GBP/USD Weekly Forecast: Is Pound Sterling set for more pain in the UK inflation week?

- The Pound Sterling reached four-month lows against the US Dollar.

- GBP/USD looks vulnerable heading into the UK inflation week.

- The Pound Sterling keeps sight at 1.2400 on bearish technical indicators.

The Pound Sterling (GBP) resumed its downside against the US Dollar (USD), sending the GBP/USD pair to the lowest level in four months below 1.2500.

Pound Sterling turns south once again

After witnessing a decent comeback in the first half of the week, GBP/USD sellers returned with a bang amid a resurgent demand for the US Dollar. Expectations surrounding the US Federal Reserve (Fed) policy pivot continued to play their part alongside heightened geopolitical tensions in the Middle East, helping the Greenback reach its highest level in five months against its major counterparts above 105.00.

The main event risk of the week, the US Consumer Price Index (CPI), came in hotter-than-expected and squashed hopes for a June Fed rate cut. The US CPI rose 0.4% MoM in March, higher than the estimates of 0.3%, according to data released by the US Bureau of Labor Statistics (BLS) on Wednesday. Monthly Core CPI also rose 0.4% in the same period, beating expectations of 0.3%. The annual headline CPI grew 3.5% against the market forecast of 3.4%.

Markets are now pricing in only a 22% chance of the Fed lowering rates in June, compared with roughly 52% odds seen before the data release. The Fed rate cut probability at the September meeting stands at about 70%.

Adding on, a hot US core Producer Price Index (PPI) for March, hawkish commentaries from several Fed policymakers and Minutes of the Fed’s March meeting only strengthened the case for a delay in the Fed’s policy pivot, as inflation remains elevated amid a resilient economy.

On the geopolitical front, Bloomberg reported on Wednesday, citing people familiar with the intelligence, “the US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent, in what would mark a significant widening of the six-month-old conflict.”

Meanwhile, Russia, Germany and Britain came together on Thursday and appealed to countries in the Middle East to show restraint, especially over the imminent risks of an Iranian threat to strike Israel. Israel said it was preparing to "meet all its security needs" in a region on a potential airstrike by Iran.

This comes after Iran vowed revenge for the April 1 airstrike on its embassy compound in Damascus (Syria) that killed a top Iranian general and six other Iranian military officers, escalating the tensions already heightened by the Gaza conflict.

Rife geopolitical tensions continued to undermine the higher-yielding Pound Sterling while boding well for the safe-haven US Dollar. The British Pound, however, received some comfort from Bank of England (BoE) policymaker Megan Greene’s hawkish comments. Greene said on Thursday that “UK services inflation remains much higher than in the US,” implying that BoE rate cuts are still a distance away.

Despite a modest bounce from four-month lows of 1.2511, GBP/USD remained vulnerable on Friday amid sustained US Dollar strength. The Pound Sterling buyers failed to find any inspiration from the in-line with estimates UK Gross Domestic Product (GDP) and strong industrial figures for February.

The latest data published by the Office for National Statistics (ONS) showed on Friday that the UK economy expanded 0.1% in February, having rebounded 0.3% in January. The market consensus was for an expansion of 0.1% in the reported period. Other data from the UK showed that Industrial Production and Manufacturing Production rose 1.1% and 1.2%, respectively, on a monthly basis, in February.

