fed) interest rates cut in September back on the table.

A slew of US economic data released during the week raised concerns about the US economic health, reviving expectations of the Fed policy pivot. Renewed dovish Fed expectations weighed heavily on the US Treasury bond yields and the US Dollar, allowing the GBP/USD pair to hold ground near multi-month highs near 1.2800.

Data released by the ISM showed on Monday that the Manufacturing PMI index dropped from 49.2 in April to 48.7 in May, missing the expected 49.6 print. The ISM Manufacturing Prices Paid eased to 57.0 in May vs. 60.9 previous and 60.0 expected. Job openings, a measure of labor demand, were down 296,000 to 8.059 million on the last day of April, the lowest level since February 2021, the Labor Department's Bureau of Labor Statistics (BLS) said on Tuesday in its JOLTS survey.

On Wednesday, Automatic Data Processing (ADP) said that 152,000 jobs were created last month, sharply lower than the 173,000 jobs gain predicted. The previous figure was revised down to 188,000. Meanwhile, the US ISM Services PMI expanded firmly from 49.4 in April to 53.8 in May but the Price Paid sub-index dropped from 58.1 in the same period, compared to April’s 59.2. Thursday’s US Initial Jobless Claims also added to the economic gloom, rising to 229K in the week ended May 31, as against 221K booked previously.

Markets are currently pricing in about a 56% chance of a 25 basis points (bps) Fed rate cut in September, against a 46% probability of such a reduction seen a week ago, CME Group’s FedWatch tool showed.

Meanwhile, there was nothing of note from the UK side of the equation, as all the public appearances of the Bank of England (BoE) policymakers were canceled heading into the July 4 general elections in the UK. Further, the UK docket lacked any top-tier economic data releases, which have a significant impact on the value of the Pound Sterling. Therefore, no news turned out to be good news for the British Pound, helping GBP/USD to sustain at higher levels during the week.

On Friday, traders turned cautious and refrained from placing fresh bets on the GBP/USD pair, as they keenly await the US Nonfarm Payrolls (NFP) data to seal in a September Fed rate cut. The Bureau of Labor Statistics announced that NFP rose by 272,000 in May, beating the market expectation for an increase of 185,000 by a wide margin. Additionally, the annual wage inflation, as measured by the change in the Average Hourly Earnings, climbed to 4.1% from 4%. The USD gathered strength following the upbeat labor market data and caused GBP/USD to decline toward 1.2700 heading into the weekend.

Week ahead: US inflation and Fed verdict hold the key

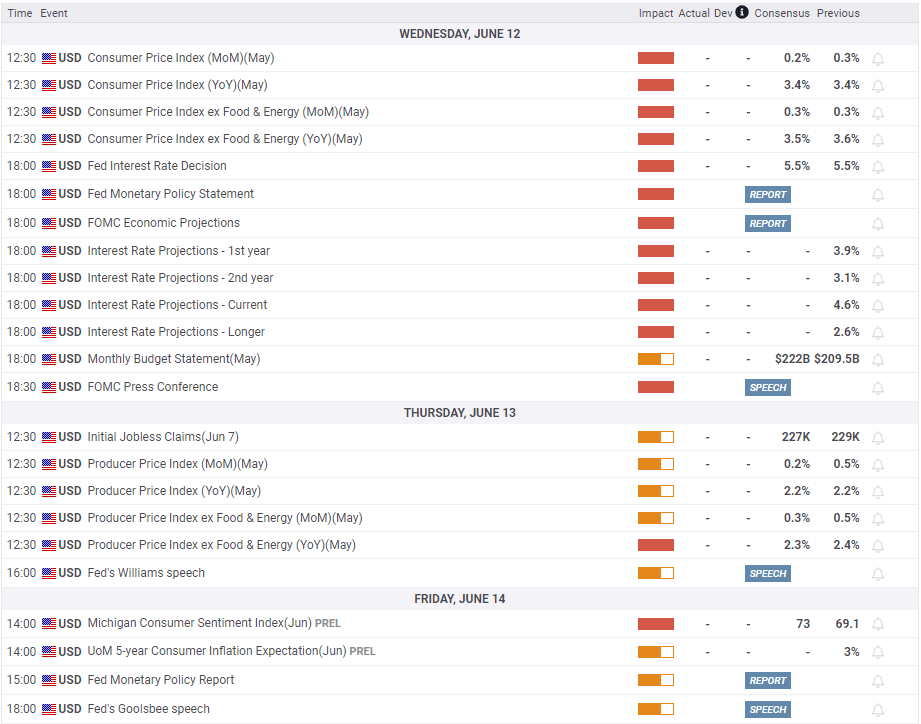

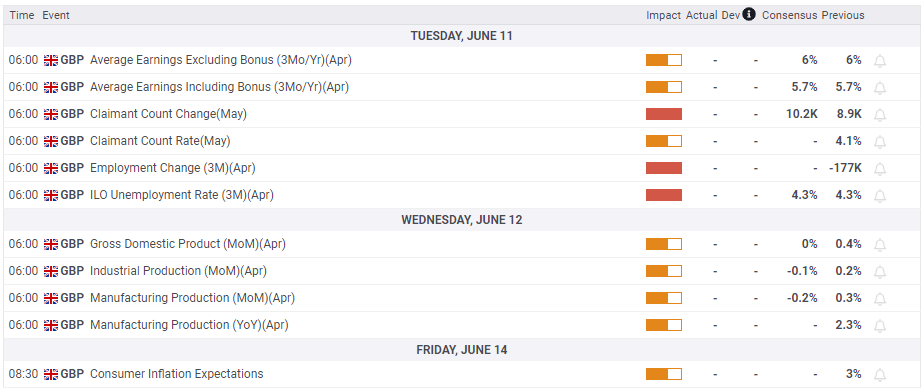

Although traders gear up for the top-tier employment and the monthly Gross Domestic Product (GDP) report from the United Kingdom in the upcoming week, Wednesday’s US Consumer Price Index (CPI) data and Fed policy announcements will likely steal the show.

