GBP/USD rebounds from near an upside line

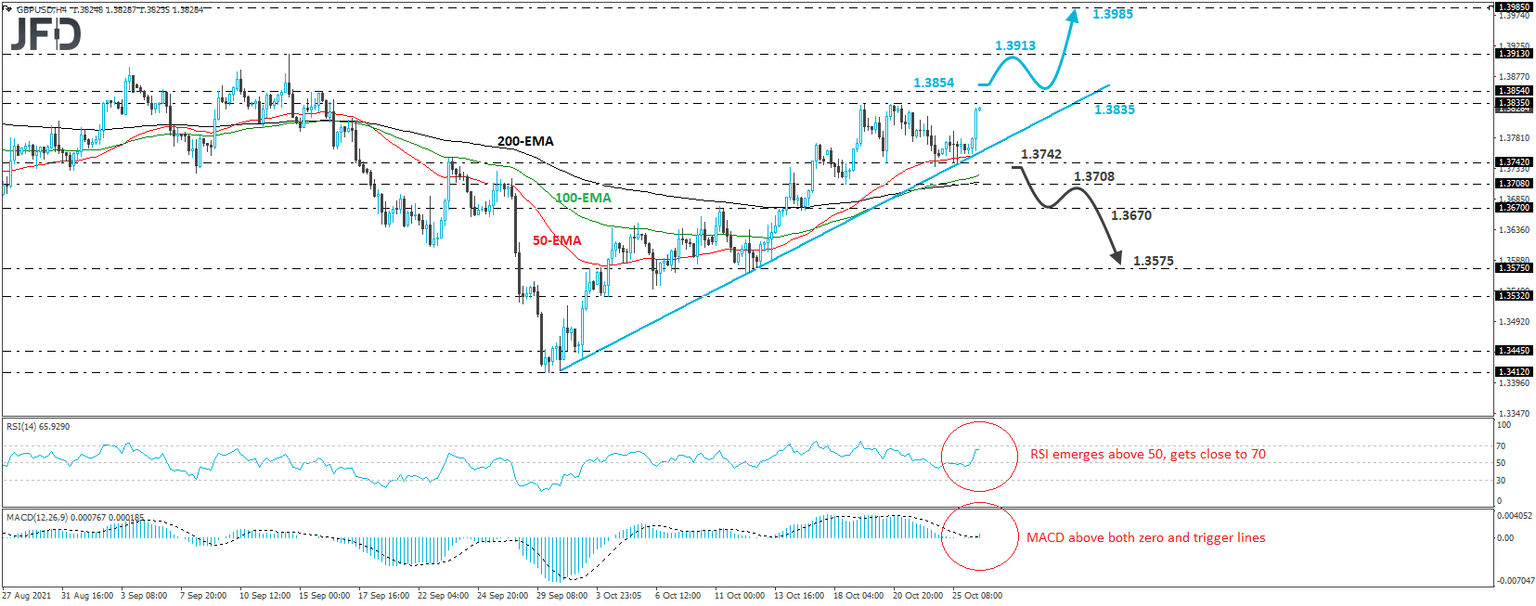

GBP/USD traded higher on Tuesday after it hit support at the upside line drawn from the low of September 30th. Overall, the price structure remains of higher highs and higher lows above that line, and thus, we would consider the near-term outlook to be positive.

However, we would like to see a break above 1.3854, the peak of September 16th, before we get confident on a trend continuation. This would confirm a forthcoming higher high and may initially pave the way towards the peak of September 14th, at around 1.3913. If the bulls are not willing to stop there, then a break higher may see scope for more advances, perhaps towards the high of July 29th, at 1.3985.

Shifting attention to our short-term oscillators, we see that the RSI emerged above 50 and is now close to the 70 barriers, while the MACD lies slightly above both its zero and trigger lines. Both indicators detect upside speed and support the notion for further advances.

On the downside, we would like to see a dip below 1.3742 before we start examining the case of a bearish reversal. This will not only signal the break below the aforementioned upside line but also a forthcoming lower low on the 4-hour chart. Initially, the bears may target the low of October 18th, at 1.3708, or the low of October 14th, at 1.3670. If the bears are not willing to stop there, then we could see extensions towards the 1.3575 area, which provided support on October 12th and 13th.

Author

JFD Team

JFD