GBP/USD Weekly Forecast: Pound Sterling aims at 1.3200 as UK economic calendar gathers steam

- The Pound Sterling resumed its weekly recovery above the 1.3200 level.

- GBP/USD remains poised for extra advances amidst Dollar weakness.

- The Pound Sterling is expected to closely follow key UK releases.

Following a drop below the key 1.3100 support earlier in the week, the Pound Sterling (GBP) managed to regain balance against the US Dollar (USD), lifting GBP/USD back north of the 1.3200 hurdle soon after US Nonfarm Payrolls disappointed expectations on Friday (+142K jobs). While that move fizzled out afterwards, it was not enough to reverse Cable’s positive weekly performance.

Pound Sterling continued to look at Dollar dynamics

GBP/USD reversed the previous week’s downward bias on the back of the persistently bearish tone in the Greenback. The US Dollar remained under pressure against the backdrop of a renewed and aggressive Federal Reserve (Fed) easing narrative, which now includes a potential 50-basis-points interest-rate cut at its September 18 gathering.

The Dollar’s offered stance remained propped up by dovish remarks from the Fed’s Chairman, Jerome Powell, at the Jackson Hole Symposium in late August. His views were later reinforced by many Fed officials, who seem to have advocated for starting to reduce interest rates as soon as this month.

The BoE thinks otherwise

Following the Bank of England’s (BoE) rate cut on August 1, Governor Andrew Bailey argued that it remained uncertain whether the persistent elements of inflation were aligned with keeping price increases at the bank's 2% target. He also questioned whether the current decline in inflation persistence was largely assured as global shocks that previously drove up inflation were easing, or if the UK economy would need a period of slack.

Furthermore, at his speech in Jackson Hole, Bailey said that he believed longer-term inflation pressures were easing. However, he highlighted that further interest-rate cuts would not be made hastily, as it was still too early to be certain that inflation had been fully controlled.

A survey released on Thursday indicated that British companies expect to raise their selling prices by the smallest margin in nearly three years, while wage growth shows no signs of slowing. This mixed news poses a challenge for BoE officials assessing inflation pressures.

Indeed, according to the BoE's Decision Maker Panel (DMP), closely monitored by the Monetary Policy Committee, businesses in the three months to August anticipated a 3.6% rise in selling prices over the next year. This is the lowest figure since September 2021, slightly down from a previous estimate of 3.7%. However, projections for wage growth, a key factor for the BoE in monitoring inflation, remained steady at 4.1% for the three months to August, unchanged from July's survey. The monthly data revealed that wage growth forecasts have been stable at 4.0% to 4.1% since May, indicating that the sharp decline in expectations seen over the past 18 months has halted. That said, persistent wage growth remains a major concern for the hawkish members of the MPC, who are worried that it could lead to prolonged inflationary pressures in the economy.

Investors estimate about a 25% likelihood that the “Old Lady” will cut interest rates at its September 12 policy announcement, while a rate cut is fully anticipated for November.

What’s next for the Pound Sterling?

All the attention is expected to be on the publication of US inflation figures tracked by the Consumer Price Index (CPI). However, the UK calendar appears pretty interesting with the releases of the always-relevant labour market report on Tuesday, and GDP figures among other key fundamentals, on Wednesday.