The week ahead: UK CPI remains on tap

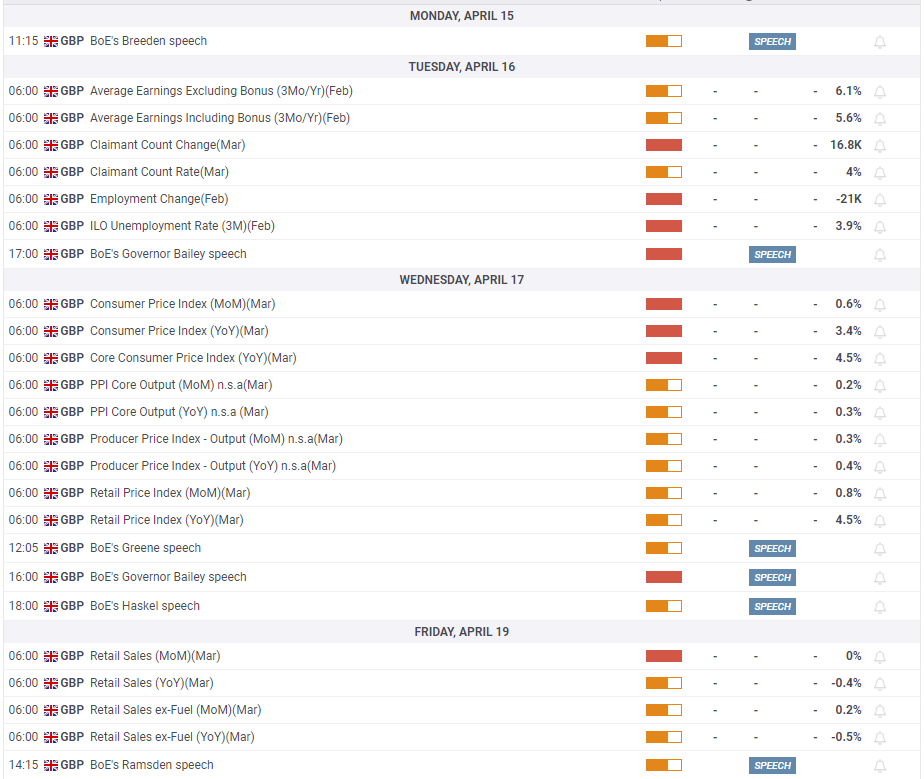

Following a busy week, Pound Sterling traders gear up for a relatively data-light week, with only the UK CPI inflation report for March to emerge as a key event.

The inflation data will be released on Wednesday. Ahead of that, the US docket will feature the March Retail Sales report on Monday while BoE policymaker Sarah Breeden will speak earlier that day.

The UK jobs report is scheduled for release on Tuesday. Later that day, BoE Governor Andrew Bailey will speak at the International Monetary Fund (IMF) Spring Meetings.

Bailey will take up the rostrum again on Wednesday, speaking at the Institute of International Finance Global Outlook Forum.

On Thursday, the US weekly Jobless Claims will be reported, followed by the Existing Home Sales data for March.

Finally, on Friday, BoE policymakers Sarah Breeden and Dave Ramsden will make their scheduled appearances after the release of March’s UK Retail Sales data.

Besides, speeches from Fed policymakers will be closely scrutinized by market participants for affirming the bets for delayed Fed rate cuts.

GBP/USD: Technical Outlook

From a short-term technical perspective, the bearish potential for GBP/USD remains intact, as sellers look to extend the downside break from the rising channel witnessed a few weeks ago.

The 14-day Relative Strength Index (RSI) indicator, stays vulnerable below the midline, near 40.00, leaving the door open for further declines.

Pound Sterling sellers yielded a sustained break below the horizontal 200-day Simple Moving Average (SMA) at 1.2584, justifying the bearish bias.

Sellers need to find a strong foothold below the 1.2500 round figure to extend the downtrend toward the November 22 low of 1.2449. The next strong support is seen at around 1.2375, where the November 16 and 17 lows align.

Alternatively, if buyers manage to recapture the 200-day SMA at 1.2584 on a daily closing basis, it could alleviate the near-term selling pressure.

GBP/USD could then initiate a meaningful recovery toward the confluence resistance zone between the 1.2650-1.2670 region. That area is the convergence of the 21-day, 50-day and 100-day SMAs.

Further up, the rising channel support-turned-resistance at 1.2790 will act as a tough nut to crack for Pound Sterling buyers.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.