Also, of note will be the US Producer Price Index (PPI) data during the week, as the Fed policymakers will take up the rostrum from Thursday once the ‘blackout period’ ends.

Friday’s UK Consumer Inflation Expectations and the US Michigan Consumer Sentiment data will be closely scrutinized for fresh hints on the central banks’ policy outlooks.

GBP/USD: Technical Outlook

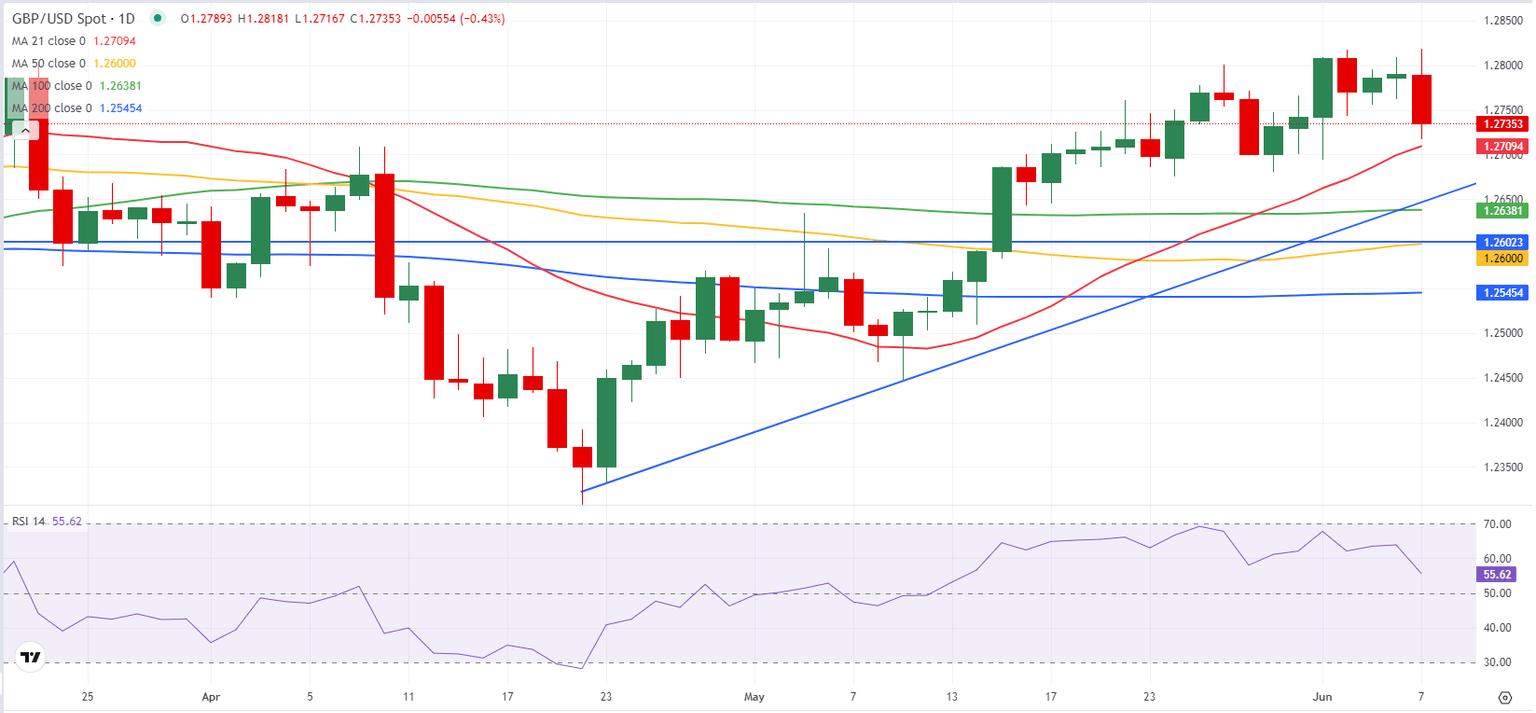

As observed on the daily chart, GBP/USD has been prodding the critical resistance at 1.2800 since May 28.

A weekly candlestick close above the level is needed for Pound Sterling buyers to embark on a sustained uptrend.

Acceptance above the latter would negate any near-term bearish bias, fueling a fresh advance toward the March 8 high of 1.2894. The next relevant resistance is seen at the 1.2950 psychological level.

The 14-day Relative Strength Index (RSI) has declined towards the 50 level, currently near 54, suggesting that the bullish potential for the Pound Sterling has partly waned.

If buyers fail to bid at higher levels, GBP/USD could turn south toward the initial support at 1.2712, where the 21-day Simple Moving Average (SMA) aligns.

Further south, the confluence zone of the rising trendline support and the 100-day SMA at around 1.2640 will challenge the bullish commitments.

The next downside targets are seen at the 50-day SMA of 1.2600, followed by the 200-day SMA at 1.2546.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.