The British Pound have just hit a fresh 3-month low against the greenback at 1.5309, following the release of poor UK data.

In Britain, the August Markit Manufacturing PMI slipped to 51.5, against expectations of another advance up to 52.0, whilst the Consumer Credit in July shrunk to £1.173B from its previous £1.22B. Mortgage approvals rose to near 69K, all of which suggests that the economic growth may get a set back during the second quarter.

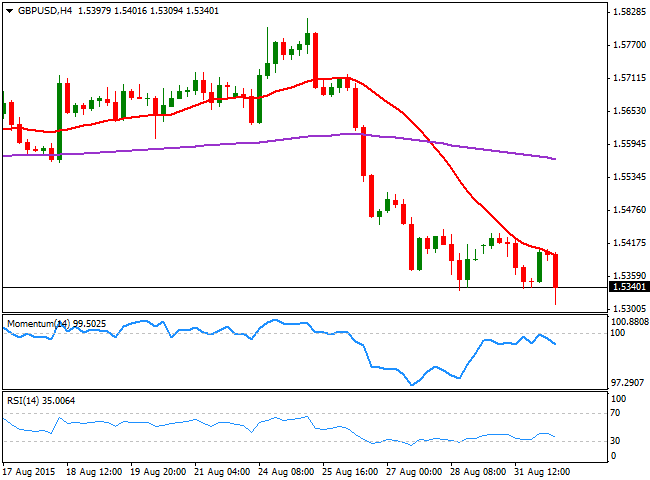

The bearish trend remains firm in place, and the pair has now scope to test the 1.5250 region, a strong long term static support level. Technically, the 4 hours chart shows that the price has been rejected from a strongly bearish 20 SMA, currently around 1.5400, whilst the technical indicators have resumed their declines below their mid-lines. Daily basis, the pair has set a lower low and a lower high, supporting the ongoing negative tone, albeit the day is not over yet.

Nevertheless, a break below the 1.5300 level should see a test of the mentioned 1.5250 price zone, whilst below this last, 1.5220 is the next short term support. Above 1.5360, the pair may retest the 1.5400 level, where selling interest is expected to resume.

View the live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.