The GBP/USD pair is bouncing from a fresh 2-week low established at 1.5580, barely holding above the 1.5600 level ahead of the US employment data to be released in a couple of hours. The Pound found support in local construction data, showing that the sector rebounded in June, from the almost two year low posted in April, according to the latest Construction PMI reading, up to 58.1. At the same time, the Nationwide Housing Prices report for June, showed that the annual pace of house prices slowed in June, moderating to 3.3% from 4.6% in May. Lower prices are positive for the GBP as the BOE fears a housing bubble due to strong surge in price over the last two years.

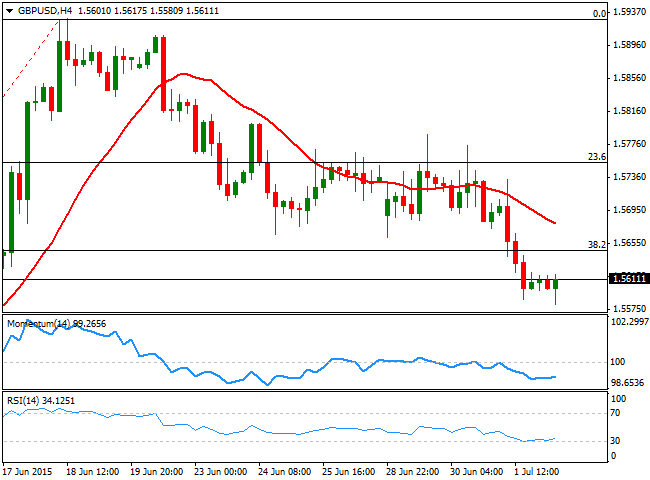

Technically, the pair maintains a negative tone according to its 4 hours chart, as the price is far below its 20 SMA, whilst the technical indicators are barely bouncing from oversold territory. The upcoming direction will be solely dependent on US data, with a negative reading probably triggering a stronger reaction in the pair than a positive one. Should the numbers disappoint, the key resistance level to watch comes at 1.5645, the 38.2% retracement of the latest daily run, as a recovery above it should lead to a continued advance up to the 1.5690/1.5700 region.

To the downside, the main support stands at 1.5550, the 50% retracement of the same rally, with a break below it exposing the pair to a decline down to 1.5480/1.5500.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.