GBP/USD Weekly Forecast: Pound Sterling looks at US inflation amid data-light week

- The Pound Sterling hit three-week highs against the US Dollar above 1.2750.

- GBP/USD awaits US inflation data amid a relatively data-light week ahead.

- Bearish bias intact while the Pound Sterling holds below the key 200-day SMA.

The Pound Sterling (GBP) held on to the corrective upside against the US Dollar (USD), fuelling a brief GBP/USD recovery above the 1.2750 barrier.

Pound Sterling stood resilient to persistent USD demand

Political turbulence in South Korea and France, US President-elect Donald Trump’s tariff threats, and the diverging monetary policy outlooks between the US Federal Reserve (Fed) and the Bank of England (BoE) emerged as the main drivers for the GBP/USD price action.

On Monday, the pair started the week negatively, tumbling over a big figure to hit weekly lows at 1.2617. Since then, Pound Sterling buyers fought back control and resumed the previous week’s recovery to reach the highest level in three weeks above 1.2750.

Trump threatened on Saturday that he would impose 100% tariffs on BRICS nations if they tried to replace the USD with their own. Mounting tariff war fears fuelled risk-aversion across the financial markets, reviving the demand for the Greenback as a safe-haven asset while weighing on risk currencies such as the British Pound.

However, sustained bets for a 25 basis points (bps) Fed interest rate cut in December remained a drag on the US Dollar despite Chairman Jerome Powell’s prudent remarks. Markets price in a 70% chance of such a move later this month, the CME Group’s FedWatch Tool shows, at the press time.

Powell said in his speech at the New York Times' DealBook Summit, “growth is definitely stronger than we thought, and inflation is coming a little higher. The good news is that we can afford to be a little more cautious as we try to find neutral," he added, referring to the neutral interest rate.

A series of US economic data releases, including the ISM surveys, JOLTS Job Openings and the ADP Employment Change, came in mixed and failed to alter the market’s expectations of a rate cut this month, limiting the Greenback’s upside attempts.

That said, the USD stayed underpinned by the market’s nervousness amid looming geopolitical and trade war risks and ahead of the all-important US Nonfarm Payrolls data release.

On the other side, the Pound Sterling regained traction, paying little heed to the dovish comments from BoE Governor Andrew Bailey on Wednesday. In a pre-recorded interview with the Financial Times (FT), Bailey said that “he expects four UK rate cuts next year as inflation eases.”

Heading into the weekend, GBP/USD consolidated at multi-week highs, anticipating the key US labor data for a fresh directional impetus.

Following the 36,000 increase recorded in October, the US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls (NFP) rose by 227,000 in November. This print came in above the market expectation of 200,000 but failed to boost the USD, helping GBP/USD cling to its weekly gains. Other details of the jobs report showed that the Unemployment Rate edged higher to 4.2%, while the annual wage inflation held steady at 4%.

The week ahead: All eyes on US CPI inflation

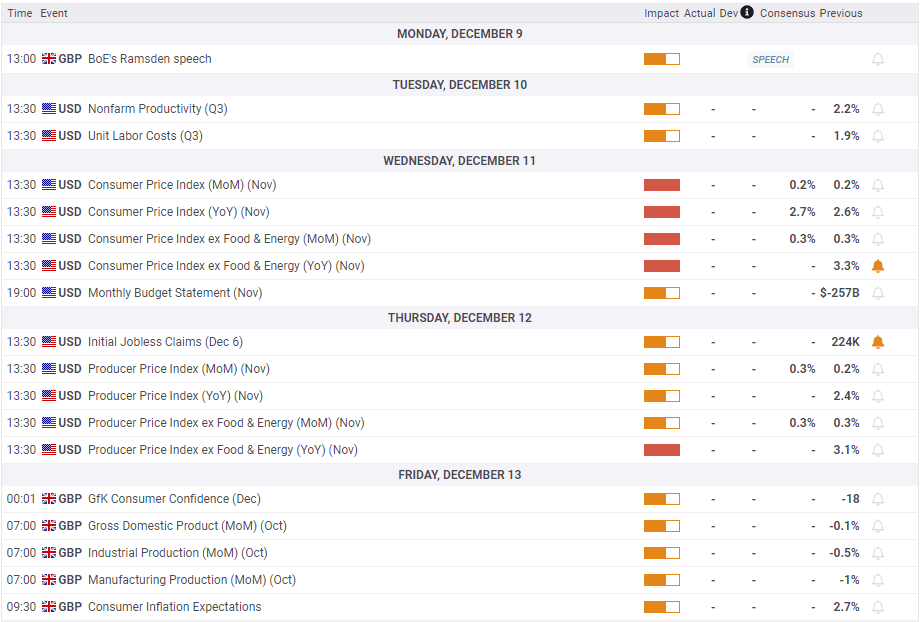

It’s a mediocre week from the point of view of macroeconomic news, with the US Consumer Price Index (CPI) data likely to stand out.

The first two trading days of the week have little to no top-tier economic publications from both sides of the Atlantic until the US inflation report drops on Wednesday.

However, China’s inflation data could stir markets amid mounting concerns about an economic slowdown, impacting risk sentiment and high-beta currencies such as the British Pound.

Thursday will feature the US Producer Price Index (PPI) data, while the UK monthly Gross Domestic Product (GDP) and industrial figures will feature on Friday.

It will be dry in terms of Fedspeak as the Fed enters its ‘blackout period’ on Saturday ahead of the December 17-18 policy meeting.

That said, geopolitical developments and US-Sino trade updates will be closely followed.

GBP/USD: Technical Outlook

From a short-term technical outlook, sellers will likely retain control if GBP/USD holds below the 200-day Simple Moving Average (SMA) at 1.2821.

Adding credence to the negative outlook, the pair charted dual Bear Crosses a week ago.

However, the 14-day Relative Strength Index (RSI) has recovered to the 50 level from the negative territory, suggesting that the rebound could extend before the next leg down.

The Pound Sterling needs a sustained break above the 200-day SMA at 1.2821 to sustain the recovery.

The next substantial contention area aligns near 1.2900, the confluence of the round figure and the 50-day SMA.

Further up, the 100-day SMA at 1.2967 could challenge the bearish commitments.

On the downside, the immediate support aligns at the 21-day SMA at 1.2685, below which the week low of 1.2617 will be tested.

Additional declines will threaten the six-month low of 1.2488.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.