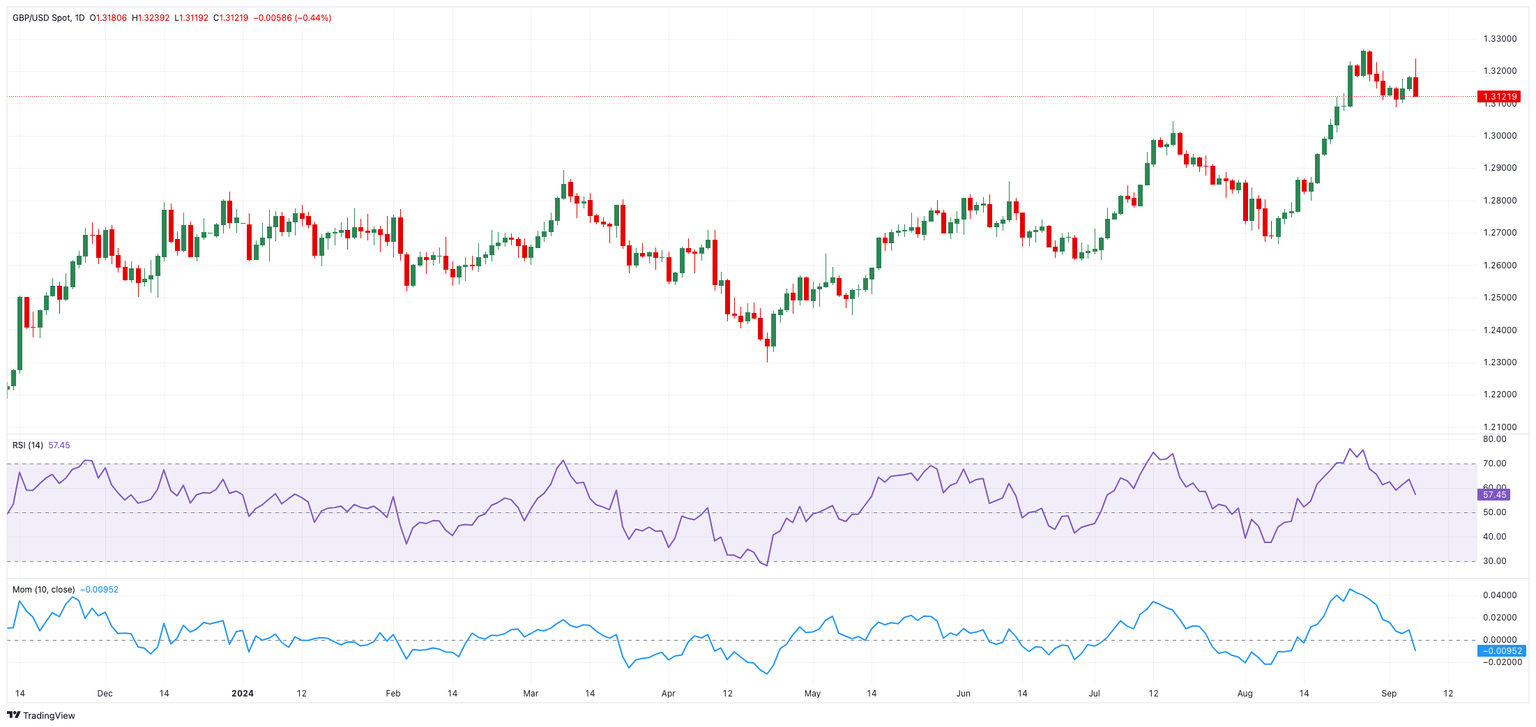

GBP/USD: Technical Outlook

If bearish momentum takes hold, GBP/USD could retest the September low of 1.3087 (set on September 3), followed by the interim 55-day SMA at 1.2900 and the important 200-day SMA at 1.2720. Beyond these levels, the pair may target the August low of 1.2664 (from August 8), the June low of 1.2612 (from June 27), and the May low of 1.2445 (from May 9). A break below this zone could bring the 2024 bottom of 1.2299 (recorded on April 22) back into focus, seconded by potential moves toward the weekly lows of 1.2187 (from November 10, 2023) and 1.2069 (from October 26), and ultimately the October 2023 low of 1.2037 (from October 4).

Conversely, on the upside, the immediate resistance for GBP/USD stands at the 2024 high of 1.3266 (reached on August 27), ahead of the weekly top of 1.3298 (from March 23, 2023) and the February 2022 peak of 1.3643 (from February 10). The daily RSI has eased a tad below 63.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.